Published on 03 Dec 2025

Marginal tax rates describe how much tax you pay on each extra dollar of income you earn, and they’re one of the most important concepts to grasp if you run a business or work as a contractor in Australia. Understanding your marginal tax rate directly affects your take home pay, determines how much tax liability you face each financial year, and helps you make smarter decisions about paying yourself from your business. Without this knowledge, you might find yourself paying far more tax than necessary or missing out on strategies that could put extra money back in your pocket.

The reason marginal rates matter so much is that Australia uses a progressive tax system rather than a flat tax system. This means different portions of your taxable income are taxed at different rates, creating what we call marginal brackets. If you’re running a business in Australia or earning multiple income streams, your decisions about profit extraction, salary, dividends, and structure all hinge on understanding where your income falls within these different tax rates. Getting this wrong can cost thousands in unnecessary tax across a year.

How Does the Progressive Tax System Create Marginal Tax Rates?

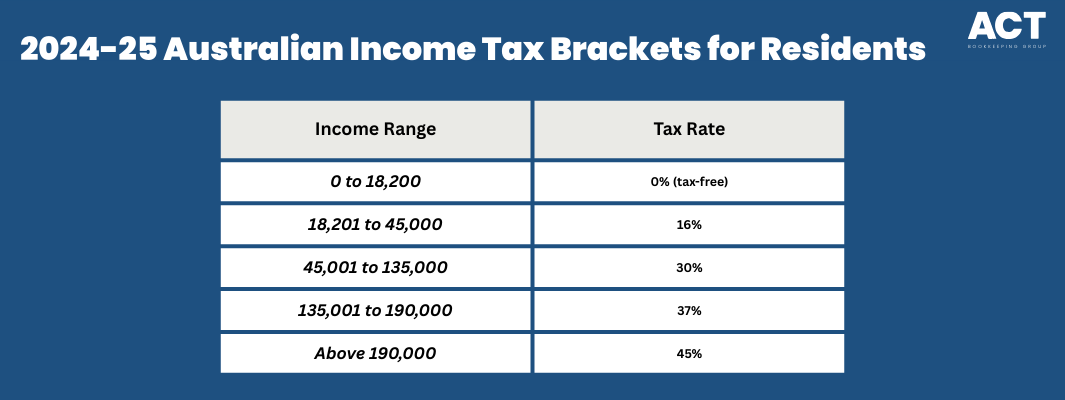

Australia’s tax system operates on a stepped approach where your income is split into different ranges, with each range taxed at its own percentage. The marginal tax rate is specifically the rate applied to your next dollar of earnings. For Australian residents in the 2024–25 financial year, the tax-free threshold sits at 0 to 18,200, meaning you pay no tax on income up to this certain level.

Above that threshold, your taxable income enters different brackets that determine the percentage of tax you’re liable for. This structure means a dollar earned at 18,201 is taxed differently to a dollar earned at 135,000, and entirely differently to a dollar above 190,000. Your effective tax rate (total tax divided by total income) will always be lower than your marginal rate because earlier dollars are taxed at lower percentages.

Worried you’re paying too much tax on business income?

Schedule a complimentary consultation with us today to review your marginal rate and cut unnecessary ATO tax.

Why Does Your Marginal Tax Rate Matter More Than Your Average Rate?

When you’re deciding whether to take on extra work, launch a new business line, or extract more profit from your company, it’s your marginal tax rate that matters, not your average rate. Each new dollar you earn gets taxed at your marginal bracket. If you’re currently earning 120,000, your next dollar falls into the 30% bracket, so any growth in your business is taxed at 30% until you reach 135,000.

Many business owners get caught out here because they think about their overall tax burden rather than the cost of earning extra revenue. You might also face a Medicare levy of 2% on top of your income tax, which adds another layer to your real tax payable. For certain circumstances and income levels, additional levies like the Medicare levy surcharge might also apply, particularly if you don’t have private health insurance. This is why understanding where your income sits within these brackets is absolutely critical for making smart business decisions.

What Changes Did the 2024–25 Tax Year Bring for Business Owners?

From 1 July 2024, the Australian tax system shifted to new brackets designed to provide relief for lower and middle-income earners. The bracket that runs from 18,201 to 45,000 is now taxed at just 16%, down from previous rates, making this range significantly more attractive. The 45,001 to 135,000 bracket remains at 30%, while higher earners in the 135,001 to 190,000 range continue at 37%.

These changes mean many business owners who draw income at mid-range levels benefit from genuine tax relief. If your business has grown and you’re now earning between these brackets, you may find your actual tax bill is lower than it would have been under the old rules. Conversely, if you’ve been structuring your income based on previous rates, it’s worth revisiting your approach to make sure you’re still optimising your tax liability under the new system.

How Do Company Tax Rates Interact with Your Marginal Rate?

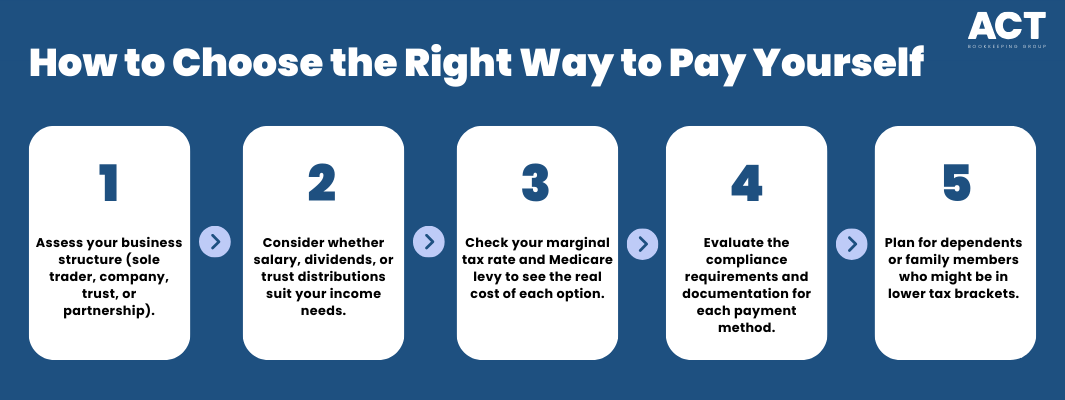

A key decision for growing businesses is whether to operate as a sole trader, company, trust, or partnership structure. If you’re a sole trader, all your business income is taxed at your personal marginal rate. However, if your business is structured as a company, profits are taxed at the company level first, either 25% or 30% depending on the company’s classification, and then again when you draw that profit as salary or dividends.

At first glance, this seems like double taxation, but there’s a mechanism called franking credits that partially offsets the second layer. A 25% company tax rate with fully franked dividends means you as the owner receive a credit that reduces your personal tax payable. Whether a company structure is worthwhile depends entirely on your personal marginal rate and the profit you want to retain versus draw.

How Do Marginal Tax Rates Affect How You Should Pay Yourself?

As a business owner, you have multiple ways to extract income: salary, dividends, distributions, or simply drawings if you’re self-employed. Each method has different tax consequences. A salary you pay yourself is a deduction for your business, reducing company taxable income, but you’ll pay tax on that salary at your personal marginal rate plus Medicare levy.

Dividends work differently. They come from after-tax profit and come with franking credits already attached. If you’re in a lower marginal bracket, you might get a refund; if you’re in a higher bracket, you’ll owe more tax. A trust structure gives you even more flexibility, allowing you to distribute income to beneficiaries in lower tax brackets, though this requires careful documentation and compliance with ATO rules. The optimal mix depends entirely on your specific circumstances, projected income, and whether you have dependents in lower brackets.

What Role Does Superannuation Play in Managing Your Marginal Rate?

Superannuation is one of the most powerful tools for reducing your effective marginal rate because concessional contributions are taxed at just 15% rather than your personal rate. If you’re in the 30%, 37%, or 45% marginal bracket, contributing to super saves you the difference immediately. For example, at a 37% marginal rate, a 10,000 contribution into super saves you approximately 2,200 in tax compared with taking that money as income.

However, there’s a trade-off: super money is locked away until a certain level of preservation age. You need to balance your immediate cash needs with long-term wealth building. By integrating super into your annual tax plan, you can maximise contributions within your caps while maintaining the cash flow your business needs to operate and grow. This is where professional advice becomes valuable.

We’re more than bookkeeping experts

As part of ACT Tax Group, we offer complete accounting and business advisory services tailored to your needs.

How Do Deductions Work at Different Marginal Rates?

Every deduction you claim effectively reduces your taxable income, and the value of that deduction to you is calculated at your marginal rate. If you’re in the 45% bracket and claim a 5,000 business expense deduction, you save 2,250 in tax. The same 5,000 deduction claimed by someone in the 16% bracket saves only 800. This is why business owners in higher marginal brackets see greater benefit from careful expense management and timely capital purchases.

Strategic timing of deductions, bringing forward expenses into a year where you expect to be in a higher bracket, can legitimately reduce your overall tax over time. Investments in equipment, vehicles, or technology during good profit years are more valuable from a tax perspective than making those same purchases during lower-income years.

Taking Control of Your Marginal Tax Position

Understanding marginal tax rates and how they apply to your specific circumstances transforms tax from something that simply happens to you into something you can actively manage. Whether you’re a sole trader, run a company, operate through a trust, or work across multiple structures, your marginal rate is the key number that drives real financial decisions.

The next step is to map out your projected income levels for the current financial year and see exactly which brackets you’ll occupy. From there, decisions about business structure, salary versus dividends, superannuation contributions, and strategic expense timing all become clearer. If you’d like help working through your specific situation and building a plan that minimises your tax while keeping you compliant, we’re here to support you.