Published on 26 Nov 2025

The main residence CGT exemption is one of the most valuable tax outcomes available to Australian property owners because it can remove Capital Gains Tax when you sell your family home. For small business owners, understanding how the CGT main residence exemption works helps you manage tax liability, protect profit from a future sale, and keep more of your capital for business growth and retirement. When a CGT event occurs on your principal place of residence, the way you have used the property over time will determine whether you receive a full exemption, a partial exemption, or no exemption at all for CGT purposes.

Your main residence is generally the house where you and your family live, receive mail, and are based for tax purposes in Australia. If you meet certain criteria and the dwelling and land have been used as your main residence the whole time you owned it, you can usually sell without having to pay tax on any capital gain. Small business owners who run a business from home or rent out part of the property need to take special care, because these choices can reduce the main residence exemption and increase assessable income in their tax return when they sell.

What Is the Main Residence Exemption and Why Does It Matter?

The main residence exemption is a Capital Gains Tax rule that can make the capital gain on your family home exempt when a CGT event occurs on the sale of that property. For many property owners, this residence exemption means that the house they have owned and lived in for years can be sold without adding any net capital gain to assessable income.

For small business owners, losing the CGT exemption by mistake can create a large and unexpected tax liability. When you rely on property as a safety net for your business and family, understanding how to keep the house exempt and avoid unnecessary Capital Gains Tax becomes a key part of sensible planning. In many cases, this exemption is worth more than other tax concessions you might claim during your working life.

Worried about losing your main residence CGT exemption?

Schedule a complimentary consultation with us today to review your property use and protect your tax-free sale.

How Do You Qualify for the Main Residence CGT Exemption?

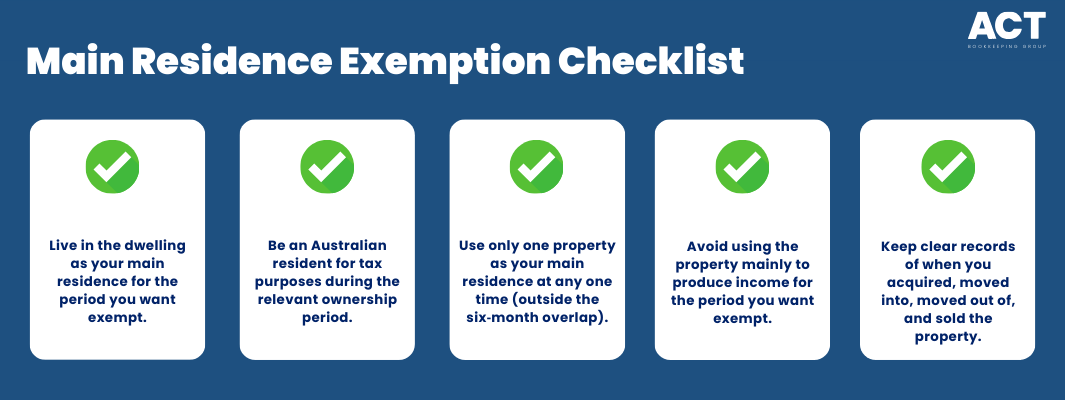

To qualify for the main residence CGT exemption, you must be an Australian resident for tax purposes when you own the property and when the CGT event occurs on sale. The dwelling must have been your main residence for the period you want to claim as exempt, meaning you and your family live there, keep your belongings there, and use it as your base.

Generally, the property will qualify if you move in as soon as practicable after you acquire it and live there for at least six months, and you do not use it mainly to produce income. If you meet these following conditions and do not treat any other property as your main residence for that period, the capital gain from the sale may receive a full exemption. When you do not fully meet the criteria, you may still be eligible for a partial main residence exemption.

How Does the Six-Year Rule and Absence Work?

The six-year rule, sometimes called the six-year exemption period, allows you to continue treating your former home as your main residence for CGT purposes after you move out and rent it, for up to six years. As long as you do not treat any other property as your main residence in that same period, the capital gain relating to that period can still be exempt when you eventually sell.

If you move back into your former home and make it your main residence again, a new six-year period can begin if you move out in the future. This is helpful for small business owners who move for work or business but want to keep the home as an investment. If the property is empty and does not earn income, you may be able to treat it as your main residence for more than six years, as long as the conditions are met.

What Happens When You Use Your Home for Business or Rent?

If you use part of your main residence to run a business or you rent out a portion of the property, you may still claim a partial exemption. In this case, only the part of the dwelling and land used to produce income is exposed to Capital Gains Tax, while the rest may stay exempt. This is common for small business owners who have a home office and claim a portion of costs in their tax return.

Generally, if you claim deductions for occupancy costs like interest, rates, or insurance for business use, this will affect the cost base and potential exemption for that part of the house. Over time, this can reduce the main residence exemption and increase the capital gain that becomes assessable income when you sell. You may then have to pay tax on that part of the capital gain at your marginal tax rate.

How Do Partial Exemptions Work When the Property Is Not Always Your Main Residence?

A partial main residence exemption applies when the property has only been your main residence for part of the ownership period, or when part of the land is not used as your residence. In these cases, you need to apportion the capital gain based on dates and use to work out the taxable amount. This can happen when you rent out the entire property for a period longer than the six year rule allows, or when you use it partly to produce income.

The calculation usually takes into account the total days you owned the property and the number of days for which the dwelling qualified as your main residence. Any period when the property is used as other property for rental income, or used mainly for business, reduces the exempt portion. The result is that a percentage of the capital gain is exempt and the remainder is added to assessable income as net capital gain.

What About Foreign Residents and the Main Residence Exemption?

Recent changes mean that foreign residents can no longer generally access the main residence exemption when they sell their family home in australia. This applies even if they were an australian resident and lived in the house as their main residence for many years before becoming a foreign resident. The rules focus on your tax residency status at the time the CGT event occurs, not just when you owned or lived in the property.

There are some limited special rules for certain events, such as terminal illness or death, but these are narrow and come with strict eligibility conditions. If you are planning to move overseas and become a foreign resident, the timing of your sale and settlement date can have a major impact on whether you receive any exemption. It is often wise to sell the property while you are still a resident, or understand clearly what tax you may face if you decide to keep it as other property.

How Does the Main Residence Exemption Interact with Deceased Estates?

When a property owner dies, the main residence exemption can continue to apply to a deceased estate under certain criteria. The beneficiary or legal personal representative may be able to sell the dwelling without Capital Gains Tax if the family home is sold within a reasonable time and the house continues to be used as a residence. Special rules apply where the beneficiary moves into the property as their main residence after the date of death.

If the deceased had used part of the property to produce income, or if the house was rented out for long periods before death, only a partial exemption may be available. The way cost base is worked out can differ for deceased estates, and the settlement date on a later sale will determine when the CGT event occurs. These rules can be quite detailed, so support from a professional is often helpful for the beneficiary or executor.

How Is the Capital Gain Calculated on a Main Residence?

To work out Capital Gains Tax on a property that is not fully exempt, you start with the capital gain or capital loss as the difference between the capital proceeds from the sale and the cost base. The cost base usually includes the original purchase price, buying costs such as stamp duty and legal fees, and certain improvement costs like major renovations. If the property qualifies for a full exemption, you do not need to work out the detailed net capital gain.

Where only a partial exemption applies, the capital gain is apportioned according to periods and use, and then any capital loss from other assets can be applied to reduce the net capital gain. After that, the 50% discount may apply for individuals who have owned the property for at least twelve months. The final net capital gain is then included in assessable income in your tax return for the income year in which the CGT event occurs.

We’re more than bookkeeping experts

As part of ACT Tax Group, we offer complete accounting and business advisory services tailored to your needs.

Key Steps to Manage Your Main Residence and CGT

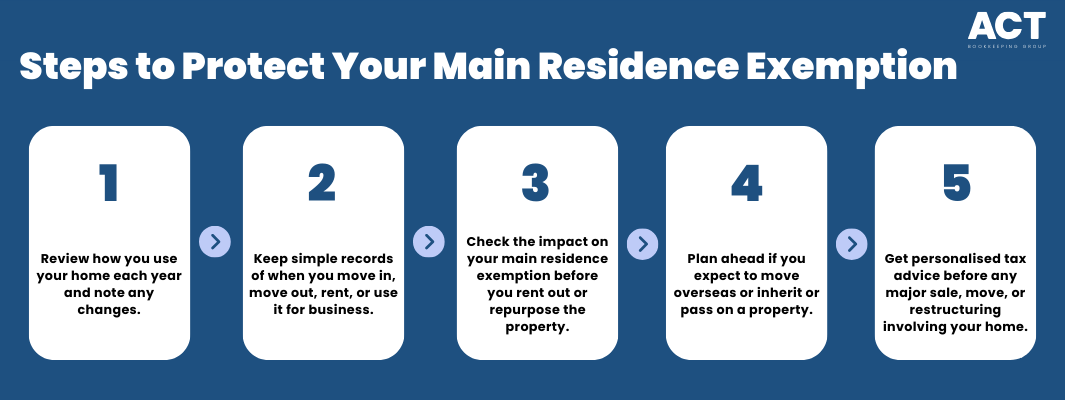

For small business owners, managing your main residence exemption is about planning ahead and keeping good records. You should regularly review how you use your house, when you claim deductions, and whether you intend to move, rent, or renovate. Simple decisions, such as how long you rent out your former home or which property you treat as your main residence during an overlap, can change tax outcomes by thousands of dollars.

When you are considering a sale, contract date and settlement date can affect which income year the net capital gain falls in, and how it interacts with business income or other capital events. This is especially important if you have other property, a business sale, or investments that might also create a capital gain or capital loss in the same period. Careful timing and advice can help you manage cash flow and avoid surprises.

Conclusion

The main residence exemption is a key tool for protecting the value of your family home and supporting long term security for your business and family. Because rules about use, foreign residents, deceased estates, and business activity are detailed, small choices can have a big impact on how much tax you pay when you sell. Early planning, good records, and clear decisions about which property is your main residence make a real difference.

If you are running a business, thinking about moving, planning to rent your former home, or helping manage a deceased estate, it is worth reviewing your position as soon as possible. A friendly, professional adviser can help you understand your eligibility, work through examples, and make confident decisions that suit your goals. At ACT Bookkeeping, the focus is on making these rules easy to understand so you can protect your property, manage your tax, and grow your financial future with clarity and confidence.