Published on 06 Feb 2026

How individual tax rates in Australia affect small business owner salaries is one of the most important money questions for owners heading into the 2025-26 financial year. When you understand how your taxable income is calculated and how much tax you are likely to pay, it becomes much easier to decide on a sensible salary. Our aim is to give you clear, practical guidance so you can feel confident about both your personal income and your business.

Australian residents who run small businesses often juggle business income, wages, dividends, interest, and other income from investments, which all feed into their tax return. Without a clear plan, you can drift into higher income tax rates or trigger extra costs such as the Medicare levy surcharge. We want to help you use the rules in a straightforward way, so you can keep more of what you earn and reduce stress in your tax affairs.

What are Individual Tax Rates for Australian Residents In 2025-26?

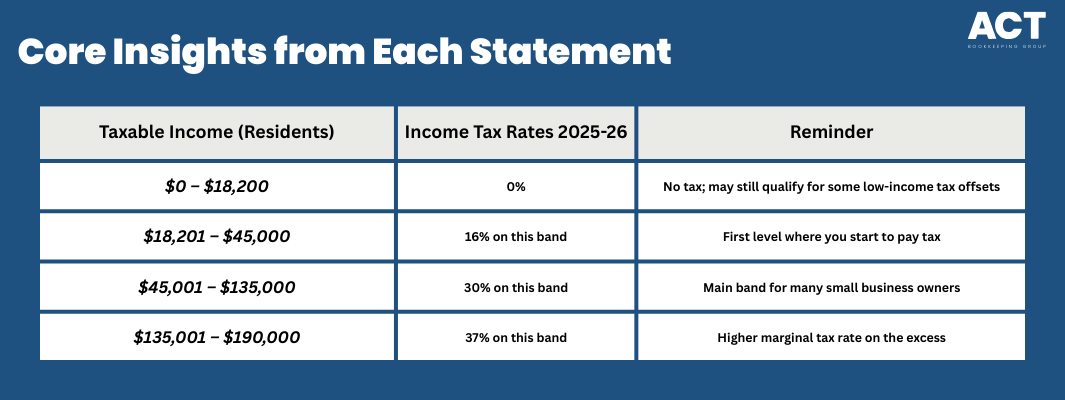

For 2025-26, Australian income tax for residents uses a progressive tax scale, which means your marginal tax rate increases as your taxable income rises. You do not pay the same rate on every dollar; instead, each level of income is taxed at different tax rates. Your assessable income can include salary, wages, business income, interest, dividends, rent, and certain capital gains.

These above rates are set by the Australian Taxation Office and apply for tax purposes to the full financial year. On top of income tax, most taxpayers must include the Medicare levy of 2% on their taxable income, unless they are exempt or low-income earners under specific thresholds. The mix of basic tax, levy, and any income tax offset determines the final tax payable in your tax return.

Worried about triggering the Medicare levy surcharge?

Schedule a complimentary consultation with us today to calculate thresholds and plan your private health strategy.

How Do Income Tax Rates Affect Small Business Owner Salaries?

For small business owners, salary is often just one part of their total income, but it drives a large part of the tax bill. Your salary or wages from your own business count as taxable income, just like any employee, and are taxed using the same income tax rates. As your salary climbs, more of it falls into the higher bands, so your marginal tax rate and overall tax payable both increase.

If your business is a company, the company may pay tax on profits and then pay you a salary, superannuation contributions, or dividends. These payments form part of your assessable income and need to be reported in your tax return alongside any other income from investments or employment. Understanding this structure helps you decide how much to pay yourself without putting too much pressure on your business cash flow.

Why Salary Choices Matter in the 2025-26 Financial Year

Salary decisions matter more in 2025-26 because steady growth in business income can quietly push you into higher tax bands. Many owners do not review their salary regularly, so they are surprised when their tax payable jumps from one financial year to the next. This can create cash flow stress and make it harder to plan for expenses and investments.

Your total income often comes from different sources, such as:

Business income and wages from your own company.

Other income like interest, dividends, and gains on investments.

Possible capital gains when you sell assets such as shares or property.

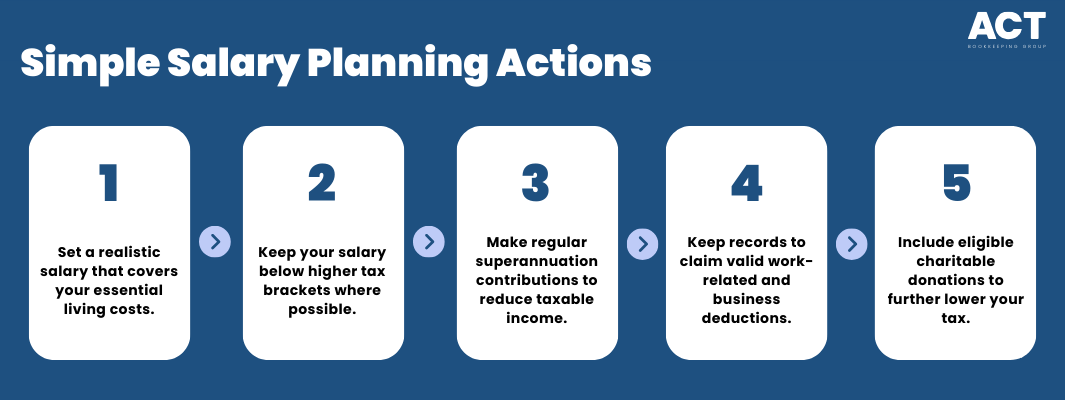

When you add all these forms of income together, your taxable income may exceed the thresholds for higher tax rates or the Medicare levy surcharge. Reviewing your salary, superannuation contributions, and deductions at least once a year helps you manage liabilities and avoid unpleasant surprises.

How Can You Utilise Your Salary Against Individual Tax Rates?

Utilising your salary starts with understanding your total assessable income, not just your wages. This includes your salary, business income, interest, dividends, and any gains from investments or foreign sources that are generally subject to Australian taxation. Once you know your starting point, you can adjust your salary and contributions to reach a more efficient position.

You should also ensure your employee and employer super contributions stay within the allowable caps, so you do not create extra liabilities. Because every business and family situation is different, it is wise to treat these examples as general guidance purposes only. Getting personalised professional advice helps you use the rules correctly and avoid costly mistakes.

How Do Offsets, Medicare Levy and Surcharge Affect What You Pay?

Tax offsets and the Medicare levy can significantly change how much tax you actually pay on your taxable income. The low-income tax offset is designed to give extra relief to low-income earners, and it reduces as income rises above a certain level. This means someone earning a lower salary may have less tax payable than the headline rates suggest.

Most residents pay a Medicare levy of 2% of taxable income, although some low-income earners may pay a reduced levy or be exempt. On top of this, the Medicare levy surcharge can apply to taxpayers with income above a certain level who do not have suitable private health insurance. This surcharge is an extra charge and is separate from the standard levy.

Do Temporary Residents and Non-Residents Face Different Rules?

Temporary residents and non-residents often face different income tax rules compared with Australian residents. Non-residents do not receive the tax-free threshold and can be taxed from the first dollar of assessable income earned in Australia. Their income from foreign sources may also be treated differently under Australian taxation law.

If you are a temporary resident running a business in Australia, your tax position may depend on where the income is sourced and how long you stay. For example, income from employment, business, and some investments in Australia is generally subject to tax, while certain foreign income may be exempt. Because the rules can be complex, especially where gains and investments are involved, this area almost always calls for professional advice.

Residency status can change over time, and the way your income is calculated for tax purposes may change with it. If you are unsure whether you are a resident or non-resident for tax, or which rules apply to your situation, checking this early can prevent unexpected liabilities. Clear advice helps you stay compliant while avoiding paying more tax than necessary.

We’re more than bookkeeping experts

As part of ACT Tax Group, we offer complete accounting and business advisory services tailored to your needs.

How Can ACT Bookkeeping Support Your Salary and Tax Planning?

Working out how individual tax rates in Australia affect small business owner salaries is not something you have to do alone. As a business owner, you are already managing staff, customers, suppliers, and day-to-day operations, so digging through tax rules can feel like too much. That is where having steady, practical support around your tax affairs makes a real difference.

We focus on simple explanations, so you can see how each decision affects your money and your business. By working with you through the financial year rather than just at tax time, we can help you adjust before problems arise. This proactive approach supports both your personal financial goals and the long-term stability of your business.

Conclusion

Individual tax rates, the Medicare levy, offsets, and your overall mix of income all play a role in how much tax you pay on your salary as a small business owner. When you understand how your taxable income is calculated and how different salary levels move you through the brackets, you gain real control over your money. This knowledge helps you make decisions that suit both your lifestyle and your business.

If you would like help reviewing your salary and overall tax position for the 2025-26 financial year, our team at ACT Bookkeeping is ready to support you with clear, tailored guidance. Together, we can look at your income, contributions, and deductions, and use simple tools and calculator estimates to find a structure that works. Taking action now can reduce stress, improve cash flow, and put you in a stronger financial position for the years ahead.