Published on 05 Nov 2025

Understanding how much Medicare Levy you actually pay is essential for managing your business finances and planning your tax obligations. Many Australian business owners find themselves confused about calculations, income thresholds, and potential surcharges. We want to make this simple so you can stay confident about exactly what you owe.

The Medicare Levy helps fund Australia’s public health system and is compulsory for most working Australians. Your personal circumstances—whether you’re a sole trader, have a family, or earn above certain income levels—directly affect how much Medicare Levy you’ll pay each year. Getting it right means peace of mind when you lodge your tax return.

How Much Medicare Levy Do I Pay?

The Medicare Levy is typically 2% of your taxable income, applying to most Australian taxpayers including business owners and sole traders working in Australia. You pay this in addition to income tax, calculated on wages, business profits, and other income combined. For families, the levy is based on combined income, meaning both spouses’ earnings count toward your total tax obligations.

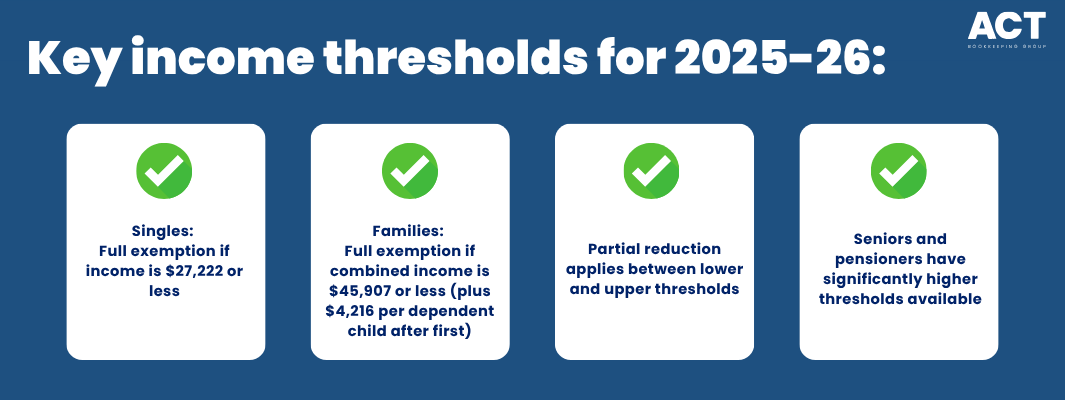

Some taxpayers might not pay the full 2% depending on their income and personal circumstances. If your income falls below certain thresholds, you may qualify for an exemption or reduction. This is especially important for business owners with fluctuating income or families with dependent children requiring support.

Unsure if your income qualifies for a levy reduction?

Schedule a complimentary consultation with us today to check your eligibility and adjust your ATO payments.

What Are Income Thresholds and Why Do They Matter?

Income thresholds determine whether you pay the Medicare Levy and how much tax you’ll owe annually. For singles, income below a certain amount means no levy applies. For families, the family income threshold is higher and increases with dependent children after the first child. These thresholds change yearly, so check them before tax time.

The reduction formula means if your income is just above the threshold, you pay only part of the levy rather than the full 2%. This phase-in approach protects lower-income earners and families effectively. Understanding your income relative to thresholds helps you plan your business structure or superannuation contributions to reduce tax obligations.

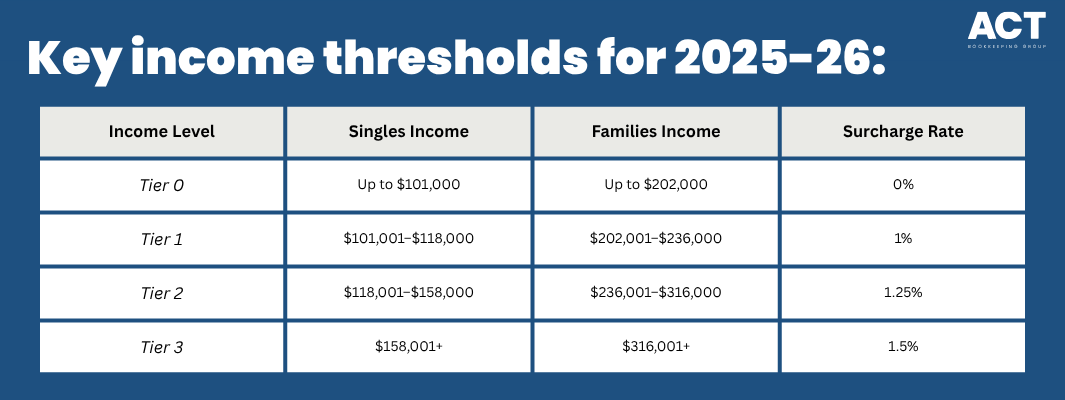

How Much Medicare Levy Surcharge Will You Pay?

The Medicare Levy Surcharge applies when you earn above a specific income level without private hospital cover protecting you. This additional tax ranges from 1% to 1.5%, depending on how much you earn annually. It’s designed to encourage higher income earners to take out private health insurance.

If your income puts you in higher MLS tiers without appropriate private hospital cover, the surcharge adds significantly to your tax bill each year. Family tiers increase by $1,500 for each child after the first, so families with multiple dependent children have higher thresholds before surcharge kicks in.

A business owner earning $140,000 without private hospital cover pays 1.25% MLS ($1,750), plus standard Medicare Levy of $2,800, totalling $4,550.

What Private Health Insurance Can Help You Avoid

Holding private hospital cover at an appropriate level avoids paying the Medicare Levy Surcharge entirely. If your income sits above the income threshold and you maintain qualifying cover throughout the year, the surcharge simply doesn’t apply. Private health insurance often costs significantly less than the MLS you’d pay without it.

The Australian Government offers a Private Health Insurance Rebate to help offset insurance costs, depending on your age and income. As income increases, rebate decreases, but it still makes private cover more affordable for most Australians. Compare annual MLS cost against insurance premiums and rebate before deciding your strategy.

How to save with private hospital cover:

Compare annual MLS cost against private insurance premiums

Factor in the Private Health Insurance Rebate available to you

Review annually as income changes affect both MLS thresholds and rebates

Ensure cover is maintained year-round to avoid surcharge

We’re more than bookkeeping experts

As part of ACT Tax Group, we offer complete accounting and business advisory services tailored to your needs.

Are You Eligible for Exemption or Reduction?

Some people qualify for partial exemption or full exemption based on income, personal circumstances, or eligibility for Medicare benefits. Very low income earners may be exempt entirely. If you’re not an Australian resident or don’t qualify for Medicare, exemption might apply. Long-term care recipients and certain veterans may also qualify.

An exemption means no levy due, while reduction means paying less than 2%. To claim, provide supporting information to the Australian Taxation Office. If personal circumstances change—having another child, income loss, or residency changes—check your eligibility status.

Who might qualify:

Low-income earners below minimum threshold

Families with dependent children on low income

Seniors and pensioners with higher thresholds

Certain temporary visa holders

Long-term care residents and recipients

Department of Veterans’ Affairs supported persons

How Business Structure Affects Your Medicare Levy

Your Medicare Levy is assessed on personal income, not at business level, regardless of your structure. If you’re a sole trader, business profit adds to other personal income for levy purposes. For partnerships, distributions are included in each partner’s personal income. For company directors, dividends become personal income.

Multiple business owners in one household combine separate incomes when checking MLS thresholds or family income thresholds. A spouse’s wages or business income counts toward combined family income, affecting both standard levy and potential surcharge liability significantly.

Planning Your Medicare Levy Before Tax Time

Proactive planning helps you avoid unexpected Medicare Levy bills and prevents overpaying throughout the year. Before year-end, review income against current ATO thresholds carefully. If you’re near an MLS threshold without private hospital cover, consider whether taking out cover makes financial sense. If income fluctuated significantly, check whether you qualify for reduction or exemption.

Speak with your tax agent about strategies tailored to your business and personal circumstances. Some business owners reduce reportable taxable income through additional superannuation contributions, moving below an MLS tier and saving thousands annually. Others restructure businesses to better manage family income for threshold purposes.

Conclusion

Understanding how much Medicare Levy you actually pay puts you in control of tax planning and removes stress from tax time surprises. Whether you’re a sole trader, family with multiple earners, or higher-income business owner, knowing your thresholds and planning ahead is essential.

We’re here to help you understand these details and ensure you’re paying exactly what you owe—no more, no less. Every business has unique circumstances, and tailored advice saves you time and money. If you’re unsure about your Medicare Levy or want strategies to reduce tax obligations, reach out to ACT Bookkeeping Group.

Your next step is simple: gather your latest income information and speak with a tax professional before year-end. We’re ready to answer questions and help you feel confident about your tax position.