Published on 12 Nov 2025

Australian business owners can avoid the Medicare Levy Surcharge by holding private hospital cover for the full financial year, staying aware of income thresholds, and managing taxable income effectively. The surcharge is an extra tax levied on individuals and families who earn above certain annual income levels and don’t have private hospital insurance. Failure to take action often results in paying more tax than necessary—just because requirements and exceptions are unclear.

What Is the Medicare Levy Surcharge and Who Pays It?

The Medicare Levy Surcharge is an extra tax paid by Australian taxpayers without private hospital cover when their annual income exceeds prescribed thresholds. This surcharge is designed to encourage individuals and families to take out private hospital insurance and reduce reliance on the public system. Most Australian taxpayers already pay the standard Medicare Levy as part of their income tax return, but the surcharge only applies once your income reaches certain levels.

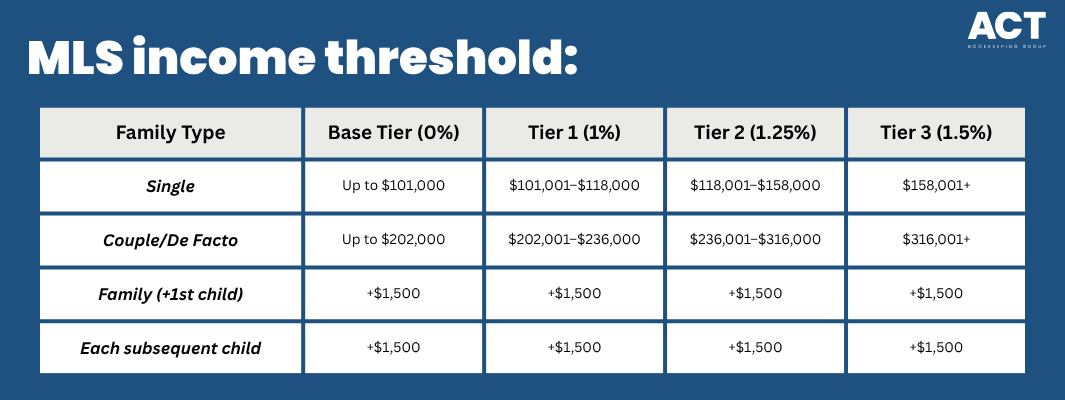

If you are single with an income above the MLS income threshold, or if your combined family income goes beyond the family income threshold, the levy surcharge will be calculated and added to your additional tax for the year. This means singles earning over a certain amount, couples, and families with children need to check both their own and their dependants’ income status to avoid paying unnecessary surcharge.

Struggling to balance super contributions and hospital cover?

Schedule a complimentary consultation with us today to develop strategies that reduce tax and exceed ATO standards.

How Private Hospital Cover Helps You Avoid the Surcharge

Holding appropriate private hospital insurance is the most direct way to avoid the Medicare Levy Surcharge. To meet the criteria, your private health insurance policy must include private patient hospital cover and not just extras like dental or optical. The government encourages individuals to take out this cover to reduce pressure on the public system and awards peace of mind by allowing you to avoid the medicare levy surcharge.

To avoid paying, the cover must be held for the full financial year. If you are covered for only part of the year, you may still be subject to a pro-rata calculation, but this could mean you pay the surcharge for the months you weren’t covered. Arranging hospital cover that fits within the correct excess limits ensures you benefit from less tax while also protecting your health.

The hospital policy excess cannot exceed $750 for singles or $1,500 for families.

Only private patient hospital cover policies are eligible.

Extras-only health policies will not help you avoid paying the levy surcharge.

What Income Counts Toward the Levy Surcharge?

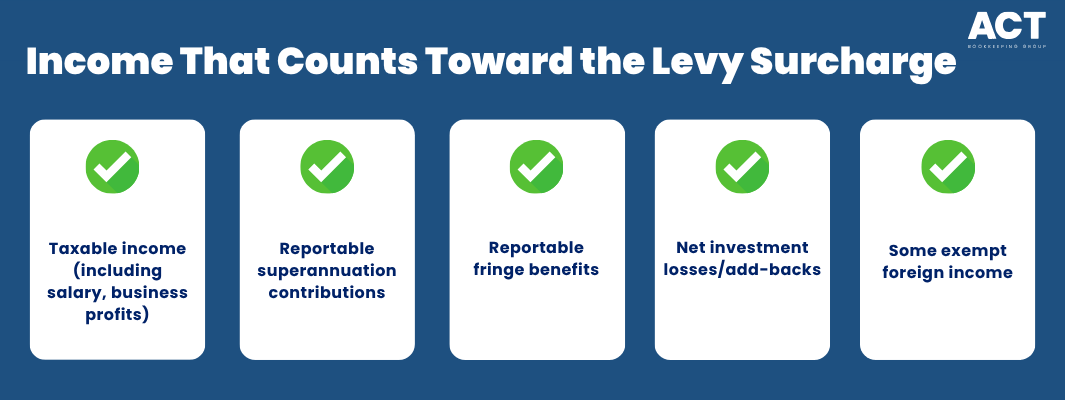

The Australian Taxation Office calculates the surcharge based on your income for MLS purposes. This value is broader than just your salary—it includes taxable income, reportable fringe benefits, some foreign income, and super contributions. Combined income for couples and de facto couples is calculated together, and families must also include income from a dependent child if it applies.

Business owners often find themselves at risk of paying the Medicare Levy Surcharge as their income can be inconsistent, and many forget that business profits, investment returns, and trust distributions are all included in the assessment. If you have several sources of income, keeping track of what will count toward the threshold is essential.

Steps for Business Owners to Avoid Paying Extra Tax

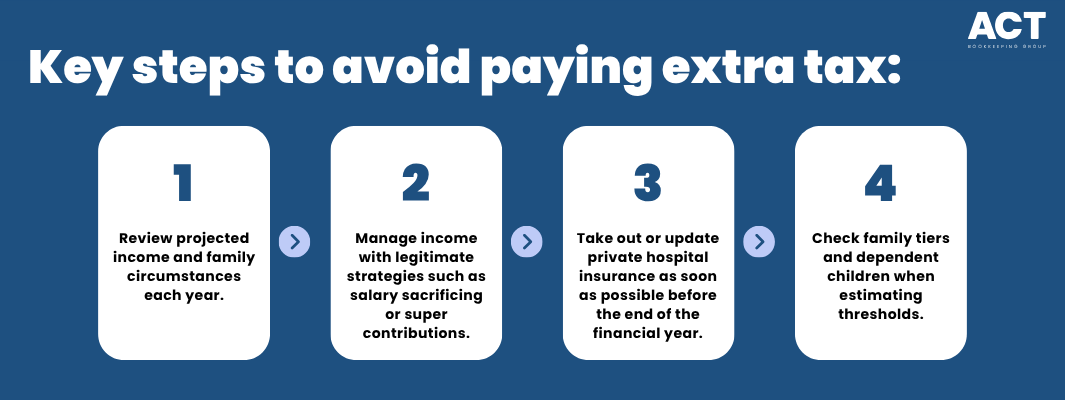

To avoid the surcharge, make sure you are aware of the applicable income thresholds and how your income fits into those tiers. If your income is close to the limit, taking steps like making super contributions or managing investment gains before the end of the financial year can help. If you expect your income will exceed the threshold even after planning, make arrangements to hold hospital cover before 1 July so your policy is in force for the full financial year.

As your business income may change year-to-year, reviewing your health cover situation each year before tax time should become part of your standard routine. Remember that different family tiers mean each additional child increases the threshold, which may help multi-child families avoid paying the surcharge even with higher combined income.

Exemptions and Special Circumstances

Some Australian taxpayers qualify for a Medicare Levy exemption or exemption from paying the MLS. For example, if you are a foreign resident for part or all of the year, or if you have a Medicare entitlement statement due to not being entitled to Medicare benefits. Exemptions also apply to certain visa holders and residents with a special definition from Services Australia.

Partial exemption may apply for people who only meet the following criteria for part of the year, like entering or leaving Australia or having a change in residency status. Always update your health or tax records with changes to personal circumstances—this can have a direct impact on whether or not you are required to pay the surcharge.

We’re more than bookkeeping experts

As part of ACT Tax Group, we offer complete accounting and business advisory services tailored to your needs.

What Should Business Owners Do Next?

Business owners should calculate their income early each financial year to see if they’re at risk of exceeding the MLS income threshold. Arranging private hospital insurance before the new financial year begins ensures no months are uncovered. Checking eligibility for a rebate on private health insurance may also help with affordability.

It’s wise to review all personal and business income sources, review health insurance policies for appropriateness, and seek advice if circumstances change. Checking the Australian Taxation Office guidelines or consulting with a trusted advisor helps keep track of threshold increases and any updates to the rules or benefits.

Conclusion

Paying the Medicare Levy Surcharge is avoidable for most business owners by holding the appropriate hospital cover and keeping an eye on changing income and personal circumstances. Regular review and planning keep extra tax at bay, while understanding the intricacies of income and family tiers ensures compliance without paying more than necessary.

Taking proactive steps—reviewing annual income, holding hospital cover for the full year, and consulting with accounting professionals—results in less tax and more peace of mind. Stay on top of income, hospital policy status, and exemption opportunities to benefit your business at tax time and beyond.