Published on 17 Dec 2025

Medicare Levy Rate Changes: What Australian Businesses Need to Know for Payroll are reshaping how employers think about wages, PAYG and employee communication. These shifts affect how the employer withholds tax on salary and wages, even though the medicare levy itself is still calculated on taxable income. When payroll does not reflect updates, most Australian taxpayers in your business can end up with surprises on their income tax return.

For ACT and Australian employers, the Australian Taxation Office expects PAYG to be accurate and consistent with current income thresholds, including the family income threshold and any family income threshold increases announced for the income year. When PAYG is not aligned, most people either pay too much during the year or face a shortfall when they lodge their tax return. That is why businesses benefit from reviewing their payroll setup whenever levy, surcharge, or reduction rules change.

What Is Changing with Medicare Levy Rates and Thresholds for Payroll?

The core medicare levy rate remains at 2% of taxable income for most Australian taxpayers, but changes to low‑income settings and the family income threshold affect when people start paying the medicare levy in full. For the 2024–25 income year, single taxpayers earning $27,222 or less are exempt from the levy, while families with no children earning $45,907 or less qualify for exemption, with an additional $4,216 per dependent child. These settings shape how much tax an employer should withhold from each pay so that the final levy is as close as possible to the year‑end amount.

At the same time, updates to income thresholds and mls income threshold settings for the Medicare Levy Surcharge (MLS) can affect employees with higher annual income and no private hospital cover or private patient hospital cover. For the 2025–26 income year, single employees earning above $101,000 and families above $202,000 may be liable for MLS if they lack appropriate hospital cover. As the income year rolls over, these changes are built into ATO tax tables that payroll systems rely on. Keeping your software current helps ensure the medicare levy helps fund Australia’s public health system without creating avoidable stress for staff.

How to keep your payroll accurate with new Medicare Levy rates?

Schedule a complimentary consultation with us today to review your payroll setup and avoid surprises at tax time.

How Does the Medicare Levy Work for Australian Taxpayers?

The Medicare levy is a separate line item from standard income tax, but both are based on taxable income and reported on the income tax return in the same way. For most people, if their income is above the relevant income thresholds, they become liable to pay the full 2% levy on their income.

Some taxpayers may qualify for a medicare levy exemption, medicare levy reduction, or partial exemption, depending on their personal circumstances and whether they meet the following criteria for income level, residency or special situations. In certain cases, an exemption means they do not pay the levy at all for that income year, or for part of it. Employers cannot decide whether someone is exempt, but they can make sure that the employer withholds correctly based on the ATO settings that assume most workers are eligible for the usual rules.

How Does the Medicare Levy Surcharge Work Alongside the Standard Levy?

The Medicare levy surcharge is different from the standard Medicare levy and is designed to encourage individuals with higher annual income to hold hospital cover through private health insurance. If someone’s income for MLS purposes goes above the relevant income thresholds, and they do not have an appropriate level of private hospital insurance, they may have to pay the MLS on top of their usual levy.

For MLS purposes, the ATO uses a special definition of income, often called income for MLS purposes, which may differ from ordinary taxable income. This can include combined income for families, spouse income, and amounts for each child after the first, depending on family income and dependants. While payroll systems do not usually calculate the surcharge directly, employers are often asked to explain why someone became liable for MLS when they thought their salary and wages were already fully taxed.

How Do Family Income Thresholds and Dependants Affect the Levy?

For families, the family income threshold and family income threshold increases play a key role in whether they receive a Medicare levy reduction or Medicare levy exemption. The ATO looks at combined income for a spouse and their dependants, including each child and child after the first, to work out how the levy applies.

Having a dependent child or multiple dependants can change whether someone is exempt or receives a reduction on the levy, even when their own wages appear modest. In some cases, retirees with family responsibilities may also access relief alongside other offsets, such as a pensioners tax offset. While employers cannot see the full family picture, understanding that family income matters helps when staff ask why their levy outcome on the tax return looks different to their workmate on similar wages.

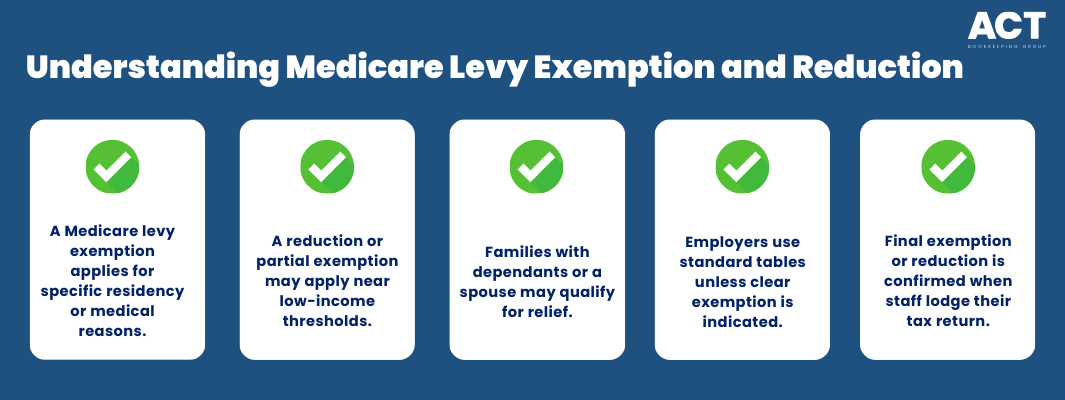

What Is Medicare Levy Exemption and Reduction, and How Does It Show Up for Payroll?

A medicare levy exemption applies when a person meets specific conditions, such as certain residency or medical categories, meaning they do not pay the levy for all or part of the income year. In other cases, a medicare levy reduction or partial exemption may apply when income is close to the low‑income thresholds, especially for families with a dependent child or spouse.

From a payroll point of view, employers generally treat everyone as though they are not exempt unless they are clearly outside the scope, and the final decision rests with the ATO at income tax time. The main takeaway for businesses is that the employer withholds using standard tables, and any exemption, reduction or surcharge adjustments are calculated when the worker lodges their income tax return. Helping staff understand this difference can reduce confusion and complaints about payslips.

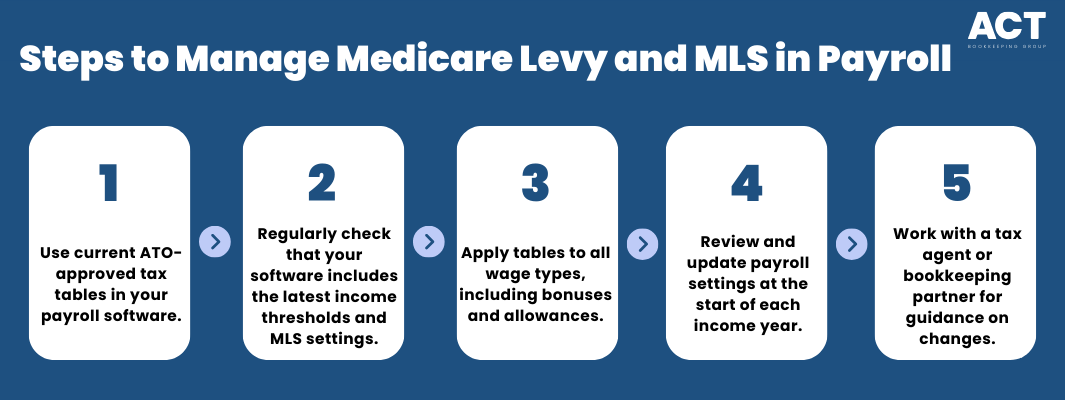

How Should Employers Handle Medicare Levy and MLS in Payroll Systems?

In practice, payroll systems handle the Medicare levy, Medicare levy rate and most Medicare levy surcharge purposes settings through ATO‑approved tax tables. The Australian Taxation Office publishes the necessary scales so that an employer can apply them to wages includes bonuses, allowances and ordinary time earnings without manually calculating levy amounts each pay.

Businesses should check that their payroll software uses current ATO tables, including any settings linked to income thresholds, mls income threshold, and common reliefs such as low‑income reduction rules. Regular checks ensure the employer withholds the right amount of tax, even when policy changes affect australian taxpayers differently based on personal circumstances, families and dependants. For most small businesses, working with a tax agent or bookkeeping partner makes this process smoother.

How Do Private Health Insurance and Hospital Cover Affect Paying the MLS?

Employees often ask if getting private health insurance or private hospital cover will help them avoid paying the Medicare levy surcharge. The core rule is that those above the relevant income thresholds for MLS purposes generally need an appropriate level of hospital cover or private patient hospital cover to avoid paying the surcharge.

If someone chooses not to be covered by private hospital insurance and their annual income for MLS is above the mls income threshold, they may have to pay the MLS on top of their regular levy. As an employer, your role is not to advise which product to buy, but to understand how MLS fits into the broader Australian taxation system so you can respond clearly when staff ask why their tax outcome changed.

How Does Medicare Fit into Australia’s Public Health System and Why Does It Matter for Payroll?

The Medicare levy helps fund Medicare, which sits at the core of Australia’s public health system and provides Medicare benefits for eligible residents. When staff see the levy on their income tax return, they are effectively contributing to shared costs of access to doctors, hospitals and other services across Australia.

Even though employers do not send a separate payment labeled “Medicare” each pay, the levy is built into tax tables so that the employer withholds enough from salary and wages through the year. Clear payroll processes help ensure employees are correctly contributing to this system without over‑ or under‑paying. Supporting staff to understand this structure can also build trust in how your business handles their entitlement and obligations.

We’re more than bookkeeping experts

As part of ACT Tax Group, we offer complete accounting and business advisory services tailored to your needs.

Why Is Accuracy Around Medicare Levy Settings So Important for Employers?

When Medicare settings are wrong in payroll, staff can become unintentionally liable for extra tax or surcharge at the end of the year. That might look like a surprise bill because the employer withholds too little, or a smaller refund because too much was held back for levy and MLS during the income year.

For businesses, repeated issues with levy and medicare levy surcharge outcomes can erode confidence in your payroll processes and in your understanding of Australian taxation rules. Aligning your systems with the ATO, regularly checking for official ATO updates, and reviewing your setup each year shows your team that you take compliance and fairness seriously.

How Can a Bookkeeping and Payroll Partner Support You with Medicare Levy Changes?

Working with a specialist bookkeeping and payroll team means you have experts watching out for Medicare levy rate, income thresholds, Medicare levy reduction, surcharge and related settings so you do not have to track every detail alone. They can help you interpret how new rules apply to wages, salary, families, dependants, and specific roles in your business.

A good partner will also make the language simple, so your employees understand how their income, hospital cover, personal circumstances and family income affect whether they are eligible for exempt, standard, or partial exemption outcomes. Instead of being buried in technical wording, you can rely on clear steps that keep your payroll aligned with the Australian Taxation Office and protect your team from avoidable levy surprises.

Conclusion: What Should Your Next Steps Be?

The practical next step for Australian employers is to confirm that your payroll system is using current ATO tax tables that correctly factor in the Medicare levy, Medicare levy surcharge, and related income thresholds. This keeps the link between taxable income, levy, surcharge, reduction and exemption settings as accurate as possible for every worker on your books.

From there, consider a short review with your tax agent or bookkeeping partner to walk through a few example pays and ensure the employer withholds the right mix of tax, levy and related amounts for different income levels and families. By taking these steps now, you support your staff, protect your business from errors, and play your part in funding the Medicare system that benefits communities right across Australia.