Published on 30 Sep 2025

Company structure basics are essential knowledge for every Australian small business owner considering this legal entity option for their business operations. We understand that the complexities of establishing a company business structure can feel overwhelming, especially when you’re focused on growing your own business and serving your customers. That’s why we’re here to break down everything you need to know about company structures.

Understanding the Company Business Structure

The most significant advantage of a company business structure is the limited liability protection it provides. Unlike a sole trader structure where you’re personally liable for all business debts, a company is a separate legal entity that protects your personal assets. This means your home, car, and personal savings are generally protected if your business fails or faces financial difficulties. The company itself is legally responsible for its own debts and obligations, not you personally.

From a tax perspective, companies benefit from corporate tax rates that can be more favourable than personal income tax rates. Small businesses operating as companies currently pay 25% tax on business profits, while higher-earning sole traders can face personal income tax rates up to 47%. This difference becomes increasingly valuable as your business grows and generates more substantial business income.

Companies also offer superior opportunities to raise capital and attract private investors. Banks and investors view registered companies as more credible and stable than other business structures, making it easier to secure funding for expansion. The ability to issue shares to new shareholders provides flexible options for bringing in investment without taking on additional debt.

Unsure if a company structure suits your business?

Schedule a complimentary consultation with us today to assess tax savings and ATO compliance benefits.

Your Company Structure Responsibilities

Operating a company business structure comes with specific legal obligations and responsibilities that every business owner must understand. These requirements ensure your company operates within Australian law and maintains its status as an independent legal entity.

Company Directors and Their Legal Obligations

Company directors hold significant responsibility for ensuring the company meets all its legal obligations under the Corporations Act 2001. As a director, you must act in the company’s best interests, not your personal interests, and make business decisions with reasonable care and diligence. The Australian Securities and Investments Commission oversees company compliance and can impose penalties for directors who fail to meet their obligations.

Directors are legally responsible for preventing insolvent trading, which means you cannot allow the company to incur debt when you suspect it cannot pay its obligations. If the company trades while insolvent, directors can be held personally liable for debts incurred during this period. This is one area where the limited liability protection doesn’t apply.

You must also ensure the company maintains proper financial records and lodges its annual company tax return with the Australian Taxation Office each financial year. Directors who fail to meet these tax requirements can face significant penalties and may be held personally responsible for unpaid company taxes.

Compliance Requirements and Administration Costs

A registered company must meet ongoing compliance requirements that don’t apply to simpler business structures. You’ll need to pay annual fees, maintain a registered office address, and keep detailed records of company activities. These administration costs are higher than other structures, but they’re part of maintaining your company’s legal status and the benefits it provides.

The company requires a proper constitution or can adopt the replaceable rules under the Corporations Act 2001. You’ll also need to maintain registers of shareholders, directors, and company secretaries, and notify the Australian Securities and Investments Commission of any changes to company details. While these requirements involve more paperwork than a sole trader structure, they create a professional framework that supports business growth.

Companies must also lodge annual statements, even if the company hasn’t traded during the financial year. Missing these deadlines can result in penalties and potentially lead to the company being deregistered, which would remove your limited liability protection.

Tax Advantages and Considerations for Company Structures

Understanding the tax implications of operating as a company is crucial for making an informed decision about your business structure. Companies benefit from several tax advantages that can significantly impact your bottom line as your business grows.

Company Tax Rates and Future Profits

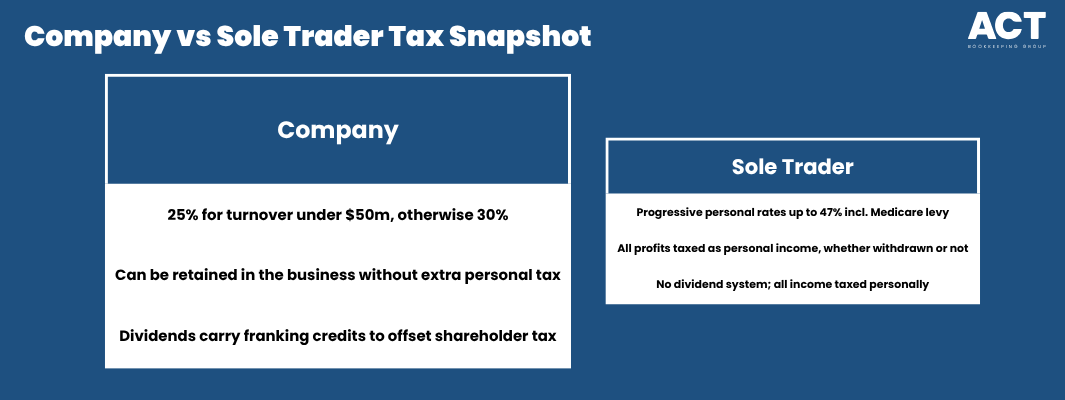

Companies pay a flat corporate tax rate on their business profits, currently 25% for eligible small businesses with annual turnover under $50 million, or 30% for larger companies. This contrasts with the progressive personal income tax rates that apply to sole traders, where rates increase with income and can reach 47% including the Medicare levy for high earners above the tax-free threshold.

Companies can retain future profits within the business without immediate tax consequences for shareholders. This retained income can be reinvested in business growth, equipment, or expansion without triggering additional personal tax for the business owners. Sole traders, in contrast, pay personal income tax on all business income whether they withdraw it from the business or not.

When companies do distribute profits to shareholders as dividends, the dividend imputation system prevents double taxation. Franking credits attached to dividends represent the company tax already paid, which shareholders can use to offset their personal income tax obligations.

Managing Income Distribution

Individual shareholders in a company can still access their personal tax-free threshold of $18,200, as company dividends are separate from employment income. This can be particularly beneficial for family companies where dividends can be distributed to family members in lower tax brackets, subject to distribution rules.

Companies also have access to specific tax concessions not available to other business structures, such as the Research and Development Tax Incentive. This can provide significant benefits for companies investing in innovation and development activities.

We’re more than bookkeeping experts

As part of ACT Tax Group, we offer complete accounting and business advisory services tailored to your needs.

Making Your Decision

Deciding whether a company business structure suits your business requires careful consideration of your current situation and future goals. The benefits of limited liability protection and tax efficiency must be weighed against the higher set up costs and ongoing compliance requirements.

Companies work particularly well for businesses with higher risk exposure, those planning to raise capital from private investors, or businesses aiming for significant growth. Professional service providers, manufacturers, and businesses with employees often benefit from the credibility and protection a company structure provides.

If you’re currently operating as a sole trader and your business income is growing substantially, transitioning to a company structure could provide significant tax savings. The Australian Taxation Office has provisions for transferring assets from a sole trader to a company, though this requires careful planning to improve tax outcomes.

Taking the Next Step

Choosing to operate through a company business structure is a significant decision that can provide substantial benefits for the right business. The combination of limited liability protection, tax efficiency, and growth opportunities makes companies an attractive option for many Australian small business owners.

However, the increased compliance requirements and administration costs mean this structure isn’t suitable for every business. We recommend discussing your specific circumstances with qualified professionals who can assess whether a company structure aligns with your business goals and risk profile.

Don’t let the complexity discourage you from examining this option. With proper guidance and support, establishing a company structure can provide the foundation your business needs to grow, attract investment, and protect your personal wealth.