Published on 09 Oct 2025

Avoiding surprise corporate tax bills is crucial for Australian businesses, as unexpected tax obligations can significantly impact cash flow and create unnecessary financial stress. Understanding eligibility requirements and recognising common mistakes can help companies stay compliant while managing their corporate tax obligations effectively throughout the financial year.

Understanding Corporate Tax Eligibility Tests

Corporate tax eligibility in Australia hinges on specific tests that determine whether your company qualifies for the lower company tax rate of 25% or must pay the full company tax rate of 30%. These tests form the foundation of your tax planning strategy and directly impact your annual corporate income tax liability.

Many business owners face unexpected corporate income tax bills at year-end simply because they misunderstood the eligibility requirements for different tax rates or overlooked key compliance requirements. These surprises often stem from incorrectly assessing their Base Rate Entity (BRE) status, mismanaging Pay As You Go (PAYG) instalments or failing to plan for changing business circumstances that affect their tax position.

Unsure if your company qualifies for the 25% tax rate?

Schedule a complimentary consultation with us today to check your BRE status and avoid ATO surprises.

The Base Rate Entity Test

Companies eligible for the reduced corporate tax rate must qualify as Base Rate Entities by meeting two critical requirements simultaneously. The first is the aggregated turnover test, which requires your company’s aggregated turnover to be less than $50 million for the income year. This calculation includes revenue from your company and all connected or affiliated entities, not just your individual company’s trading income.

The second requirement is the passive income test, which stipulates that no more than 80% of your company’s assessable income can come from Base Rate Entity Passive Income. This passive income includes interest income, dividends, rental income, royalties, net capital gains, and trust distributions traceable to passive sources. If your passive income exceeds this 80% threshold, your company will pay the standard rate of 30% regardless of aggregated turnover.

Calculating Aggregated Turnover

The aggregated turnover threshold calculations often challenge business owners because they must include income from all related entities. Connected entities include companies with common ownership or control, while affiliated entities might include businesses owned by family members or related parties. For example, if you operate multiple companies or have business interests across different entities, all their revenue combines to determine your eligibility.

This aggregation rule means a seemingly small business might actually exceed the $50 million aggregated turnover threshold when all connected entities are considered. Companies must carefully review their corporate structures and relationships to ensure accurate turnover calculations for their tax return.

The Passive Income Assessment

The passive income test requires careful analysis of your company’s total assessable income sources. Many businesses incorrectly assume that any investment income disqualifies them from the lower rate, but the test only applies when passive income exceeds 80% of total assessable income. For instance, a company with $8 million in trading income and $2 million in rental income would still qualify for the 25% rate, as passive income represents only 20% of total income.

However, companies primarily focused on investments, investment properties, or holding assets for capital gains often fail this test. The 80% threshold ensures the reduced rate benefits eligible small businesses engaged in active business activities rather than passive investment vehicles.

Common Pitfalls That Lead to Surprise Tax Bills

Understanding where businesses typically go wrong helps you avoid the same costly mistakes that result in unexpected tax obligations and potential penalties from the Australian Taxation Office (ATO).

Several recurring issues create surprise corporate tax bills for Australian companies, often stemming from misunderstanding eligibility requirements, poor accurate record keeping, or inadequate tax planning throughout the financial year.

Misclassifying Base Rate Entity Status

One of the most common mistakes involves incorrectly self-assessing BRE status without properly calculating company’s aggregated turnover or passive income percentages. Companies often overlook connected entities when determining their aggregated turnover, leading them to believe they qualify for the lower tax rate when they actually exceed the threshold.

Similarly, businesses frequently misunderstand what constitutes passive income. They might include franchise income, which could be considered active business income, or exclude certain investment returns that should count as passive sources. This misclassification can result in underpaying corporate income tax throughout the year, creating a significant tax burden at year-end.

PAYG Instalment Miscalculations

Poor management of PAYG instalments creates cash flow surprises for many companies. Businesses often underestimate their tax obligations when varying their instalment amounts, particularly during periods of fluctuating income. When actual profits exceed estimates, the ATO may apply general interest charges and penalties for underpayment.

Companies also make mistakes by failing to adjust their PAYG instalments when business circumstances change. For example, a company that experiences significant growth mid-year but doesn’t increase its payments may face a substantial year-end corporate tax bill. The ATO expects businesses to monitor their tax position throughout the year and adjust payments accordingly.

Record-Keeping and Documentation Failures

Inadequate accurate record keeping undermines precise corporate tax calculations and creates compliance risks. Many businesses fail to maintain proper documentation for income classification, making it difficult to accurately assess their passive income percentage or aggregated turnover calculations for their tax return.

Poor records also make it challenging to support deduction claims or demonstrate the business nature of expenses. When the ATO reviews these companies, missing documentation can result in denied deductions and additional taxable income, increasing the overall tax burden.

Timing and Structural Mistakes

Businesses sometimes implement artificial arrangements to manipulate their BRE status, such as restructuring operations to reduce aggregated turnover or shifting income between entities. The ATO actively monitors these arrangements under various tax laws and may deny the lower company tax rate benefits while applying penalties.

Timing mistakes also create problems, particularly around year-end planning. Companies might delay income recognition or accelerate deductions without considering the impact on their BRE eligibility tests, potentially losing access to the reduced rate and facing the full company tax rate instead.

Proactive Strategies to Avoid Tax Surprises

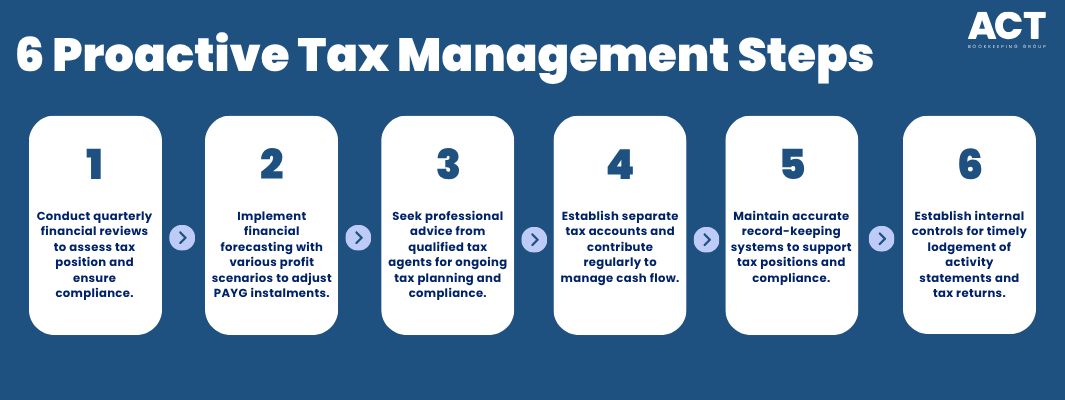

Implementing systematic approaches to tax planning and compliance helps businesses maintain accurate tax positions and avoid unexpected corporate income tax liabilities throughout the year.

Effective tax management requires regular monitoring, professional advice, and proactive planning rather than reactive responses to ATO notices or year-end calculations.

Regular Financial Monitoring and Forecasting

Establish quarterly reviews to assess your company’s tax position, including BRE eligibility status and PAYG instalment adequacy. These reviews should include updated aggregated turnover calculations incorporating all connected entities and current passive income assessments to ensure ongoing compliance with eligibility requirements.

Implement financial forecasting that considers different profit scenarios, including best-case, worst-case, and most likely outcomes. This approach helps you prepare for various tax obligations and adjust PAYG instalments accordingly. Regular monitoring also helps identify when business changes might affect your BRE status, allowing for timely adjustments to tax strategies and improve cash flow management.

Professional Tax Planning Support

Seek professional advice from qualified tax professionals who understand corporate tax complexities and can provide ongoing guidance throughout the financial year. A registered tax agent can help you correctly assess BRE eligibility, manage PAYG obligations, and implement tax-effective strategies while maintaining compliance with tax laws.

Regular consultations with tax professionals ensure you stay current with legislative changes and ATO guidance that might affect your corporate tax position. They can also help you understand the implications of business decisions on your tax obligations before implementation, potentially identifying opportunities for tax concessions or the instant asset write off provisions.

Cash Flow and Payment Management

Establish separate accounts for tax obligations and contribute regularly throughout the year rather than scrambling for funds at payment time. This approach treats corporate income tax as a regular business expense, smoothing cash flow and reducing financial stress during peak payment periods.

Consider setting aside a higher percentage than your estimated tax liability to provide a buffer for unexpected changes in your tax position. This conservative approach protects against surprises while ensuring funds are available when corporate tax payments are due, helping to improve cash flow management overall.

Documentation and Compliance Systems

Implement robust accurate record keeping systems that capture all income sources, properly classify transactions, and maintain supporting documentation for tax positions. These systems should clearly distinguish between active business income and passive sources to support accurate BRE assessments for your tax return.

Establish internal controls that ensure timely lodgement of activity statements and tax returns, as late penalties can significantly increase your overall compliance costs. Regular compliance reviews help identify potential issues before they become costly problems, ensuring you meet all eligibility requirements and compliance requirements throughout the income year.

Maximising Tax Benefits and Planning Opportunities

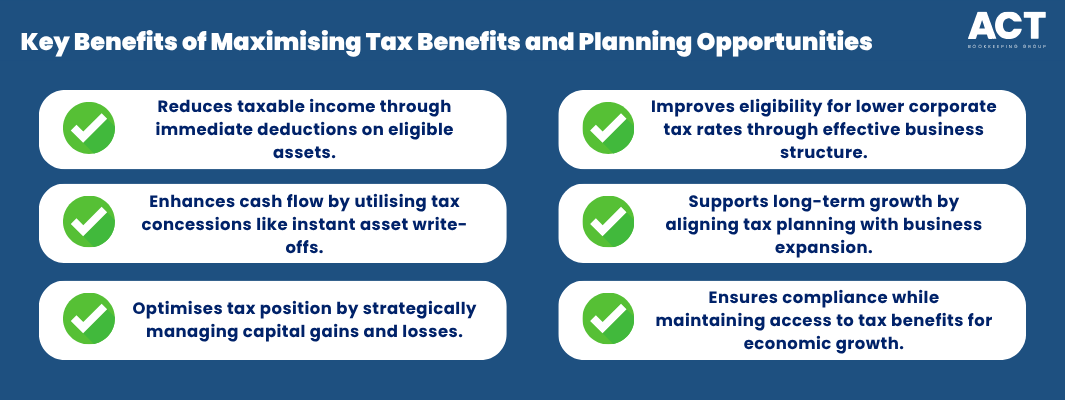

Understanding available tax benefits and planning opportunities helps eligible companies improve their tax position while maintaining compliance with Australian company tax rates and requirements.

Utilising Available Tax Concessions

Eligible small businesses can access various tax concessions beyond the lower corporate tax rate. These include the instant asset write off provisions, which allow businesses to immediately deduct the full cost of eligible assets rather than claiming depreciation over several years. This can significantly reduce taxable income in the year of purchase while improving cash flow.

Companies should also consider the timing of capital gains and losses to improve their tax position. Strategic planning around the disposal of assets can help manage the impact on assessable income and maintain eligibility for the lower rate. Professional advice is essential when implementing these strategies to ensure compliance with income tax laws.

We’re more than bookkeeping experts

As part of ACT Tax Group, we offer complete accounting and business advisory services tailored to your needs.

Strategic Business Structure Considerations

The choice of business structure significantly impacts your corporate tax obligations and eligibility for different tax rates. Companies operating across multiple jurisdictions should consider how their worldwide income affects their Australian tax position and whether separate entities might provide tax benefits.

For businesses with investment properties or significant passive income, restructuring operations to separate active trading activities from investment activities might help maintain eligibility for the lower company tax rate. However, any restructuring must have genuine commercial purposes and comply with tax laws to avoid ATO scrutiny.

Long-term Tax Planning and Economic Growth

Successful tax planning extends beyond the current income year to consider long-term business growth and changing circumstances. As businesses expand and approach the aggregated turnover threshold, they need strategies to manage their tax position effectively.

Planning for economic growth should include regular reviews of business structures, income sources, and tax obligations to ensure continued access to available tax benefits. This forward-thinking approach helps businesses maintain optimal tax positions while supporting their growth objectives and managing compliance costs effectively.

Conclusion

Managing corporate tax obligations effectively requires understanding eligibility tests, recognising common pitfalls, and implementing proactive strategies throughout the financial year. The Base Rate Entity tests determine your corporate tax rate, but misunderstanding these requirements or failing to monitor your status can result in significant surprise bills that impact cash flow.

Successful tax management involves regular financial monitoring, professional advice, and systematic approaches to compliance and cash flow planning. By treating corporate income tax as an ongoing business consideration rather than an annual event, companies can avoid surprises while improving their tax positions and accessing available tax benefits.

Take control of your corporate tax obligations by reviewing your current BRE status, assessing your PAYG instalment adequacy, and implementing regular monitoring systems. Working proactively with a registered tax agent ensures you stay compliant with tax laws while minimising your tax burden and avoiding costly surprises that can impact your business’s financial health and long-term success.