Published on 05 Feb 2026

Why Every Small Business Needs Regular Financial Statements (Even If You’re Not Required by Law) comes down to visibility and control. When you understand the importance of financial statements, you gain a clear view of your business performance, not just your bank balance. That clarity gives you confidence in your day‑to‑day choices and long‑term plans.

For small businesses in Australia, regular financial statements are one of the simplest ways to protect your business success and support future growth. Even if the law does not force you to prepare financial reports, your company’s financial stability depends on knowing your numbers. With the right support, these reports become practical tools rather than paperwork.

What Are Regular Financial Statements for Small Businesses?

Regular financial statements are organised financial reports that show your income, costs, financial position, and cash flow over a specific period. For most small businesses, the key financial statement components are the profit and loss statement (also called income statement or loss statement), balance sheet (or statement of financial position), and cash flow statement. Together, these form your company’s financial statements and provide a complete picture of your company’s financial health.

These financial statements play a vital role in showing how much profit you make, how much cash you have, and what business assets and debt obligations you hold. They break down revenue generated, operating expenses, and money owed so you can assess company performance at any time. Clear reports also help you keep your financial data tidy and ready for your accountant or the ATO.

Struggling to keep your books ready for BAS lodgement?

Schedule a complimentary consultation with us today to simplify reporting and stay ATO‑compliant.

Why Aren’t Most Small Businesses Legally Required to Prepare Them?

Many small Australian businesses are not treated like public companies or publicly traded companies, so they are not bound by full financial reporting standards. Larger or listed entities must follow Australian Accounting Standards, which incorporate international financial reporting standards, plus strict rules on transparent financial reporting. Small businesses often only need records for tax and basic compliance with tax laws and the ATO.

However, not being forced to prepare full company’s financial statements does not remove the need to understand your company’s financial performance. As a business owner, you still need to know your entity’s financial position, even if you are not lodging reports to the financial markets. The gap between minimum legal requirements and good business practice is where many small businesses run into trouble.

What Problems Arise without Regular Financial Statements?

Without regular financial statements, most owners rely on guesswork instead of solid financial data. You may not notice rising operating expenses, creeping accounts payable, or slow‑paying customers until cash gets tight. This makes it hard to track company performance or see how your company’s financial position is changing.

It becomes harder to prove your company’s creditworthiness to banks, landlords, or suppliers. Poor records mean more stress at tax time and a higher chance of mistakes with tax laws. Inconsistent data entry also increases the risk of errors that affect both your business and your personal finance.

How Do Financial Statements Support Compliance and Tax?

Good financial reporting processes make it easier to meet your obligations. When your financial statements are up to date, your accountant can quickly complete your tax returns and check that operating expenses and money owed are recorded correctly. That reduces the risk of errors and keeps you aligned with current tax laws.

Accurate reports also help with things like payroll, superannuation and accounts payable planning. Having accurate financial statements means less scrambling at year‑end and more confidence when the ATO asks questions. Clear records also support emerging areas such as sustainability reporting, which is becoming increasingly relevant for businesses seeking funding or partnerships.

How Do Financial Statements Improve Business Growth and Decisions?

When you can see your company’s financial performance clearly, you make better strategic decisions. The profit and loss report shows which products or services drive revenue generated and which drain profit. The balance sheet shows whether your company’s assets are funded by sustainable assets liabilities and equity levels or risky debt.

The cash flow statement helps you understand how much cash is tied up in stock, accounts payable, or unpaid invoices. With this information, you can plan future growth, manage future trends, and decide when to hire, invest, or hold back. Over time, this builds a strong pattern of historical data that helps you forecast more accurately.

How Often Should Small Businesses Prepare Financial Statements?

For most small businesses, quarterly financial statements are a practical starting point. This timing lines up with BAS and superannuation cycles. Some fast‑growing businesses benefit from monthly reports, especially where cash flow is tight.

At a minimum, you should have a full set of financial statements prepared each year, along with your tax return. More frequent checks give you a chance to fix issues before they grow. Regular reviews help you stay in control of company performance and protect your overall financial health.

What Key Insights Do the Different Financial Statements Provide?

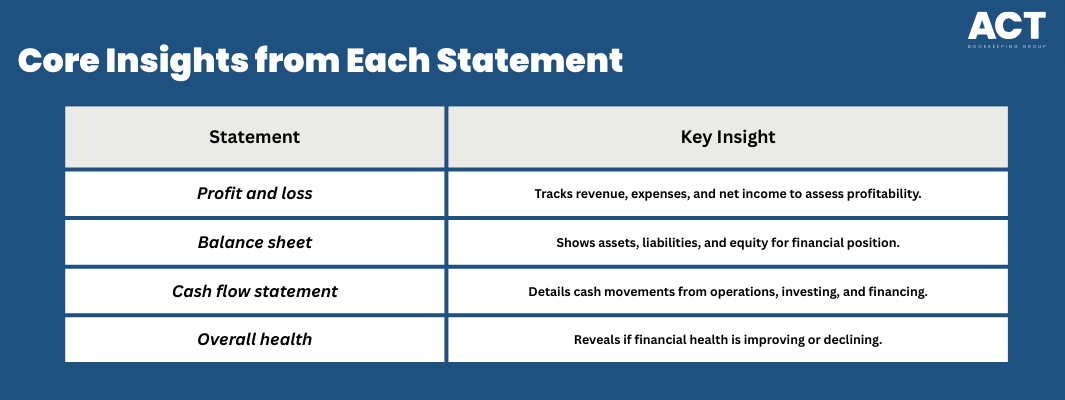

Each report shows a different side of your company’s financial story. The profit and loss statement summarises your company’s revenue, operating expenses, and net income over a specific period. It lets you assess company performance by seeing which costs can be trimmed and where margins can be improved.

The balance sheet or statement of financial position shows assets liabilities and equity at a specific point in time. This helps you understand company’s financial position, including money owed, business assets, and shareholders’ equity. The cash flow statement explains how cash generated from core operations, investing and financing activities moves through the business.

These reports help you see whether your company’s financial health is improving or declining. They also support decision making by giving you reliable financial data. Over time, consistent reports turn into valuable historical data that reveal future trends.

How Do Financial Statements Help with Funding and Stakeholders?

Banks, lenders and current and potential investors often ask for your company’s financial statements before approving loans or investment. They look at your company’s creditworthiness, company’s ability to repay debt obligations, and the strength of your company’s assets. Clear, consistent reports show that you take financial reporting standards seriously.

Regular, transparent financial reporting also builds trust with company’s shareholders, partners and key staff. It helps in enabling stakeholders to understand your overall financial health and growth prospects. This is valuable even for smaller businesses that are not public companies.

We’re more than bookkeeping experts

As part of ACT Tax Group, we offer complete accounting and business advisory services tailored to your needs.

How Can Professional Support Improve Financial Reporting?

While software can help with data entry, it still takes experience to turn raw financial data into meaningful financial reports. Professional support helps you apply practical accounting principles and sensible accounting policies, so your reports are consistent and easy to read. This leads to more accurate financial statements and fewer surprises.

Experienced advisers or finance teams can set up simple systems that suit your business and budget. They can help streamline your financial reporting processes and keep you aligned with broader accounting principles and, where relevant, financial reporting standards. For many owners, this support frees up time and reduces stress, allowing them to focus on running the business.

Conclusion: Turning Numbers into Practical Decisions

Regular financial statements are not just for big corporations or financial markets. They are everyday tools that help you manage cash flow, track business performance, and protect your overall financial health as a small business owner. By understanding the importance of financial statements, you turn numbers into decisions.

When you have clear financial reports at your fingertips, you can plan future growth, respond to changing conditions, and make confident strategic decisions. Whether you are just starting out or looking to grow, now is the right time to tighten your financial reporting processes and use them to guide your next move.