Published on 10 Dec 2025

Using a Medicare levy calculator helps you work out how much you may need to pay the Medicare levy and whether any Medicare levy surcharge could apply to your situation. Most taxpayers in Australia contribute a certain amount on top of income tax, so knowing the figures early makes it easier to plan and avoid surprises. When your annual taxable income changes during the financial year, a calculator is a simple way to estimate how much tax and how much extra tax may be payable.

What Is The Medicare Levy And Why Does A Calculator Matter

The Medicare levy is an amount that most taxpayers in Australia pay to support the public health system, usually calculated as a percentage of taxable income once you pass a certain threshold. A calculator uses your annual income, family details and other eligibility rules to estimate this amount for you. It can also show whether you might be exempt or entitled to a reduction for part or all of the full financial year.

Because rules and income thresholds can change, relying only on old figures or rough guesses can lead to under‑ or overpaying tax. A good Medicare levy calculator lets individuals and families quickly see how different income levels, dependants and other factors affect what they pay. This saves time, reduces stress and helps keep your records consistent with current Australian Tax Office guidance.

Will changes in your income affect your Medicare levy for this year?

Schedule a complimentary consultation with us today to work out your tax position and update your payroll records.

How Does A Medicare Levy Calculator Work Step By Step

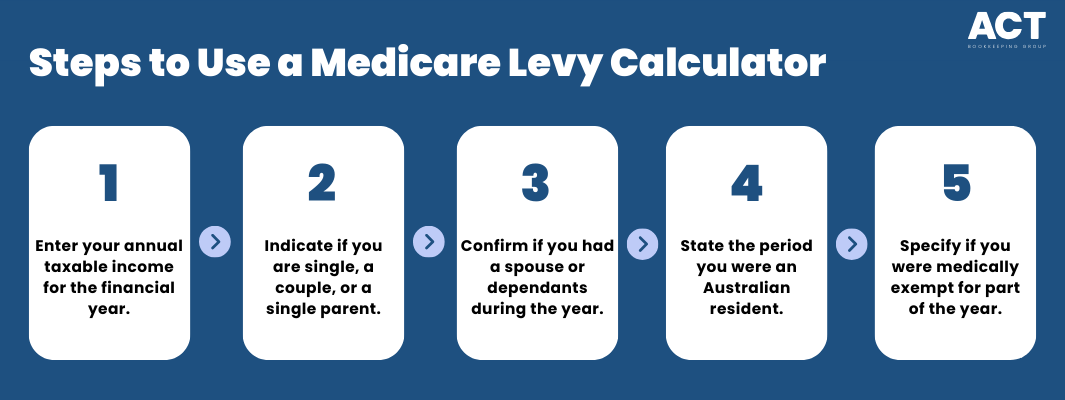

A typical calculator asks a series of questions designed to mirror how the Australian Tax Office works out your levy in a tax return. You usually enter your annual taxable income, whether you are single, a couple or a single parent, and whether you had a spouse or dependants during the year. Some tools also ask about the period you were an Australian resident and whether you were medically exempt for part of the year.

Once these details are entered, the calculator uses current thresholds to calculate an estimate of how much you may need to pay. It may show both the standard levy and any extra tax for MLS purposes if a Medicare levy surcharge applies. Many tools also break this down to a fortnightly or weekly figure so you can see how it might affect regular pay.

What Information Do You Need Before Using A Medicare Levy Calculator

To get an accurate estimate, you need reliable figures and some basic personal information before you start. This includes your annual income from all sources for the financial year, along with any deductions that reduce it to your taxable income. You should also know whether you have a spouse, how many kids or other dependants you support, and whether you were in Australia for the full year.

Having this information ready means your calculations are smoother and you are less likely to enter the wrong amount. It also helps when you later check that your payslips and tax records match what the calculator has shown.

How Do Medicare Levy Income Thresholds Affect Calculator Results

Income thresholds are one of the main reasons results differ between individuals, families and different income levels. If your annual taxable income is below a certain amount, you may pay no levy or a reduced amount, which a Medicare levy calculator can show clearly. Once your income goes above those thresholds, you generally pay the full rate on your taxable income.

Because these thresholds are set by the Australian government and can move over time, it is important to use a calculator that is updated for the current financial year. This ensures your estimate reflects the correct rates for singles, families and seniors. It also helps you understand whether earning more will mean a little more tax or a larger jump as you cross a new tier.

How Are Medicare Levy and Medicare Levy Surcharge Different in Calculators

The standard Medicare levy is separate from the Medicare levy surcharge, even though both relate to health funding. The surcharge is aimed at higher‑income individuals and families who do not hold private hospital cover, and it can mean extra tax on top of the normal levy. When you use a Medicare levy surcharge calculator, you will often see both the levy and surcharge displayed together.

When using any Medicare levy surcharge calculator, you will usually be asked whether you have private health insurance, including basic hospital cover or more comprehensive cover. You may also be asked if your cover includes extras cover, but for surcharge purposes the focus is on hospital cover only. Answering these questions accurately helps you see how much extra tax you might pay if you do not have suitable cover.

How Does Private Hospital Cover Affect the Medicare Levy Surcharge

For MLS purposes, having the right level of private hospital cover can help you avoid paying the surcharge at all. If your annual income goes above the MLS thresholds and you do not hold private hospital cover, the calculator may show a certain amount of extra tax. This is on top of the normal Medicare levy that applies to most taxpayers.

When you hold private hospital cover for the full financial year, you are generally not required to pay the surcharge as long as the cover meets the minimum standards. Some people also receive an Australian Government rebate on their private health premiums, which reduces the price of the cover. Balancing the cost of cover against how much extra tax you might pay without it is a common use of these calculators.

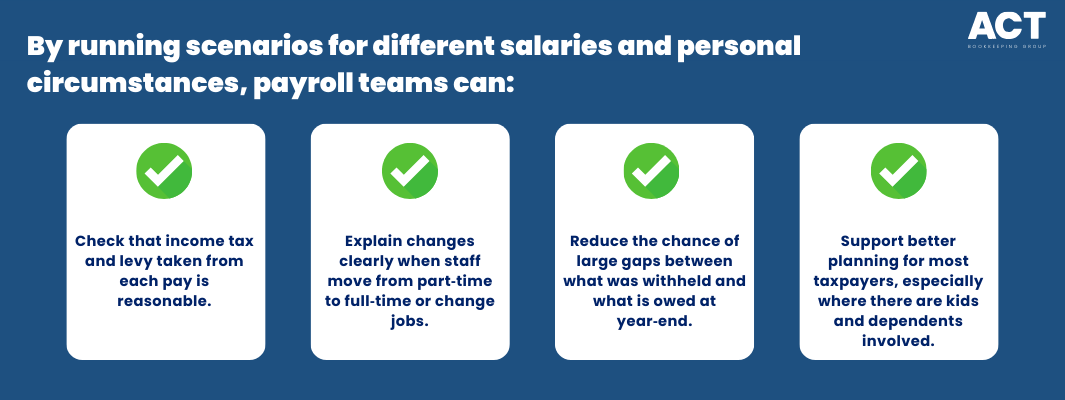

How Does a Medicare Levy Calculator Support Accurate Payroll Records

In payroll, Medicare levy amounts are usually built into overall tax tables so that the right amount of pay is withheld during the year. When staff have changing roles, bonuses or varying hours, a calculator can help check whether their fortnightly withholding is close to what will be owed. This is useful for both employers and employees who want to understand how much tax is being taken out and why.

This approach helps keep tax and payroll records aligned with current rules and supports a smoother experience when you lodge returns. It also shows staff that you take their money and their personal circumstances seriously.

How Can Individuals Use Calculators to Plan for Tax Time

For individuals, a Medicare levy calculator is a handy planning tool at any stage of the financial year. It lets you learn how changes in income, deductions, or family status might affect what you owe. You can also see how taking on extra shifts or side work might translate into a higher levy or extra tax.

Having this information ahead of time makes it easier to budget for transportation, ambulance, hospital or other costs that may arise if you have a serious accident or medical issue. Knowing your likely tax position also supports long‑term planning and helps you avoid surprises when the Australian Tax Office finalises your return.

We’re more than bookkeeping experts

As part of ACT Tax Group, we offer complete accounting and business advisory services tailored to your needs.

What Should You Look for in a Reliable Medicare Levy or MLS Calculator

A reliable Medicare levy or Medicare levy surcharge calculator should be clear, up‑to‑date and easy to use. It should show which financial year it applies to and whether its calculations include both levy and surcharge rules.

A good tool will also remind you that results are an estimate, not a final Australian Tax Office assessment. This sets the right expectations and encourages you to seek tailored advice if your situation is more complex or involves multiple sources of income.

How Often Should Businesses and Individuals Review Medicare Levy Calculations

Because income and life events change, it makes sense to review your Medicare levy position several times during the financial year. A new job, a rise in annual income, or a change in spouse or dependents can all affect how much you might pay. Updating your calculations when these events occur means your estimate stays relevant.

Regular checks keep your expectations realistic about how much you might owe, and they support accurate payroll, budgeting and savings plans. They also help you avoid large gaps between what you thought you would owe and the certain amount eventually assessed.

How Can ACT Bookkeeping Help with Medicare Levy and Payroll Accuracy

Keeping across levy rules, surcharge rules and payroll settings can feel like a lot when you are focused on running a business. ACT Bookkeeping helps you build simple, practical steps into your bookkeeping systems, so the right tax and levy amounts are allowed for in each pay.

By taking this supportive and practical approach, we help businesses use tools like Medicare levy calculators to maintain accurate tax and payroll records throughout the year. This gives owners and staff more peace of mind, more control over their money, and more time to focus on running and growing their business.