As an entrepreneur, you need to be good in managing both your personal finances and business finances. Business financial management is more than balancing accounts and bookkeeping. As an entrepreneur, you need to carefully look at the purpose of your finances, right from the start. You must have a plan on how you can survive challenging times and thrive during good times.

In this article, we will be sharing with you tips on how you can effectively manage your business finances, especially in this time of crisis, so you can keep growing and enhance your success. Hopefully, at the end of the article, you will see financial management not as a dark art but as an important tool to help you build a successful company.

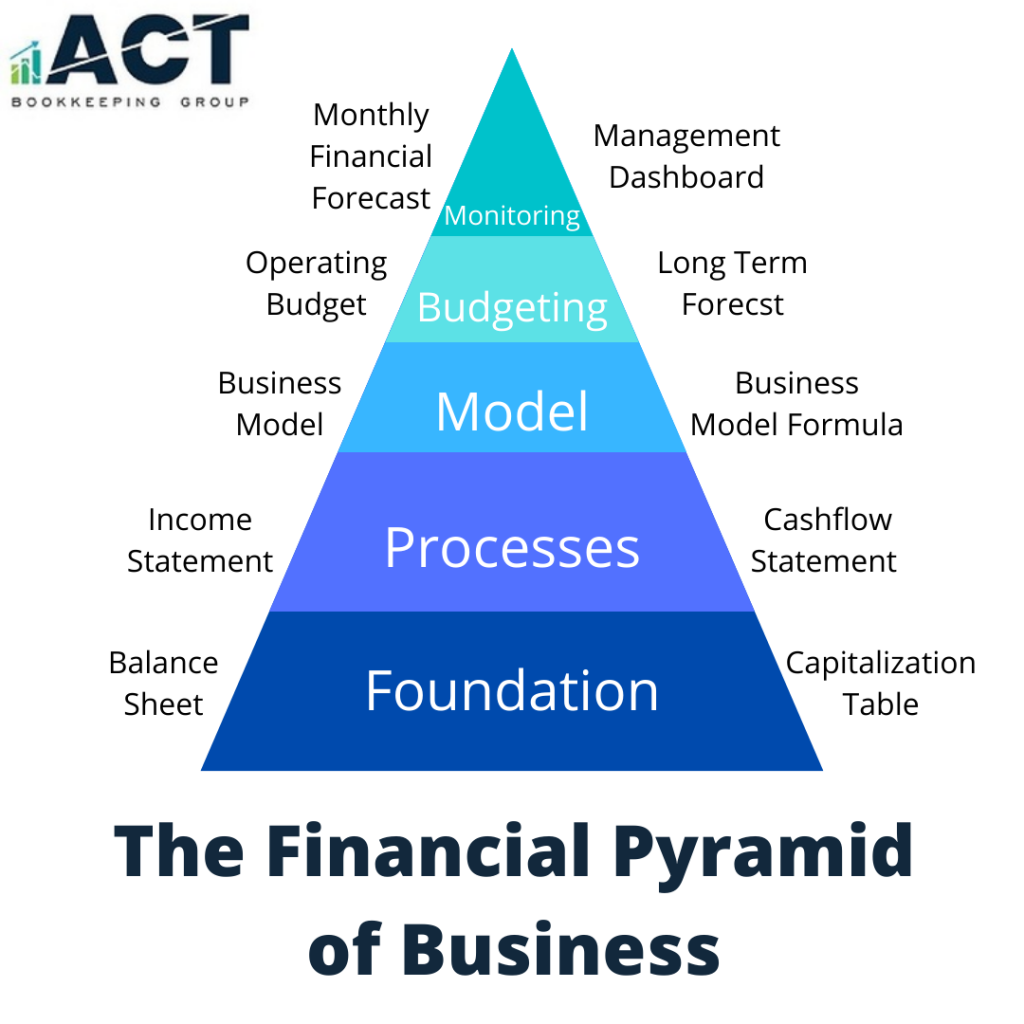

1. Know the Key Elements of Business Financial Foundation

Bookkeepers and accountants are important people who can help you run your business, but don’t leave all your business finances with them. As the business owner, you need to be the first to understand the underlying financial flow of your company.

Sometimes finances do not only involve money. It could also include how long it will take for customers to consistently buy your products or avail your services; how much cash is needed to achieve this milestone; how much does marketing need; or what is the time span to convert a prospect into a paying client? Knowing the five key elements of financial foundation will help you manage your business day by day, give you an early warning system to make you see what’s going to happen in your company before it even happens, and help you run a successful company.

2. Pay Attention to the Key Points in your Balance Sheet

The balance sheet is basically the picture of the financial condition of your company. Your balance sheet reflects your assets, liabilities, and shareholder’s equity. Your assets include your cash, accounts receivable, inventory, equipment, and property. Liabilities are your debts, payables and accrued liabilities.

Your balance sheets are one requirement bankers and investors will look for when you would need to apply for a loan or ask for investments. They will look at your cash and working capital and take away from these your liabilities to get your net working capital. This is what you also work with to keep the company going. Bankers and investors will also look at your debt-to-equity ratio; so when you have higher debts than equities, it is essential to improve your company’s performance.

3. Understand your Financial Processes

You can understand your financial processes by looking at your income statement and financial reports. Your income statement reflects your revenue, cost of goods/ services sold, gross profit and gross profit margin.

You can find the value of your gross profit and gross profit margin by using the formula below:

Gross Profit= Revenue – Cost of Goods/ Services

Gross Profit Margin= (Gross Profit / Revenue) x 100

Your gross profit margin reveals if the fundamental structure of your business is profitable. A company with a 70 to 80 percent gross profit margin has a big potential to grow.

Your income statement also shows your selling, general and administrative expenses, and your operating profit. As a business owner, you need to organize your income statement and operational expenses according to the critical activities of your business. If you’re not doing your own books, you can ask your bookkeeper to customize your income statement for you.

Your gross profit margin, operating margin and net margin are indicators of how profitable you are and how efficiently you are running your business.

4. Manage Your Cash Flow

You will know if you are managing your cash flow right by looking at your cash flow statement. This document shows your net income and accounts receivable. Sometimes, when you make a sale, the cash does not come right away because the customer may opt to pay 30 days after. Make sure you give a timely invoice and collect payments on time. Delayed payments can eat in on your cash and if you are a small business; you may not afford that.

Another thing that significantly affects your cash flow is your account payables. Slow payments of accounts receivable can affect the accounts payable, so try to keep your cash flow level in check.

Other things you’ll find in your cash flow statement are cash flow from operations, capital expenditures, and financing activities. These terms basically show the concept that increasing equities increases your cash while paying off debts and buying back equities, reduces your cash.

5. Budget and Forecast your Financial Position

One way to ensure the success of your business is to have an operating budget and to create a long term financial forecast. An operating budget is a detailed plan of how you will spend and earn money over the next year. You can do this by figuring out the design of your business and the key drivers for your expenses and revenue. When you put up your operating budget, use frames of reference that your whole team and your investors can understand.

One powerful way of developing your operational budget is milestone based budgeting. In this method, you frame your operating budget around the key milestones you need to hit.

The other thing you need as an entrepreneur is a long term financial forecast- a five-year projection of how you plan to make your business grow over a period of time. You need to lay down your assumptions about your business, your competitors, and the marketplace. A financial forecast shows how you plan to build your business month by month and estimate the expenses that you may need to incur to achieve your plan.

Learning business finance may seem complicated, especially if you are still launching your startup, but learning at least the basics is essential for every business owner. If you don’t have the time and expertise to generate financial documents, you can hire a bookkeeper to do it for you, but it is crucial that you have knowledge on how to interpret it.

If you need experts to manage your books and generate financial documents for your business, ACT Bookkeeping services can help you. We can even tailor our system to fit the way you do things. Contact us and book a free consultation.