Published on 12 Nov 2025

Insolvent trading is a critical risk for Australian small business owners, as the Corporations Act requires that company directors act responsibly when a company is insolvent or unable to pay all debts as they become due. Directors who allow a company to incur new debts while facing financial difficulties put themselves at risk of severe civil and criminal penalties, including personal liability for company debts. Recognising warning signs and immediately seeking professional advice is the best way to prevent insolvent trading and protect your company’s future.

Many Australian companies struggle with cash flow and incomplete financial records, which makes it hard for directors to keep track of the company’s affairs and accurately assess the company’s financial position. Whether you’re raising funds or managing board disputes, steering your business away from trading while insolvent must remain your top priority to protect employee entitlements, customers, and personal assets.

What Is Insolvent Trading Under Australian Law?

Insolvent trading happens when directors allow a company to continue its business and incur debts after the company is insolvent. Under the Corporations Act, directors must have reasonable grounds to expect the company can pay debts as they fall due; otherwise, personal liability for any debts incurred may result.

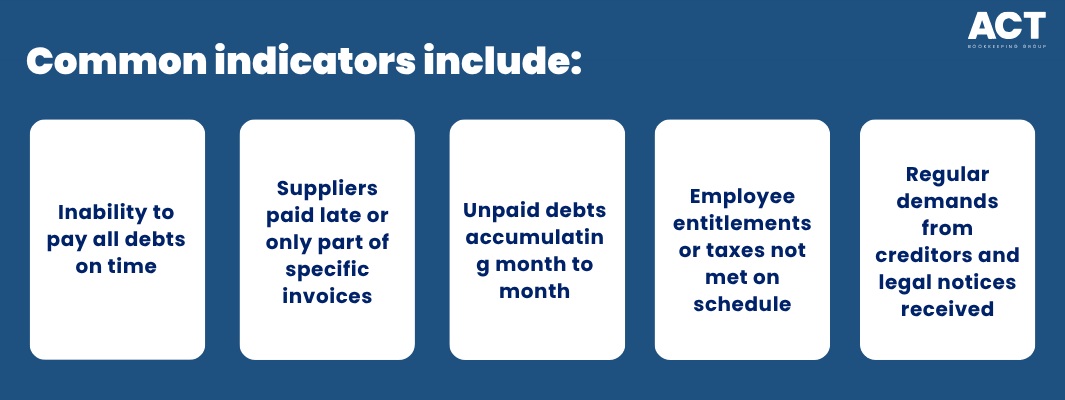

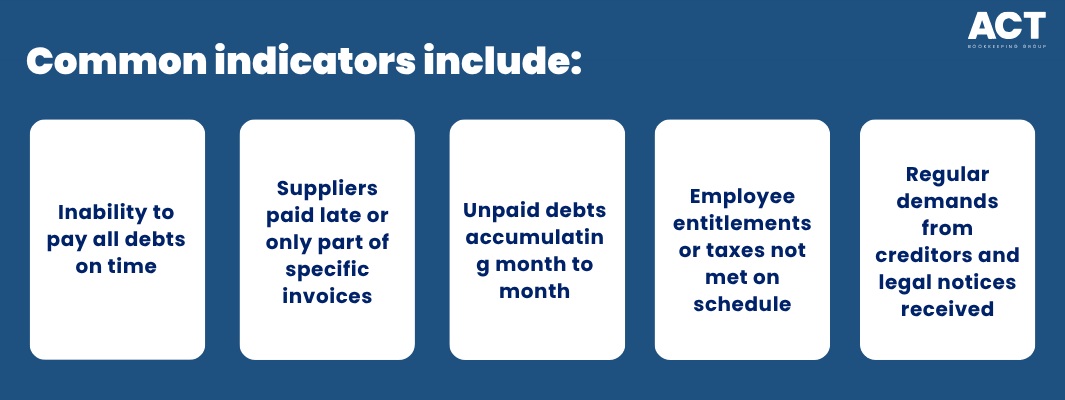

Company directors are required to actively monitor the company’s finances and respond to signs of financial distress. Warning signs such as overdue taxes, unpaid debts to suppliers, and incomplete financial records demand immediate attention. If the company fails to meet obligations or creditors are paid outside the usual terms, it’s time for directors to check whether the company is insolvent and to seek professional advice if needed.

The law considers all parties—creditors, suppliers, employees, and shareholders—when assessing a company’s financial situation. If directors neglect their duty to prevent insolvent trading in certain circumstances, they may find themselves held personally liable for the company’s debts.

Worried about personal liability for company debts?

Schedule a complimentary consultation with us today to understand director protections and limit legal exposure.

The Financial Reality of Insolvent Trading for Small Businesses

Australian small businesses face a growing challenge as market value fluctuates, and economic pressures increase the risk of company insolvency. Data shows that most insolvency events begin with financial distress, where businesses cannot raise funds to pay all the person’s debts or fulfil superannuation liabilities.

In many cases, directors continue business operations hoping for better conditions, ignoring warning signs such as increased debt-to-equity ratios, collecting debts and unrecoverable loans, and paying specific invoices just to keep trading. This practice increases the risk to unsecured creditors and exposes management personnel to civil penalties.

Employee entitlement proceedings and disputes with the board can further complicate the company’s position. When suppliers place accounts on cash-on-delivery terms or demand upfront payments, the company incurring these debts may be close to external administration.

How Directors Can Recognise Warning Signs of Company Insolvency

It’s vital for company directors to watch out for financial difficulties before they become a crisis. Warning signs that a company is insolvent include not only missed creditor payments but also a decline in the company’s assets against its liabilities.

Directors should check the company’s finances regularly, looking for patterns such as payments made to selected creditors, borrowing from associated parties, or the company’s overdraft limit frequently exceeded. Incomplete financial records make it difficult to judge the company’s financial position and can increase the risk of trading while insolvent.

Communicating with professional accounting advisers or registered liquidators can help directors get a clearer view of their company’s business plan and exposure to risk. Secured creditor claims, creditor disputes, and management personnel issues can also reveal deeper financial problems.

What Penalties Apply to Directors for Insolvent Trading?

Directors who breach their duty to prevent insolvent trading face severe civil and criminal penalties under the Corporations Act. Civil penalties can reach significant amounts, especially if directors are found personally liable for company debts or required to pay compensation to creditors and employees.

Criminal penalties can apply in circumstances where directors are dishonest, such as continuing to trade while insolvent for personal benefit obtained or failing to act in the company’s best interests. Directors may face criminal charges, fines, and even imprisonment for trading while insolvent.

If a company enters voluntary administration or is placed under an external administrator, directors can be pursued for unpaid debts by both unsecured and secured creditors. These proceedings often begin with solicitors’ letters and end with the director paying compensation or being disqualified from managing corporations.

When Safe Harbour Protections Apply to Company Directors

Safe Harbour provisions—built into the Corporations Act—give company directors room to develop a company arrangement without personal liability, as long as reasonable steps are taken to protect the company’s financial situation. Directors must act in the company’s best interests, monitor its affairs, and pursue practical steps such as raising funds, restructuring, or improving the business plan.

Directors qualify for Safe Harbour protection only if the business has paid all employee entitlements (including superannuation) and is up to date with tax obligations, and directors are developing or implementing a course of action reasonably likely to result in a better outcome for the company than immediate administration or liquidation.

Safe Harbour is only available in certain circumstances. Directors must show genuine efforts to prevent insolvent trading and improve the company’s future prospects.

Conditions for protection:

Paid employee entitlements including superannuation

Up-to-date tax filings and payments

Informed decisions based on correct financial records

Management personnel undertaking genuine restructuring actions

Regular consultation with advisers and proper documentation

We’re more than bookkeeping experts

As part of ACT Tax Group, we offer complete accounting and business advisory services tailored to your needs.

How Professional Advisers Help Directors Understand Financial Difficulties

Professional advice is essential for company directors facing financial distress or signs of insolvency. Engaging pre insolvency advisers, registered liquidators, or professional accountants can help directors assess the company’s financial position, prepare realistic budgets, and avoid incurring new debts that the company cannot pay.

Directors should immediately seek professional advice as soon as there are reasonable grounds to suspect insolvency. By documenting advice received, board discussions, and actions taken, directors prove they acted in good faith to prevent insolvent trading.

What Defence Options Exist for Directors Facing Insolvent Trading Claims

Directors facing insolvent trading claims can use several defence options under the Corporations Act. In certain circumstances, directors may show they had reasonable grounds to expect solvency at the time debt incurred or relied on accurate information from competent management personnel.

Other defences include incapacity due to illness, taking all possible steps to prevent the company from incurring further debts, or placing the company into voluntary administration. Directors must keep clear records and prove their actions were in the best interests of the company and creditors.

Conclusion

Insolvent trading presents serious risks to directors, employees, and unsecured creditors. Directors must monitor company finances and seek professional advice as soon as there are warning signs of an insolvent company, such as missed payments or difficulty meeting ongoing obligations. Superannuation liabilities and board disputes often signal bigger financial problems that need immediate attention.

Acting quickly helps address both management and compliance issues, reducing the likelihood of legal complications and penalties. Directors should communicate regularly with advisers and all board members, ensuring that superannuation, wages, and debts remain under control. Taking these steps can help a company avoid unnecessary financial hardship and protect all parties involved.

By reviewing cash flow, settling superannuation liabilities, and maintaining open dialogue during board disputes, directors give the insolvent company a better chance of recovery or orderly resolution. This clear, practical approach supports good governance and strengthens outcomes for employees, creditors, and directors.