Published on 03 Dec 2025

Marginal Tax Explained: How It Affects Your Small Business Taxes in Australia is all about how each additional dollar of taxable income is taxed and how that affects your money in real life. When you understand how marginal tax and the tax rates apply to your annual income, it becomes much easier to work out how much tax you will pay and plan ahead with confidence.

What Does Marginal Tax Actually Mean in Australia?

Marginal tax simply means the percentage of tax that applies to the next additional dollar you earn in the income year. It does not mean that the same rate applies to every dollar of your income, only to the part that falls within a particular bracket. In other words, your marginal rates are used for calculating how much tax you pay on the extra money you earn, not your whole total income.

Under the Australian income tax system, individuals move through set tax rates as their taxable income increases. This structure helps ensure people with higher incomes pay tax at higher rates on the income that falls into those upper brackets. While this can affect your tax liabilities, it also means lower income amounts still benefit from the tax-free threshold and lower rates below it.

Struggling to work out your marginal tax rate on business income?

Schedule a complimentary consultation with us today to review your total income, tax brackets and ATO obligations.

How Do Marginal Tax Rates Affect Small Business Owners Personally?

If you are a sole trader or receive business income from a partnership or trust, your business income is added to your other income and taxed as part of your personal taxable income. This means your marginal tax rate is based on your total income for the year, including wages, business profits and most other assessable amounts. As your business grows and you earn more, parts of your income may move into a higher rate bracket, which can affect how much tax is payable.

For example, a person may start the year in a lower bracket but, after a strong trading period, their taxable income moves into a new bracket with a higher rate applying to the extra income. The earlier income still keeps its lower rate, but the additional dollar above the threshold is taxed at the higher rate. Understanding this helps you see why one good year of business can increase your income tax bill and why planning ahead for those changes matters.

Why Doesn’t Your Whole Income Get Taxed at Your Top Marginal Rate?

A common misunderstanding is that once your income crosses a threshold, all of your income is suddenly taxed at the higher rate. In reality, only the income above that threshold moves into the new bracket and faces the higher percentage, while the income below it stays on the lower tax rates. This approach is a key feature of the progressive tax system used in Australia.

This structure means you are always better off when you earn more, even if part of your income moves to a higher rate. No bracket ever reduces the after‑tax money you receive on the income below the threshold. When you see the above rates in a table or calculator, it helps to remember that each set rate only applies to part of your income, not the whole amount.

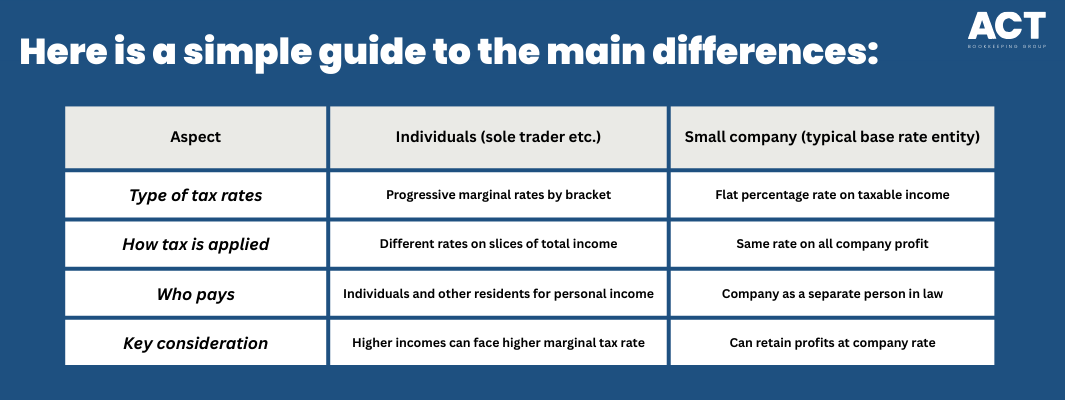

How Do Marginal Tax Rates Compare to Company Tax for Small Businesses?

For many small businesses, a key decision is whether to operate as an individual, such as a sole trader, or through a company structure. Individuals pay tax using marginal rates, while many small companies pay a flat company rate on their taxable income. This difference can affect how much tax is payable on the same level of profits.

Because the company rate is often lower than the top marginal rates for individuals, some owners choose to leave some profits in the company rather than take all earnings as wages. This can reduce current income tax but needs careful planning to manage future distributions, entitlements and possible rules about diverting income. Getting tailored advice before changing structure is important so you understand the full effect on risk, cash flow and tax.

How Does the Tax-Free Threshold and Medicare Levy Affect Your Marginal Tax?

The tax-free threshold is the amount of income you can earn before you start to pay tax. For most residents this threshold reduces how much tax is taken out on the first part of their income, which lowers their actual tax across the income year. Once your income moves above this threshold, the marginal rates start to apply on further income.

On top of income tax, many taxpayers also need to pay the Medicare levy, which is an extra percentage of your taxable income to help fund the health system. There is also a Medicare Levy Surcharge for some higher incomes without suitable private health cover, which can increase the amount payable. These amounts sit alongside your marginal tax rate and can affect how much tax you pay overall, so they should be considered in any planning.

How Does Marginal Tax Affect Sole Traders and Partnerships?

As a sole trader, your business income is not taxed separately from you as a person. Instead, your net profit after business deductions forms part of your taxable income, together with other amounts like wages from employment or investment income. Your marginal tax rate then applies to your total income for the year.

Partners in a partnership each include their share of partnership income in their own return, and it is taxed at their personal marginal rates. This means two people in the same business can pay different amounts of tax on similar partnership income if their other income or thresholds are different. Keeping clear business records in your account software and doing regular calculations with a simple calculator can help you estimate how much tax you may need to set aside.

What About Minors, Children and Diverting Income?

The rules for income earned by minors and children can be different from adults in some cases. Special tax rates may apply to discourage diverting income from adults to children simply to access lower rates. This means that money intended for a child, such as certain investment income, may be taxed differently to wages that a child genuinely earns from work.

If you are considering moving income to family members, it is important to note that the ATO can apply special rules where income is moved mainly for tax reasons. These rules are complex and can create extra liabilities and risk if the arrangement is not set up correctly. Always consult a qualified adviser before using family members or minors in income planning.

We’re more than bookkeeping experts

As part of ACT Tax Group, we offer complete accounting and business advisory services tailored to your needs.

How Can Marginal Tax Influence Your Choice of Business Structure?

When deciding between operating as an individual or through a company or trust, your marginal tax rate is only one factor to consider. While company tax can look lower on paper than personal marginal rates, you also need to think about asset protection, costs, flexibility and long‑term goals. The right choice depends on your business, your family situation and how you plan to use the money.

In some cases, using a company allows you to keep profits in the business at the company rate and pay yourself wages or dividends as needed. In other cases, staying as a sole trader can be simpler and work well where total income stays within lower brackets.

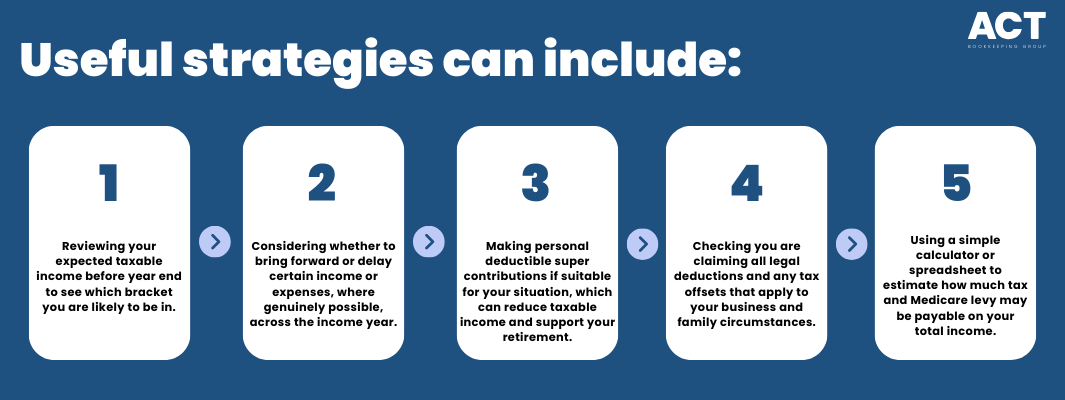

What Practical Strategies Help Manage Your Marginal Tax?

Once you understand how marginal tax works, you can start to plan your income and deductions more effectively. Small adjustments in timing and structure can affect how much tax is payable, without changing the real work you do or the value you provide. The aim is not to avoid tax but to manage your obligations sensibly while protecting your business.

Conclusion

Understanding how tax rates apply to each dollar earned can make a real difference to your bottom line. When you know how taxable income, taxable income tax, the tax-free threshold, Medicare levy and marginal rates all fit together, it becomes easier to answer the question of how much tax you are likely to pay. This knowledge supports better planning, less stress and more informed choices about your business and personal finances.

If you are unsure how the above rates and rules apply to your own account or need help interpreting an ATO page or calculator, it is wise to consult a qualified professional for personalised advice. Our team at ACT Tax Academy works with individuals and small businesses across Australia to explain taxation clearly and help you make decisions that fit your goals. Reach out for guidance that is intended to suit your situation, so you can focus on your work while we help you manage the tax side with confidence.