Published on 05 Nov 2025

Choosing the right strategy for how much you can earn before you pay tax is a big part of managing any small business in Australia. Many owners want to know the tax-free threshold and the exact amount they need to start paying tax each financial year. Understanding the requirements from the Australian Taxation Office (ATO) helps small businesses lodge a tax return accurately and plan for less tax payable.

What Is the Tax-Free Threshold for Australian Small Businesses?

For individuals and sole traders, the tax-free threshold is $18,200 per income year. This means you do not pay income tax on employment income or other income below this figure. Only income earned above this threshold is subject to income tax rates, so for low income earners, there is no tax bill until their taxable income exceeds $18,200.

When you start a new job or have multiple employers, you should only claim the tax-free threshold from one employer during the income year. Claiming it from more than one workplace may result in a tax bill when you lodge a tax return. It’s essential to provide your Tax File Number (TFN) to employers, otherwise tax is deducted at a higher tax rate for tax purposes.

Struggling to calculate PAYG instalments correctly?

Schedule a complimentary consultation with us today to forecast payments and prevent large year-end tax bills.

The Impact of Tax Rates and Brackets on Small Business Owners

Income tax rates in Australia are tiered. For 2025, once your taxable income goes past $18,200, the tax rate is 16c for each $1 over the threshold. At higher levels, tax bills rise with new brackets: $45,001 to $135,000 is taxed at 30c per $1, and earnings from $135,001 to $190,000 are taxed at 37c for each $1.

Companies and trusts are governed by different rules. For small private companies (base rate entities with a turnover under $50 million), the corporate tax rate is currently 25%. Companies do not have a tax-free threshold. To calculate company tax, multiply taxable income by the applicable rate and include items like car payments and salary package benefits.

Income tax brackets 2025:

Taxable Income | Tax Rate |

|---|---|

$0 – $18,200 | Nil |

$18,201 – $45,000 | 16c for each $1 above $18,200 |

$45,001 – $135,000 | $4,288 plus 30c for each $1 above $45,000 |

$135,001 – $190,000 | $31,288 plus 37c for each $1 above $135,000 |

$190,001 and above | $51,638 plus 45c for each $1 above $190,000 |

How Much Tax Will You Pay and When Does It Start?

You only pay tax when your income for the year exceeds the tax-free threshold, unless you’re operating as a company. Your employer deducts tax from employment income, but self-employed individuals and sole traders must arrange to pay tax themselves. PAYG (Pay As You Go) instalments help spread out pay tax obligations throughout the year and prevent a lump sum bill at year end.

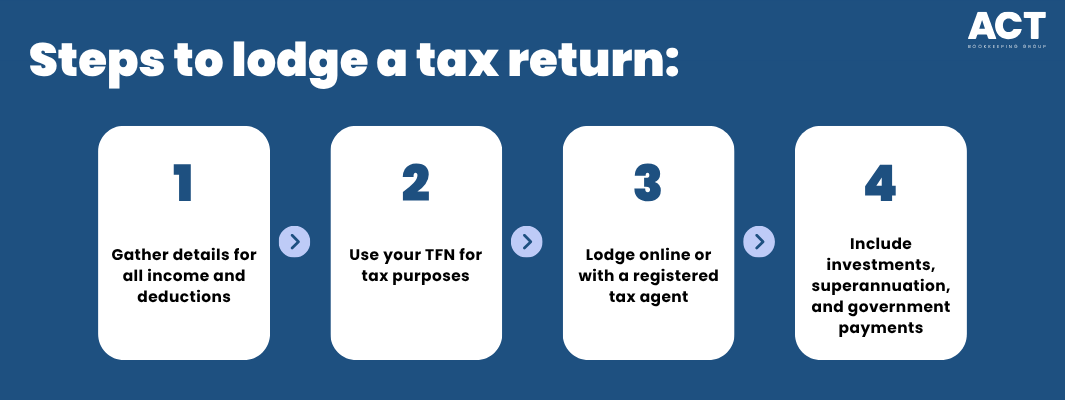

Most people need to lodge a tax return online with the ATO once yearly, declaring all taxable income including salary, investments, superannuation, and other prizes. Tax on this income is calculated based on current income tax rates. Reporting all your income ensures you receive tax refunds or avoid underestimating your taxable income tax.

Deductions, Offsets, and How to Lower Your Tax Bill

Small business owners can deduct tax for certain expenses, including superannuation contributions, cost of equipment, charitable donations, and car payments. Tax offsets may also apply, such as the small business income tax offset, which helps reduce tax payable for eligible low-income earners.

Capital gains from selling assets, investments, or other income must be declared, with the ATO offering deductions if you’ve held assets for more than one year. Salary sacrifice arrangements and salary package adjustments, including voluntary super contributions, are ways to pay less tax and increase your tax refund.

Common tax deductions:

Superannuation contributions

Charitable donations

Car expenses

Business expenses

Investment costs

Salary sacrifice arrangements

The Role of Medicare Levy and Surcharge in Taxable Income

The Medicare levy is a compulsory 2% charge on taxable income. It applies to most Australian residents but low income earners and those with special circumstances may pay less tax in this area. For higher earners without private health insurance, the Medicare levy surcharge can add 1–1.5% to your tax bill.

Private health insurance rebate helps offset part of the cost of cover, reducing your tax payable if you have eligible policies. It’s smart to review your eligibility for rebates and consider insurance options before the end of the financial year.

Medicare levy highlights:

Standard levy: 2% of taxable income

Surcharge: Up to 1.5% for higher earners without private health insurance

Private health insurance rebate helps reduce costs

We’re more than bookkeeping experts

As part of ACT Tax Group, we offer complete accounting and business advisory services tailored to your needs.

How to Lodge a Tax Return and Manage Tax Affairs

All taxpayers must lodge a tax return with the ATO for each financial year, whether online or through an accountant. Keeping accurate records is the best way to ensure your tax affairs are straightforward and you can claim all applicable deductions. Money earned from a new job, investments, or government payments must be included with employment income.

If you have a second job, or other income streams including freelance work, it’s essential to track your total earnings so you don’t underestimate your tax bracket and amount of tax to pay. Lodging on time avoids penalties and supports your financial position.

Tax Planning Strategies for Small Business Owners

Planning ahead for the financial year by reviewing income tax rates, income tax brackets, and deductions keeps your business in a stronger tax position. Maximising tax offsets, using salary sacrifice options, and accounting for superannuation contributions help lower your tax bill. Employing good record-keeping makes it easier to lodge a tax return on time and claim more deductions.

The ATO website offers free resources for tax return online submission and calculates tax refund amounts automatically. Reviewing taxable income tax estimates before the end of the income year supports better decision-making and avoids unexpected higher tax bracket burdens.

Conclusion

Understanding your exact tax-free threshold, tracking taxable income, and knowing how much tax you need to pay are essential steps for small business owners each income year. Careful management of deductions, offsets, and private health insurance options helps keep your tax affairs robust and your business ready for growth. Being proactive about submitting your return to the ATO and planning for tax time ensures you meet your obligations and take advantage of all available benefits.

For small businesses seeking clarity, ACT Bookkeeping is committed to making your tax return simple and helping you lodge with confidence for a positive financial year. Apply these insights and reach out for tailored support to maximise your results and have your tax questions answered quickly.