Published on 17 Dec 2025

Minimum income tax threshold in Australia: how it affects your business payroll will shape how you calculate PAYG on each employee’s pay, their take home pay, and whether they owe more tax at the end of the year. The minimum tax threshold, often called the tax-free threshold, is currently set at $18,200, meaning most resident taxpayers do not pay tax on this income in a full financial year. Understanding how this threshold works for taxable income, tax rates and different types of income is essential for every employer in Australia.

For an ACT business, the way the minimum tax threshold interacts with taxable income tax and resident tax rates will directly affect cash flow and payroll processes. It influences how much tax is withheld, how employees feel about their pay and how smoothly you can lodge your BAS and meet Australian Taxation Office requirements. ACT businesses should also consider if they qualify for the lower 25% company tax rate. With clear systems and communication, you can keep your business compliant while supporting staff with accurate, predictable pay.

What Is the Minimum Tax Threshold and How Does It Work?

The minimum tax threshold or tax-free threshold is the amount of taxable income an Australian resident can earn in an income year before any income tax is payable. For most resident taxpayers, this threshold is $18,200, which effectively means a 0 – 18,200 band where the tax payable and Medicare levy are generally nil for that part of their income. Once an employee earns more than this, tax applies at progressive resident tax rates across higher tax brackets.

In practice, this threshold is built into PAYG so that many employees pay tax gradually across the year instead of in one lump sum at tax time. When employees correctly claim the tax free threshold through their employer, the amount of tax on this income is reduced in each pay. This helps most resident taxpayers avoid a large tax payable at the end of the financial year, as long as their other income and deductions are reported correctly.

Unsure if you’re withholding PAYG correctly on staff wages?

Schedule a complimentary consultation with us today to review your tax-free threshold settings and ATO PAYG tables.

How Does the Tax-Free Threshold Interact with PAYG and Tax Rates?

The tax-free threshold is tightly linked to PAYG withholding and the table of resident tax rates for different levels of taxable income. For the 2024–25 and 2025–26 income years, resident tax rates apply across several key brackets, including 0 – 18,200, 18,201 – 45,000, 45,001 – 135,000 and 135,001 – 190,000 for many taxpayers. Within these bands, different tax rates apply, and PAYG is calculated to reflect how much tax is likely to be payable for the whole year.

When an employee claims the tax free threshold with your business, your payroll system applies a rate that assumes the first $18,200 of their taxable income will be taxed at nil. This reduces the amount of tax withheld from each pay and increases their take home pay compared with an employee who has not claimed the threshold. If your payroll settings ignore the claim, the employee may pay more tax during the year than required and wait for a refund after they lodge their tax return.

How Does Residency and Other Income Affect the Threshold?

The minimum tax threshold is designed for an Australian resident for tax purposes, and the rules differ for non‑residents. A resident taxpayer is someone who lives in Australia and meets specific tax purposes tests, and only they are entitled to the full $18,200 tax free threshold on their taxable income. Non‑residents generally pay tax from the first dollar of income, so there is no nil band for 0 – 18,200 in their case.

Other income outside the main job, such as investments, interest, or a second job, is also counted when working out total taxable income. If an employee earns money from business activities or investments in addition to wages, this other income can push them into higher tax brackets and change how much tax they should pay overall. As an employer, you do not control all of this, but you do need to apply the correct resident tax rates and PAYG settings based on their status and threshold claim.

How Do the New Tax Cuts and Brackets Influence Payroll?

Recent tax cuts and updated tax brackets from 1 July in the 2024–25 and 2025–26 income years change how much tax is withheld on income above the minimum tax threshold. While the tax free threshold itself remains at $18,200, the resident tax rates for the 18,201 – 45,000, 45,001 – 135,000 and 135,001 – 190,000 bands have shifted for many resident taxpayers. This means the rate applied to each extra dollar of income can be lower than in previous years, especially in the middle ranges.

For your business, these changes affect how much tax to withhold on each pay and how employees perceive their pay rises or extra hours. If your payroll software or tax tables are not updated from 1 July, the business may withhold at old rates, causing employees to pay more tax than required and rely on a refund after they lodge their tax return online. Keeping systems aligned with ATO guidance avoids confusion, protects cash flow and helps staff see the benefits of tax cuts in their take home pay during the year, not just at tax time.

What Is the Difference Between the Income Tax Threshold and Payroll Tax Thresholds?

The minimum income tax threshold affects taxable income for individuals, while payroll tax thresholds are about your business wage bill at the state or territory level. The income tax threshold and tax free threshold determine when an employee starts to pay tax on their earnings for federal income tax. Payroll tax thresholds, by contrast, determine when a business becomes liable for state payroll tax on total wages and certain superannuation contributions.

For example, a business in Australia might still be under the state payroll tax threshold and not liable for payroll tax, even though its employees all earn well above the minimum tax threshold and pay income tax. These two sets of thresholds sit alongside each other and both affect the cost of employing staff, but they are reported and calculated separately. Understanding the difference helps employers avoid mixing up income tax rules with payroll tax obligations when planning staffing and growth.

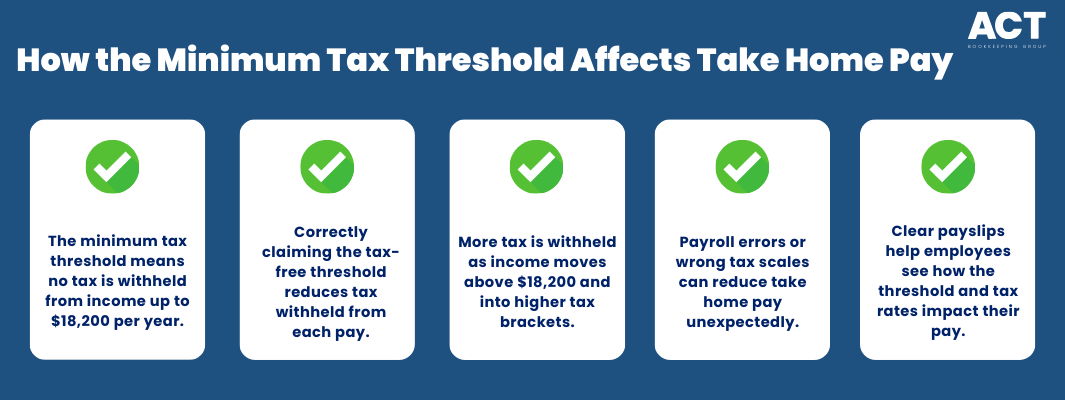

How Does the Minimum Tax Threshold Influence Take Home Pay?

From an employee’s perspective, the minimum tax threshold has a direct impact on how much tax is taken from each pay and how much money reaches their bank account as take home pay. When an employee correctly claims the tax free threshold, less tax is withheld in every pay cycle until their annual income moves well above $18,200. This can make a noticeable difference for lower‑income earners or those working part‑time, especially early in the income year.

As income rises through the tax brackets, more tax is withheld, but the threshold still ensures the first part of income attracts nil tax at resident tax rates. If payroll applies the wrong tax scale or ignores a valid claim, an employee might feel their pay is lower than expected and question how much tax they are paying. Clear payslips showing gross income, PAYG withheld, superannuation and net pay can help staff understand how the threshold and tax rates shape their pay.

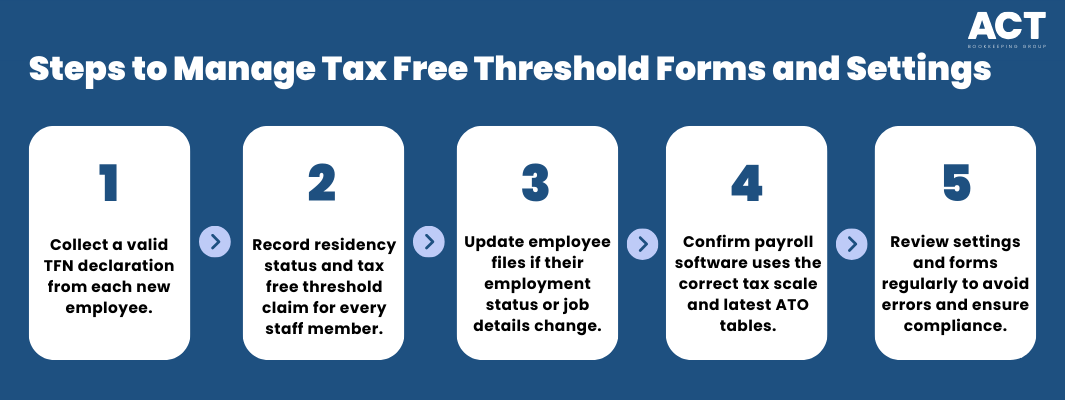

How Should Employers Manage Tax-Free Threshold Forms and Settings?

Every employer needs a robust process for handling TFN declarations and tax free threshold claims. When a new employee starts a job, they usually complete a form to confirm whether they are a resident for tax purposes and whether they want to claim the threshold from that employer. Your payroll system then uses this information, along with current ATO tables, to calculate taxable income tax for each pay.

You should ensure that every employee file clearly records their residency status, threshold claim and any changes over time, especially if they move from casual to permanent or take up a second job. It is best practice to double‑check that payroll software uses the correct tax scale for resident taxpayers and applies any updates to the tax tables from 1 July each year. Consistent setup reduces errors, saves time on corrections and helps employees understand why their pay and tax change when they submit a new declaration.

How Do Multiple Jobs and Other Income Complicate the Threshold?

The minimum tax threshold becomes more complex when an employee has a second job or other income sources such as investments or small business services. The ATO expects individuals to use the tax free threshold for only one employer, usually the main job where they earn most of their income. If a person claims the threshold with more than one employer, they might not pay enough tax during the year and can end up with a tax payable amount when they lodge their tax return.

Other income from business, investments or occasional work is added to wages to work out total taxable income and tax payable. If your employee’s other income pushes them into higher brackets, the tax on this income may be more than what was withheld through payroll alone. As an employer, you cannot control their other income, but you can explain why PAYG from a second job is often higher and encourage staff to check their situation on the ATO website or with a tax adviser.

How Does the Medicare Levy Fit into Tax Planning?

The Medicare levy is an additional amount that many Australian residents pay to support the public health system, calculated as a percentage of taxable income. While the levy sits alongside income tax, it also has its own thresholds and may not apply at lower income levels where taxable income is below certain limits. This means some low‑income resident taxpayers may pay little or no levy in addition to nil income tax on their first part of income.

There is also a Medicare levy surcharge that can apply to higher‑income individuals without the required level of private hospital cover. For employees in higher brackets such as 45,001 – 135,000 or 135,001 – 190,000, the levy and surcharge can add to tax payable if they do not hold cover and their income is above the relevant thresholds. While payroll does not always account for these amounts in detail, it is useful to mention them when staff ask why their final tax account shows more than just the income tax they expected.

We’re more than bookkeeping experts

As part of ACT Tax Group, we offer complete accounting and business advisory services tailored to your needs.

How Can Businesses Help Employees Understand Tax and the Threshold?

Businesses can turn the minimum tax threshold into a simple, practical education tool rather than a source of confusion. When onboarding new staff, consider including a short explanation of the tax-free threshold, taxable income and how PAYG works. For instance, you might show how someone earning $30,000 in a financial year pays tax only on the portion above $18,200, after the threshold is applied.

Offering occasional information sessions or short guides around tax time can also help employees understand how much tax they might owe or receive back when they lodge their tax return online. Encouraging them to use free calculators on the ATO website can show how their income, other income, tax deductions and superannuation contributions affect tax payable. This practical, calm approach builds trust in your payroll processes and helps staff feel more confident about their money and planning.

What Should ACT Employers Do Next?

For ACT employers, the minimum income tax threshold in Australia is a fundamental part of payroll compliance and staff communication. It affects how much tax is withheld on every pay, how your business plans cash flow and how confident employees feel about their take home pay and future tax return. Treating the tax-free threshold as a core setting in your payroll system, not just a formality, reduces errors and supports your team.

Consider reviewing your payroll setup, tax tables and employee files to confirm that residency status, threshold claims and superannuation details are up to date. Check that systems reflect the latest tax cuts and resident tax rates for 2024–25 and 2025–26, and that threshold settings match each employee’s claim. If you are unsure about unusual cases or want to reduce the risk of under‑ or over‑withholding, partnering with an ACT bookkeeping and tax services team can help your business stay compliant, minimise cost and support your people year after year.