Published on 01 Oct 2025

Sole Trader vs Company: Which business structure saves you the most on tax in Australia? It’s a question many business owners in the ACT ask when profits grow, risks change, or the admin starts to feel heavy. Choosing between a sole trader business structure and a company structure can affect how much tax you pay, how you protect personal assets, and how you manage day to day operations. If you’re comparing company vs sole trader, you’re not alone.

Understanding the Issue: The Core Differences That Affect Your Tax

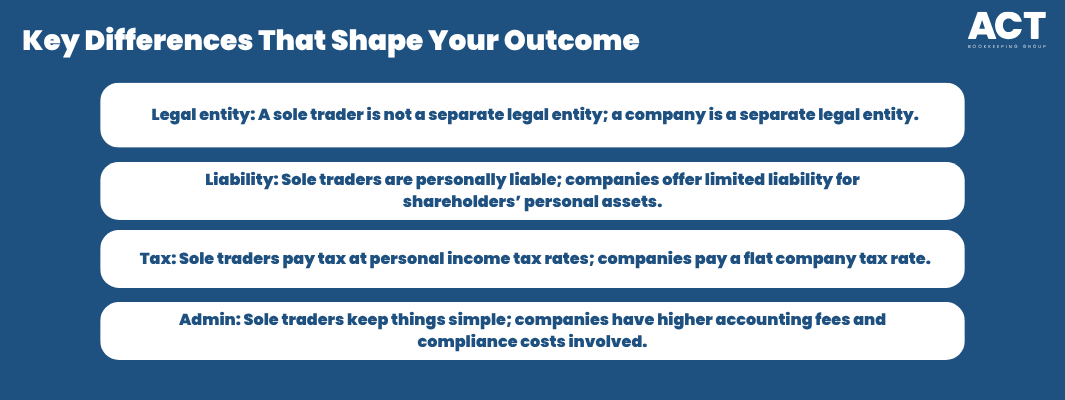

Choosing the right business structure sets the foundation for how you pay tax, manage business debts, and protect personal and business assets. Before running the numbers, it helps to understand how the structures differ in practical terms.

Is your profit growth pushing you into higher tax brackets?

Schedule a complimentary consultation with us today to see if a company structure lowers your tax.

What is a Sole Trader?

A sole trader is a simple business structure where you and the business are legally the same. You use your Individual Tax File Number and include business income in your personal tax return. You can register a business name and open a separate business bank account, but you remain personally liable for business debts and legal liabilities. Many business owners start this way because it’s fast to set up, low in ongoing costs, and easy to manage.

Key points:

You pay tax at personal income tax rates based on your total income.

You lodge your own tax returns; there is no separate business tax return for the business.

There is no limited liability — your personal assets can be used to cover business debts.

You can keep a clean separation by using a business account for day-to-day operations.

What is a Company?

A company is a separate legal entity. A company business structure has its own Australian Company Number and, for tax purposes, its own obligations. Directors run the company, and shareholders own it. A Pty Ltd company can offer asset protection through limited liability, meaning shareholders’ personal assets are generally protected from company debts (noting that directors may still have responsibilities and risks in certain situations).

Key points:

The company pays tax on its profits at the company tax rate.

You must lodge an annual company tax return that is separate to any personal tax return.

You will manage more complex business structures and admin, including an annual review fee, ASIC requirements, and accurate financial records.

A company can retain profits for future growth and raise capital more easily.

Deeper Dive: Tax Implications of Sole Trader vs Company

The decision often comes down to tax. Here’s how the tax obligations differ, and what matters as profits grow.

How Sole Traders Pay Tax

Sole traders include business income in their personal tax return. Tax is calculated at personal income tax rates. There is a tax-free threshold, and you may access certain tax concessions depending on your situation. Cash flow is straightforward — you can withdraw money from the business without extra tax events because you and the business are the same.

How Companies Pay Tax

Companies pay a flat company tax rate on their taxable income and lodge an annual company tax return. Base rate entities generally pay a lower rate, while other companies may pay the full company tax rate. Because a company is a separate legal entity, profits can be retained in the business for reinvestment. When money is paid to owners, it is usually through wages, super for eligible employees, or dividends, which have their own tax consequences for individuals.

Practical Tax Outcomes as Profits Change

At lower profit levels, the sole trader structure can be tax-efficient due to the tax-free threshold and progressive rates. As profits rise, the flat company tax rate can deliver potential tax advantages, especially when profits are retained in the business to fund growth, cover business debts, or purchase business assets.

However, if you plan to take most profits out as personal income, the final tax position may be closer than it first appears. Payments as wages are taxed to the individual, and dividends have their own tax treatment. This is where good planning with a registered tax agent or business advisor can help.

Admin, Costs, and Compliance

Both sole trader and company structures must keep good financial records and meet tax obligations. In general:

Sole trader: lower accounting fees, fewer forms, and fewer separate tax returns.

Company: more complex business structure, annual review fee, separate business tax return, and extra admin with the Australian Securities and Investments Commission (often shortened to ASIC or simply “the investments commission” in everyday conversation).

Opening a separate business bank account is useful for a sole trader and necessary for a company. It helps keep personal and business finances clean and reduces errors at tax time.

Solutions and Strategies: Choosing the Right Structure for Your Business

With the fundamentals in place, here’s how to decide what fits your business needs now and into the future.

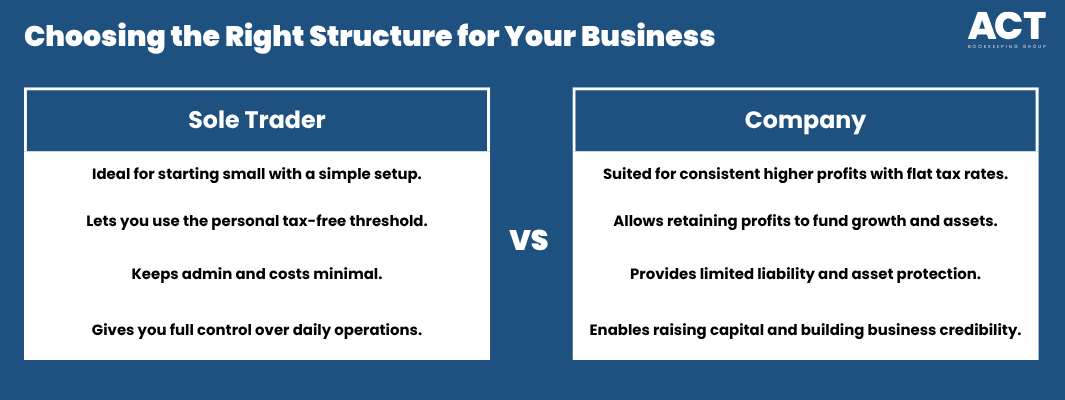

When a Sole Trader Structure Works Best

A sole trader business structure is often ideal when you’re starting out or keeping things small and want a simple business structure. This approach works particularly well for businesses with modest profits that can benefit from the tax-free threshold. Many business owners appreciate the minimal admin and lower ongoing costs that come with this straightforward structure, along with the direct control it provides over day to day operations and cash flow.

When a Company Structure Makes Sense

A company structure can be the better choice when you expect consistent higher profits and want to benefit from a flat company tax rate. This structure becomes particularly valuable when you plan to retain profits within the business to fund growth, build reserves, or acquire business assets. Companies also provide limited liability protection, which helps separate business risks from personal assets. If you need to raise capital, bring in co-owners, or build credibility with larger clients and lenders, a company structure often opens doors that might remain closed to sole traders.

Managing Money Flow and Personal Use

In a sole trader business, withdrawing money is simple because there’s no legal separation. In a company, money paid to you is either wages or dividends. This separation supports limited liability, but it adds steps. A good process and clean records help you avoid mixing personal and business funds.

Risk, Responsibility, and Protection

For sole traders, personal liability is a key consideration. Because you are not a separate legal entity, you are personally liable for company debts (in this case, business debts) and tax debts. With a company, shareholders’ personal assets are generally protected, though company directors still carry responsibilities, including ensuring the company meets its tax obligations and does not trade while insolvent.

We’re more than bookkeeping experts

As part of ACT Tax Group, we offer complete accounting and business advisory services tailored to your needs.

Growth, Perception, and Opportunity

If you plan to grow, hire, or chase larger contracts, a company can signal maturity and stability. A company structure can make it easier to onboard investors, raise capital, or bring in co-founders. It also helps establish clearer boundaries around legal liabilities and responsibilities, which can be important when negotiating with suppliers and customers.

Conclusion

Choosing between a sole trader or company is about more than the headline company tax rate. It’s about your goals, your appetite for admin, and how you plan to use profits. If your business income is rising and you want clearer separation between personal and business assets, a company can provide limited liability, structure, and potential tax advantages. If you value simplicity and low ongoing costs, the sole trader structure remains a strong option — especially for early-stage businesses.

Ready to find the best fit for your situation? Speak with a registered tax agent or business advisor who understands both sole traders and companies. The team at ACT Bookkeeping can help you weigh tax advantages against costs involved, outline your obligations with the Australian Taxation Office and the Australian Securities and Investments Commission, and set up clean systems like a separate business bank account and financial records.