Published on 24 Dec 2025

Salary Packaging for Not-For-Profits: Compliance and Tax Benefits for Australian NFPs is all about helping eligible not-for-profit organisations use NFP salary packaging to boost take home pay while staying on top of Fringe Benefits Tax (FBT). When you use a clear salary packaging arrangement, your team can pay less income tax by using pre-tax salary to cover key living expenses. The aim is to offer real employee benefits without adding extra cost or compliance stress for your organisation.

For many not-for-profit organisations in the not-for-profit sector, salary packaging is now a standard part of total remuneration packaging rather than a bonus perk. When it is set up as an effective salary sacrifice arrangement, employees can direct part of their annual gross salary to certain benefits, like rent or mortgage payments, before income tax is applied. This means the employee’s taxable income is lower, so they pay less tax while still keeping a similar cost to the employer.

What Is Salary Packaging for Not-for-Profit Organisations?

Salary packaging, also called salary sacrifice, is an agreement where an employee gives up part of their future salary in exchange for certain benefits. In the not-for-profit sector, those fringe benefits can often be treated in a more tax effective way under FBT concessions. When salary packaging works well, NFP employees use pre-tax income to cover everyday expenses, and the organisation does not pay Fringe Benefits Tax up to the relevant capping threshold.

Under ATO rules, salary sacrifice arrangements must be in place before the employee earns the income being packaged. The employee then receives a reduced salary and a mix of benefits, but their overall total remuneration packaging can deliver more money in their pocket. This simple structure makes salary packaging a practical way for a not-for-profit employee to improve their financial position without asking the employer to increase salary.

Struggling to stay under your FBT capping threshold?

Schedule a complimentary consultation with us today to review your salary packaging caps and minimise FBT exposure

How Do Fringe Benefits Tax Concessions Help NFP Salary Packaging?

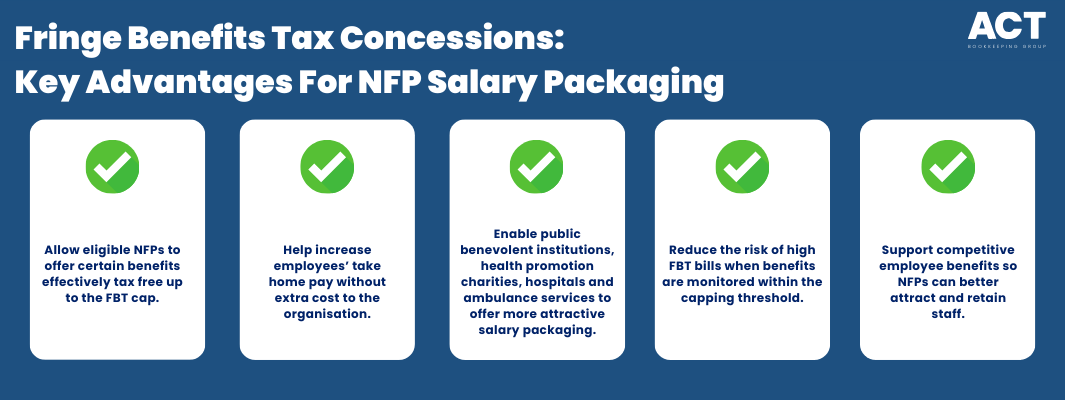

Many not-for-profit organisations qualify for special Fringe Benefits Tax concessions. Public benevolent institutions (PBIs) and health promotion charities can provide certain benefits up to a capping threshold without paying FBT. Other NFPs may be ‘rebatable employers,’ entitled to a partial rebate rather than a full exemption. Some public hospitals and ambulance services also access concessional treatment, but often with a different capping threshold.

If the total grossed up value of fringe benefits for an employee stays under the relevant cap, those benefits are effectively tax free from an FBT perspective. Once the cap is exceeded, the organisation may have to pay Fringe Benefits Tax on the excess, and this can change the value of the salary packaging arrangement. This is why it is important for not-for-profit organisations to track benefits closely throughout the FBT year.

What Tax Benefits Do NFP Employees Receive from Salary Packaging?

The main advantage of NFP salary packaging is that employees pay certain living expenses using pre-tax dollars instead of after-tax income. This lowers the employee’s taxable income, meaning less income tax and often more money available each pay cycle. For many not-for-profit employees, the result is a higher take home pay without increasing the organisation’s payroll budget.

Because part of the annual gross salary is redirected to benefits before tax is applied, the employee ends up with less tax paid and practical tax savings over the year. These tax savings are especially noticeable when packaging common everyday expenses, the employee would pay anyway. Many staff see it as a simple way to make the same salary go further with no additional cost to the employer.

What Types of Benefits Can NFP Salary Packaging Cover?

NFP salary packaging often focuses on capped benefits that fall within FBT concession limits for the not-for-profit sector. These common inclusions can cover a wide range of living expenses such as rent or mortgage payments, school fees and other everyday expenses. Some employers also allow work related expenses, professional memberships and other benefits that support the employee’s role.

How Does Salary Packaging Work in Practice for Not for Profit Employees?

In a standard salary packaging arrangement, the employee agrees to a reduced salary and a set value of benefits for the FBT year. The employer then uses part of the employee’s pre-tax salary to pay approved expenses, such as mortgage or rent or other everyday expenses. Because these amounts come out before income tax, the employee pays less tax on their remaining salary.

The process usually includes regular deductions from each pay cycle, which are used to cover the selected benefits. In many cases, providers use tools like a prepaid salary packaging card issued in the employee’s name so they can access funds for certain benefits like meal entertainment. This simple structure means salary packaging works smoothly in the background while the employee focuses on their work.

What Is the Difference Between Capped Benefits and Uncapped Benefits?

In the not-for-profit sector, certain benefits are subject to FBT capping thresholds, while other benefits may be treated as uncapped benefits. Capped benefits count toward the general FBT cap set for public benevolent institutions, health promotion charities, public hospitals or ambulance services. Once that cap is reached, further benefits may attract FBT or change the tax position of the salary packaging arrangement.

Uncapped benefits can include items like extra super contributions or some work-related expenses that do not count toward the main cap. However, even uncapped benefits must still follow ATO rules, and the employer may sometimes have to pay Fringe Benefits Tax on them. Understanding the mix of capped benefits and uncapped benefits helps you design a package that maximises tax savings without unexpected additional cost.

How Does Salary Packaging Affect Income Tax and Payment Summaries?

When a not-for-profit employee enters into an effective salary sacrifice arrangement, their income tax is calculated on the reduced salary. This reduced salary means the employee’s taxable income is lower, which can result in less tax and a higher take home pay. The tradeoff is that their reported salary on their income statement or payment summary may appear lower because of the reduced salary.

In some cases, certain fringe benefits may appear as reportable amounts on the employee’s Income Statement (accessed via myGov). These do not usually increase income tax directly but can influence other assessments such as government benefits or loan applications. It is important that employees understand how salary sacrifice arrangements impact their payment summary and their wider financial picture.

We’re more than bookkeeping experts

As part of ACT Tax Group, we offer complete accounting and business advisory services tailored to your needs.

What Are the Main Risks and When Should You Seek Professional Advice?

Key risks for not-for-profit organisations include going over the FBT capping threshold, misclassifying benefits, or failing to adjust packages when staff change jobs. If the grossed-up fringe benefits exceed the cap, the organisation may have to pay Fringe Benefits Tax on the excess, which can create an extra cost. Poor record keeping around benefits, work related expenses and other benefits can also make it harder to respond to any ATO review.

Because FBT rules can be complex, many boards and managers choose to seek professional advice. A registered tax or accounting professional can provide taxation advice about how to structure salary packaging and when you may need to pay Fringe Benefits Tax. This support helps ensure your not for profit complies with tax law while offering employee benefits that genuinely deliver less tax and more money in the hand for your team.

How Can a Structured Salary Packaging Policy Support Your Organisation?

A clear, written salary packaging policy sets out who can participate, what benefits can be included and how changes will be handled. This policy protects both the organisation and NFP employees by managing expectations around reduced salary, additional benefits and any additional cost that may arise. ensure that each salary packaging arrangement fits within your overall remuneration strategy for staff benefits and workplace culture.

Many organisations in the not-for-profit sector work with specialist providers or tools, such as eml payment solutions or similar services, to administer packages. These partners can help track benefits across the FBT year, manage reloadable Mastercard issued cards and monitor capping thresholds to avoid surprise tax. Working with experts allows your internal team to focus on service delivery while still providing strong employee benefits.

When Does Salary Packaging Make Sense for Your NFP?

Salary packaging is most effective when your organisation can offer certain benefits at a similar cost to salary while staff receive real tax savings. If your team regularly spends a large portion of their income on rent or mortgage payments, school fees or other living expenses, salary packaging may deliver clear value. The more that pre-tax dollars can be used for these expenses, the larger the gap between gross salary and after-tax cash in the bank.

On the other hand, if an employee has a very low taxable income or only plans to stay a short time, the benefits may be more modest. In those cases, careful calculation is needed to see whether the reduced salary and admin effort still produce a net gain. Talking through the options with each employee helps ensure any salary sacrifice arrangements are practical for both sides.