From launching a startup to growing a business, it is essential to manage every financial transaction- from the payable accounts to the receivables. To help businesses keep track of their income and expenditures, and to assure that everything is within the budget, financial record keeping needs to be precise. This is where bookkeepers come in. A bookkeeper oversees every financial aspect of a business. The primary task of a bookkeeper is maintaining accurate ledgers to support the company’s financial records; thus maintaining the business’ fiscal health.

Bookkeepers can have broad and varied duties in the company. Some relevant roles and responsibilities include:

1. Recording Daily Transactions

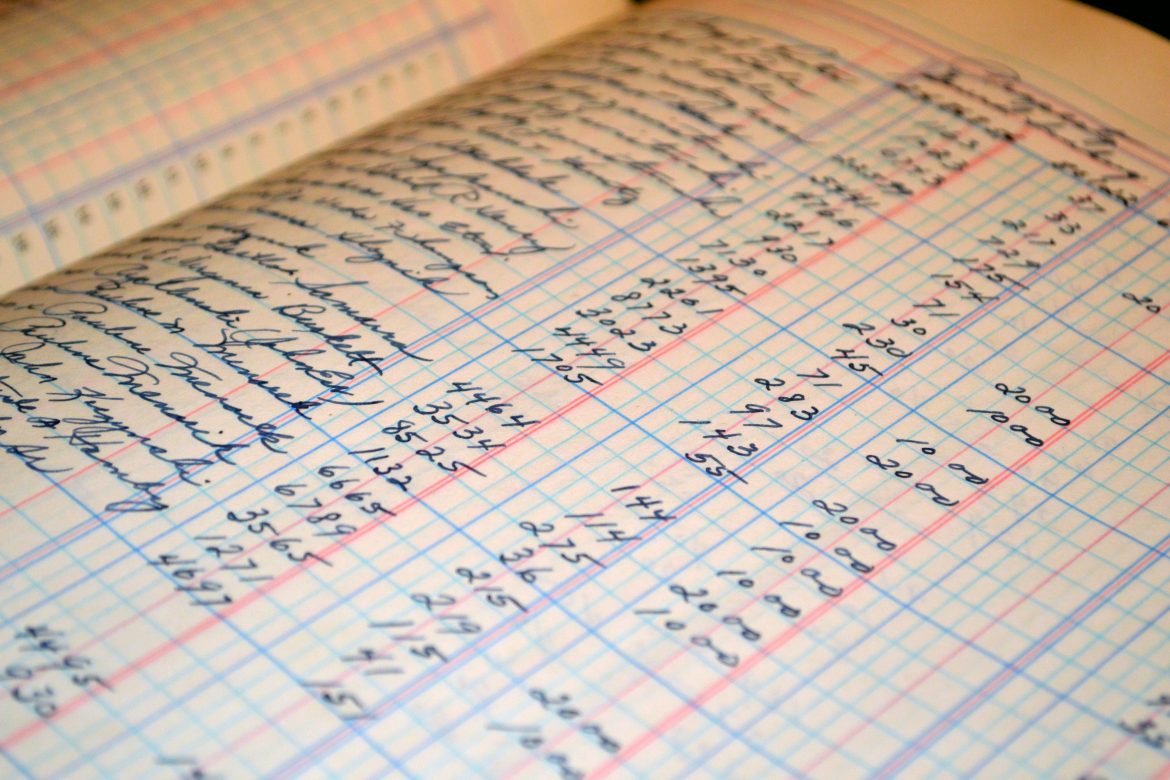

Bookkeepers check and verify receipts and invoices, and records debts and credits. They make journal entries of all payments and other financial transactions of the company. Then, they fill source documents for all journal entries and post these to ledger accounts. Most bookkeepers balance accounts on a day-to-day or week-to-week basis. A bookkeeper also keeps a record of the company’s assets and investments.

2. Managing Accounts

Managing the company’s accounts is one of a bookkeeper’s key responsibilities. This task includes managing bank feeds, reconciling bank accounts, handling accounts payable, and handling accounts receivable.

Managing Bank Feeds

Bookkeepers manage transactions brought in through software. Bank feeds link the software to the business bank account so the business owner can see transactions in real time. Most accounting software’s can automatically categorize transaction types, so bookkeepers ensure that these transactions are correctly categorized.

Reconciling Bank Accounts

To make sure that a company’s cash records are correct and to avoid overdraft fees and bouncing checks, bookkeepers regularly match the company’s book of accounts and its bank account balance.

Handling Accounts Payable

Issuing checks and paying company bills from different suppliers and vendors are part of a bookkeeper’s role. Managing the accounts payable is very important to maintain a positive trade relationship between the company and its product and service providers.

Handling Accounts Receivable

One major task of bookkeepers is sending out invoices to clients and securing timely payments to keep records consistently accurate.

3. Preparing Statements and Reports

Bookkeepers prepare trial balances, cash flow, and profit-and-loss statements. These are all important documents that show the company’s bottom line and operating expenses. Bookkeepers also collect, analyze and summarize account information to generate financial reports every month and at the end of the year.

4. Ensuring Legal Compliance and Tax Filings

The last thing any business owner wants is the stress and headache from various tax requirements and payments. Bookkeepers help companies comply with the federal state and local requirements and give advice on needed actions. They also calculate and prepare tax payments, guaranteeing that all financial obligations to the state are paid for on time.

Because bookkeepers are more familiar with the company’s books and transactions, they also work closely with accountants, preparing the groundwork for them and assisting them during audits.

5. Processing Payroll

Sometimes, bookkeepers handle the preparation and processing of payroll. This usually happens in small businesses. Since they handle the payables, more often, they also process employees paychecks and taxes.

6. Maintain Cash Flow

Another very important role of a bookkeeper is making sure that the company does not run out of day-to-day money. Business proprietors are busy and may forget about outstanding payments from clients. It is the bookkeeper’s job to ensure that the company’s cash flow remains positive by keenly monitoring the company’s income and expenses.

7. Performing Other Duties as Required

Depending on the company, there are times when bookkeepers also do other tasks. These tasks could be broad- helping human resource, producing an inventory report, dealing with foreign currency transactions or recommending accounting software.

Bookkeepers play an important role in any business. They keep track of the company’s cash flow and revenues. They also mainly provide and keep current and historical data needed for financial analysis.

FAQ’s

Do I need a bookkeeper for my small business or start-up?

Getting a bookkeeper saves you time and money, even if you have a small business. Having a professional take care of the financial aspect of your business reduces your risk of forgetting tax payment due dates and saves you from the hassle and stress of writing and filing tax reports. It also allows you to focus your expertise, time and energy on developing innovations, getting more clients, building relationships with existing ones and bringing your business to the next level.

What are the key qualities of a good bookkeeper?

A bookkeeper oversees the financial transactions in your company. They play a big role in monitoring expenses and revenues. Knowing the key qualities in a good bookkeeper allows you to partner with the right person for your business. Here are five key qualities you should look for in a bookkeeper:

1. Knowledgeable on accounting softwares and technology

2. Possesses outstanding organizational skills

3. Dependable and trustworthy

4. Possesses good interpersonal skills

5. Excellent communication skills

What is the difference between a bookkeeper and an accountant?

Some people confuse bookkeepers and accountants, especially that sometimes, the tasks that a bookkeeper and an account do sometimes overlap. Although the work these two professionals share common goals and may seem similar, they support different stages in the financial cycle. Bookkeepers maintain a general ledger that records the day to day financial transactions of a company such as sales, payments, payrolls and others. They also keep the documents that support their record. They update this ledger weekly and monthly. A bookkeeper’s task is more transactional. The accountant uses the bookkeeper’s records to dig deeper and bring fundamental financial indicators together. Accountants review, analyze and interpret the information to show the financial path of the company. With this, accountants can offer strategic advice on financial forecasting and tax planning.