Published on 22 Oct 2025

Salary packaging explained — it’s a simple way for Australian employers to help employees reduce their income tax and increase their after-tax income, while enjoying tax benefits when managed correctly. This article examines how salary packaging works, the tax implications to consider, and how businesses can stay compliant with Australian tax laws.

Understanding Salary Packaging

Salary packaging, also known as salary sacrifice, allows an employee to receive certain benefits from their employer instead of part of their pre-tax salary. This arrangement helps employees pay less tax while increasing their take-home pay. Employers benefit by offering a more attractive salary package, improving staff satisfaction and retention.

Facing ATO compliance challenges with salary packaging?

Schedule a complimentary consultation with us today to ensure every benefit is structured within ATO guidelines.

How Does Salary Packaging Work?

Under a salary packaging arrangement, employees agree to give up part of their pre-tax income in exchange for non-cash benefits of similar value. For example:

An employee earning $90,000 could salary sacrifice $10,000 towards a novated lease for a motor vehicle.

The employer pays this amount directly to the leasing provider as part of the package.

The employee’s taxable income is then reduced to $80,000, which means they pay less income tax and save money overall.

This pre-tax approach can include benefits such as superannuation contributions, loan repayments, or even selected general living expenses like rent, school fees, or mortgage payments.

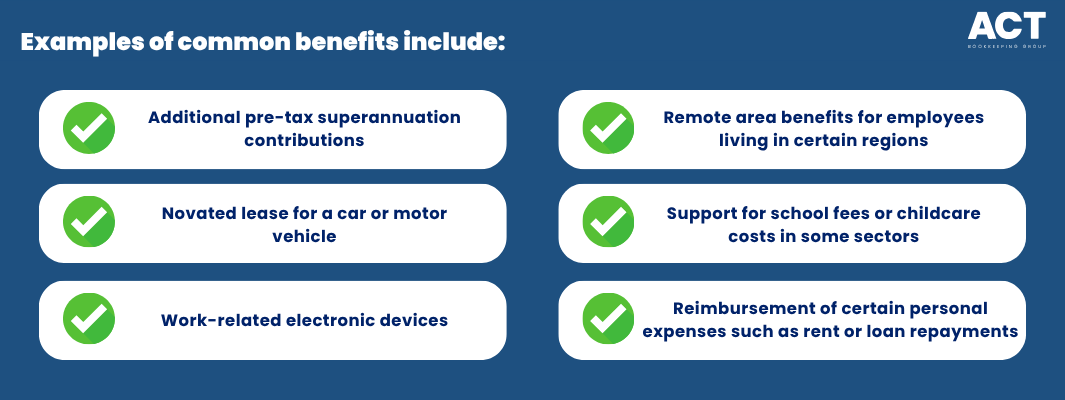

Common Salary Packaging Benefits

Employers can offer various benefits within a salary packaging arrangement depending on their industry or organisation.

Some not-for-profit organisations and health sector employers can also offer tax-free (exempt) benefits up to a capped amount. This means employees in these organisations can receive certain benefits without their employer needing to pay Fringe Benefits Tax (FBT).

Tax Benefits and Obligations

Salary packaging offers clear advantages for both the employer and employee — but only when compliance rules are followed. Employers must understand the tax implications, particularly FBT, and ensure proper records are kept for each package.

Fringe Benefits Tax (FBT)

When an employer provides benefits that are not exempt, they may need to pay Fringe Benefits Tax. The value of the fringe benefits determines how much tax the employer must pay. However, certain benefits like superannuation contributions or portable work devices may be exempt from FBT.

Employers need to record each fringe benefit’s taxable value and pay fringe benefits tax annually as required by the Australian Taxation Office (ATO). Proper reporting helps avoid penalties and ensures each employee’s salary packaging work arrangement remains compliant.

Income Tax and Reporting

By reducing the employee’s taxable income through pre-tax contributions, salary packaging allows them to pay less tax over time. However, any after-tax income should be correctly reflected in wages and payroll records. Employers are also responsible for reporting fringe benefits on employee payment summaries when required.

GST and Record-Keeping

Employers registered for Goods and Services Tax (GST) may be eligible to claim input tax credits on certain expenses such as leased vehicles or devices provided under a salary package. Keeping accurate records ensures these credits are applied correctly and that all benefits meet ATO rules.

Employers should also maintain written agreements outlining how the salary packaging arrangement works, its value, and any applicable conditions. This level of documentation protects both employer and employee from compliance issues.

We’re more than bookkeeping experts

As part of ACT Tax Group, we offer complete accounting and business advisory services tailored to your needs.

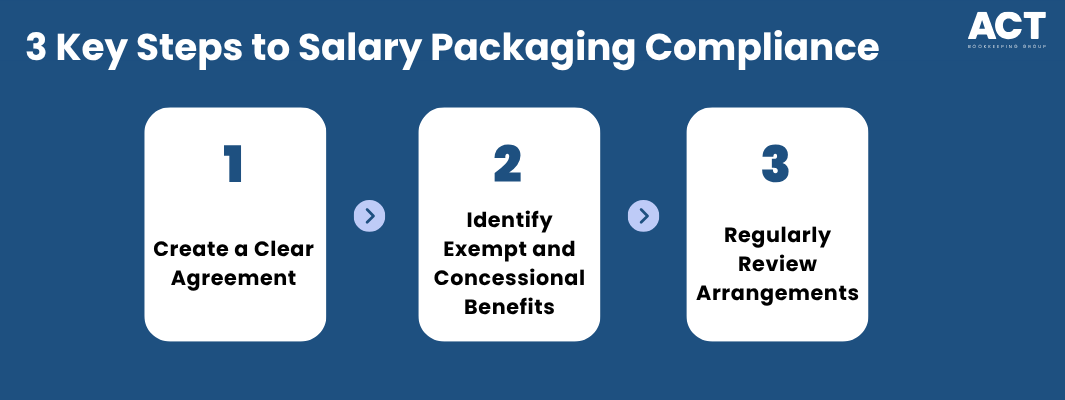

Salary Packaging Compliance Strategies

Compliance doesn’t have to be complicated. Employers can make salary packaging work effectively by following a few structured steps.

Step 1: Create a Clear Agreement

Start every salary packaging arrangement with a written agreement between the employer and employee. It should clearly explain how much of the pre-tax income is being used for certain benefits, the value of each benefit, and how any FBT or other costs will be handled.

Step 2: Identify Exempt and Concessional Benefits

Some industries, such as not-for-profit organisations or government sectors, can access specific tax offsets or exemptions. For example, certain benefits like remote area assistance, workplace equipment, or professional memberships may not require the employer to pay FBT if they qualify as exempt benefits.

Step 3: Regularly Review Arrangements

Laws around fringe benefits tax, income tax, and salary packaging change frequently. Employers should review packages annually to ensure they remain compliant and continue providing value. Consulting a registered accountant or bookkeeper ensures that expenses, reporting, and ATO guidelines are correctly managed.

Managing Employee Benefits Responsibly

Salary packaging can help employees pay less tax, access more of their pre-tax income, and manage general living expenses more effectively. However, these benefits must be handled carefully. For employees with existing commitments such as rent, mortgage, or HECS-HELP loans, adjustments to taxable income may affect eligibility for government benefits or tax offsets.

Employers can provide advice or refer staff to financial professionals to make informed decisions before entering or changing any salary sacrifice arrangement. Transparency about income, benefits, and expenses ensures everyone involved understands their responsibilities.

Conclusion: Build a Stronger and Smarter Salary Package

When used correctly, salary packaging can help businesses support their employees while maintaining tax efficiency and compliance. For Australian employers, the key lies in understanding how salary packaging works, monitoring tax obligations, and setting up clear agreements that balance savings with accountability.

ACT Bookkeeping provides practical support to make your salary packaging arrangements compliant, efficient, and tailored to your organisation’s needs. Whether you are looking to add financial flexibility for your staff or improve the structure of your employee benefits, our professional, approachable team can provide advice and guidance.

Contact ACT Bookkeeping today to make salary packaging a smart, simple way to help your employees pay less tax and make the most of their income.