Published on 26 Nov 2025

What does liquidation mean for Australian small businesses? A bookkeeper’s guide like this explains what happens when a company can no longer pay its debts and needs a structured exit. Liquidation is the process of winding up a company’s affairs, selling assets, and using the proceeds to pay creditors in a set order while a registered liquidator manages every step. Liquidation meaning in accounting is that the business is closing, its remaining value is being turned into cash, and the company will eventually be removed from the companies register.

For many small business owners, liquidation feels like a last resort, but it can also bring closure and clarity when there is no longer enough money to meet financial obligations. Understanding how the liquidation process works helps you protect yourself as a business owner and company director, especially around issues like insolvent trading and personal guarantees. With strong bookkeeping and timely professional advice, you can recognise early warning signs, examine alternatives, and, if liquidation is necessary, move through liquidation proceedings in a more controlled and informed way.

What Does Liquidation Actually Mean for a Small Business?

Liquidation means that a company is being formally closed and its remaining value is turned into cash to pay creditors as far as possible. In an insolvent liquidation, the company can no longer pay its debts as and when they fall due, so the law steps in with a structured process to deal with outstanding debts and company’s assets fairly. Once liquidation commences, a registered liquidator is appointed as an external administrator to take over control of the company’s financial affairs and everyday decisions from the company directors.

From that point, the liquidator requires full access to the company’s records, including details of assets, liabilities, creditors’ claims, and company’s debts. The process involves selling assets such as stock, equipment, vehicles, intellectual property, and sometimes the business as a going concern. After liquidation is complete and all the debts have been dealt with as far as possible, the company is deregistered with the Australian Securities and Investments Commission (ASIC), and it no longer exists as a legal entity.

Struggling with possible insolvency and ATO pressure?

Schedule a complimentary consultation with us today to review your books and spot liquidation warning signs early.

How Do Different Types of Liquidation Work?

There are several types of liquidation, each suited to different circumstances and different levels of financial distress. In a creditors voluntary liquidation, company directors and shareholders decide that the company is insolvent or will soon become insolvent and pass a resolution to place the company into voluntary winding up. This type of voluntary liquidation lets directors act before legal action escalates and gives them some control over the timing of when the company enters liquidation.

Court liquidation, also known as compulsory liquidation or involuntary liquidation, occurs when a creditor, the ATO or another party applies to court for a court order to wind up the company because it can no longer pay its debts. In this situation, the court appoints a liquidator, and legal proceedings usually feel more hostile and formal for the business owner. Members voluntary liquidation is different, as it is only available to solvent companies that can pay all debts in full and simply wish to close in an orderly way and distribute any surplus to shareholders.

What is the Simplified Liquidation Process for Small Businesses?

For small companies with relatively low levels of debt, there is a simplified liquidation process designed to reduce complexity, reporting obligations, and liquidation costs. This simplified liquidation is available only in certain circumstances, such as where liabilities are under a specific threshold and the company’s records are up to date. The idea is to provide a faster, more cost‑effective option for small business owners whose insolvent company has limited assets and straightforward affairs.

When a company meets the criteria, the liquidator may adopt simplified liquidation instead of the standard approach, which can reduce meetings, shorten timelines, and focus on essential investigations only. This does not remove the obligation to investigate inappropriate transactions or insolvent trading, but it aims to balance thoroughness with affordability. It is important to seek professional advice early to understand whether simplified liquidation is available for your business and how it would work in practice.

What Happens to Company Directors During Liquidation?

When a company enters liquidation, company directors lose control of the business and must hand over decision‑making authority to the liquidator. They are still required to help by providing information, records, and explanations about the company’s affairs and company’s financial affairs, but they no longer direct operations or deal with company’s creditors directly. In many ways, this can be a relief for business owners who have struggled with mounting debts and insufficient funds for some time.

However, directors face certain risks. If the company continued to incur debts when it could no longer pay its debts and there was no reasonable prospect of improvement, directors may be accused of insolvent trading. In such cases, directors can be held personally liable, meaning they may be personally liable to pay creditors for some or all the debts incurred after the company became an insolvent company. Directors may also be investigated for inappropriate transactions such as uncommercial payments, unfair preferences to certain creditors, or misuse of company assets.

How are Creditors Treated in Liquidation?

In liquidation, creditors are paid according to a strict order set out in the Corporations Act. Secured creditors, who hold a security interest over specific assets, usually have first rights to receive payments from selling assets covered by that security. Unsecured creditors, such as many suppliers and service providers, line up behind employee claims and other priority debts and often receive only a small percentage of what they are owed.

Employees are usually treated as priority unsecured creditors when it comes to unpaid wages, annual leave, long service leave, and retrenchment payments. After paying liquidator’s fees and liquidation costs, the liquidator will pay creditors in order of their priority and only if there is enough money available. Other creditors may receive a dividend or, if there is not enough money, they may not receive anything at all.

What Does the Liquidation Process Involve Step By Step?

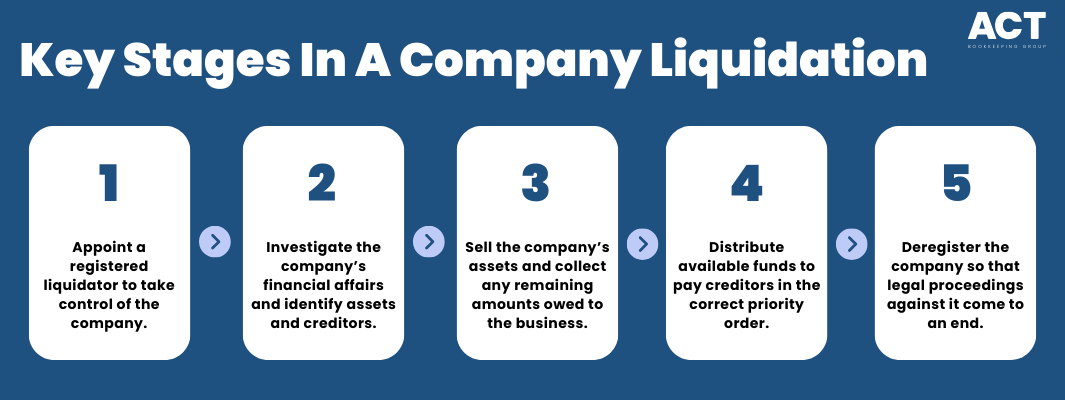

While every liquidation is different, the process generally follows a clear structure. Liquidation commences when a resolution is passed by directors and shareholders, or when a court order is made, and a registered liquidator is appointed. The liquidator then takes control of the company’s bank accounts, assets, contracts, and records and informs creditors and shareholders that liquidation has begun.

Next, the liquidator reviews the company’s financial affairs, prepares initial reports, and may call a creditors meeting to explain the situation, outline options, and confirm or change the appointed liquidator. The process involves selling assets, collecting debts owed to the company, resolving disputes, and assessing creditors claims. Throughout the liquidation proceedings, the liquidator issues progress reports so creditors and shareholders understand what has been done and what outcome is likely.

What Happens To Employees and Everyday Business Obligations?

When a company can no longer pay and enters insolvent liquidation, employees often lose their jobs as the business winds down. Their unpaid wages and entitlements are treated as priority claims, ahead of most other debts. In some cases, a small number of employees may be kept on for a short period to help wrap up operations or assist with selling assets.

Everyday obligations such as rent, utilities, and supplier accounts stop being paid once the company no longer has enough money or once the liquidator decides to cease trading. Existing contracts can be disclaimed or renegotiated, and the focus shifts from ongoing business to finalising all remaining obligations in a fair and orderly way. Where the company has given personal guarantees to landlords or financiers, those parties may seek to recover outstanding debts directly from the director or guarantor.

How Do Legal Proceedings and Court Involvement Work?

In certain circumstances, court approval or involvement is required, especially with court liquidation or when complex legal questions arise. For example, a provisional liquidator might be appointed by court order to preserve company’s assets while serious disputes are decided. The court can also issue directions for the liquidator, rule on disputes about creditors claims, or consider applications about proposed settlements or funding arrangements.

Legal action may continue against directors, particularly if there are allegations of insolvent trading, inappropriate transactions, or breaches of directors’ duties. The Corporations Act sets out offences and penalties, and some breaches can lead to criminal offences as well as civil liability. For many small business owners, this legal landscape feels intimidating, which is why early professional advice from insolvency specialists and legal advisers is essential.

We’re more than bookkeeping experts

As part of ACT Tax Group, we offer complete accounting and business advisory services tailored to your needs.

What Role Does Bookkeeping Play Before and During Liquidation?

Good bookkeeping gives a business owner a clear, real-time view of whether the company still has enough money to pay its debts and stay afloat. If financial records show that the company can no longer pay or is likely to no longer pay debts on time, this is a warning sign to seek professional advice before insolvent trading continues. Accurate books also support applications for small business restructuring, voluntary administration, or members voluntary liquidation if the business is still solvent.

During liquidation, accurate records save time and reduce stress. When the liquidator requires information, a well organised file of invoices, bank statements, contracts, and payroll records allows the external administrator to understand the company quickly. This reduces liquidation costs, leads to more accurate outcomes for creditors, and demonstrates that the directors have tried to manage the business responsibly.

What Practical Steps Can Small Business Owners Take Now?

If you are worried about your company’s ability to pay, start by checking whether outstanding debts and regular bills can be met from current cash or expected sales. Working with your bookkeeper, prepare simple cash flow forecasts and review who the company owes and who owes the company. This helps clarify whether you are facing temporary pressure or deeper structural problems.

If there is a real risk that your company cannot pay creditors on time, consider seeking professional advice on options such as voluntary administration, small business restructuring, or, if necessary, creditors voluntary liquidation. Communicate early with creditors and be honest about what the business can realistically pay and when. Early action often means more choices and better outcomes for you as the owner, for your employees, and for creditors and shareholders.

Conclusion

Liquidation is the process used when a company can no longer meet its financial obligations, but it does not have to mean chaos or personal disaster if you act early and stay informed. Understanding liquidation meaning in accounting terms, the different types of liquidation, and how the process works gives you more control, even in difficult times. With clear records and supportive advisors, you can navigate liquidation proceedings or alternative solutions with greater confidence.

At ACT Bookkeeping, our team helps business owners across the ACT keep their books accurate, highlight early warning signs, and prepare for discussions with insolvency practitioners and legal advisers when needed. If you are unsure whether your company is heading toward insolvency, worried about unpaid wages or other debts, or simply want a better handle on your company’s financial affairs, we are here to help. Reach out to our team for friendly, professional advice that supports you in protecting your business, your future, and your peace of mind.