Published on 29 Oct 2025

How long to keep tax records remains one of the most common compliance questions for Australian small businesses in 2025. Understanding clear record keeping requirements protects your business, keeps tax time stress-free and ensures you can claim every eligible expense. This guide from ACT Bookkeeping covers everything you need to know—whether you’re using paper records, electronic records, or a mix.

Understanding Australian Record Keeping Rules

Meeting record keeping rules is essential for every business—and the requirements apply whether you are using a manual system with original paper records, storing electronic copies on an external hard drive, or managing everything in accounting software.

Most small businesses in Australia need to keep their business records, tax records and financial records for at least five years from the date you completed the transaction or from when you lodged your last claim in your tax return. This applies to original records and duplicate copies, so it’s always wise to back everything up regularly.

Are your business records ATO compliant for the full five years?

Schedule a complimentary consultation with us today to set up a compliant record keeping system.

Why Good Records Matter

Good records help you manage your tax affairs and support every legitimate tax deduction or claim. In the event of an audit, having written evidence makes it easier for your accountant to respond quickly and accurately. Well-organised records also mean you can track payment amounts, business expenses, receipts and purchases with confidence.

Using automated systems such as Single Touch Payroll, combined with reliable accounting software, makes record keeping simpler and provides peace of mind. These requirements apply for the entire period—from the date of the transaction until five years after the relevant financial year. The same record keeping rules cover sole traders, companies, partnerships and individual taxpayers.

The Five-Year Rule Explained

The cornerstone of tax laws for Australian businesses is the five-year rule. You must keep your records—including purchase records, credit card statements, employment contracts, and all other documents—for five years from the end of the financial year.

How to Calculate the Five-Year Period

For example, if you buy an asset in June 2025, you need to keep your records until June 2030. If you lodge a later tax return or claim, you’ll keep your records for five years from the date of that claim. It’s smart to use electronic records, which are easier to store and retrieve over time.

Whether you operate as a sole trader or have a registered business name, it’s the same requirement—keep your tax records and financial statements for the entire five-year period. Electronic copies are valid as long as they are clear, convert easily to English, and can be accessed if needed.

What Records Should You Keep?

Understanding which records to save is a vital part of tax record keeping for every Australian business. Keeping the right documents not only protects you at tax time but also ensures you can claim all eligible deductions without stress.

For capital gains tax assets, you’ll need records for five years after selling or disposing of the asset. That means sales of property or shares, investment property documents, and details for capital gains or tax loss all stay on file well beyond a normal financial year.

Exceptions and Longer Retention Times

Not all records have the same retention period, and missing these exceptions can lead to trouble with your tax affairs.

Payroll, Superannuation, and Employment Records

Employment contracts, payroll summaries and information related to Superannuation Guarantee often need to be kept for seven years. This ensures compliance with employment law and provides written evidence for leave and wage calculations.

Company, CGT and Investment Asset Records

Financial records for companies and some trusts, along with capital gains tax documentation for business assets or investment property, must be kept for seven years from the end of the financial year they pertain to.

Records linked to capital gains, tax loss, managed funds, or main residence should be kept for five years after selling the asset—even if that takes you well beyond normal tax time.

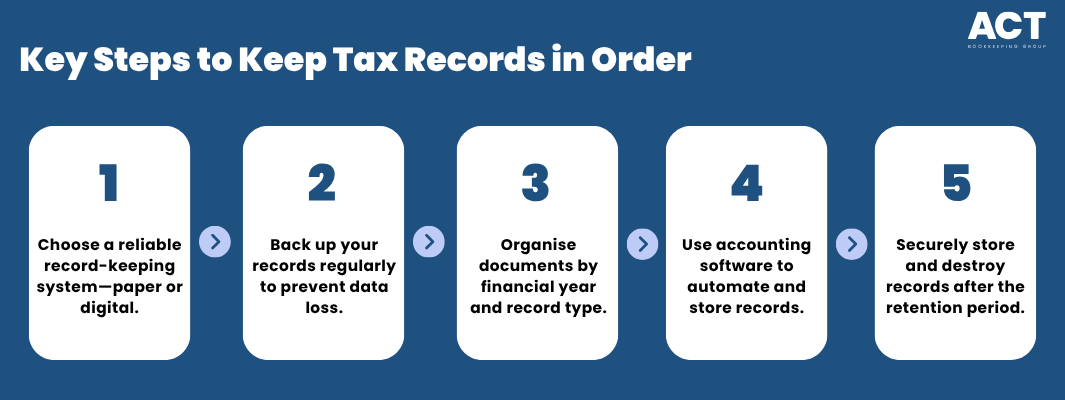

Best Practices for Tax Record Keeping

Setting up a solid record keeping system means saving time, avoiding stress, and making tax time a breeze. Here’s how to keep your records in line with ATO standards.

Paper Records vs. Electronic Records

Both original paper records and electronic records are accepted by the Australian Taxation Office. You can scan and retain a clear copy of documents in your accounting software, or securely store electronic copies on an external hard drive or cloud system.

Regularly backed up records are always best practice. This ensures claims and expenses are never lost—accidentally lost paperwork is a common issue, but easy access digital systems fix this.

We’re more than bookkeeping experts

As part of ACT Tax Group, we offer complete accounting and business advisory services tailored to your needs.

Organisation and Accessibility

Organise by financial year and type, such as business records, purchase records, and other documents. Accounting software can help prefill and automate record keeping requirements, making tax return preparation easier and more accurate.

Keep your records where you have easy access at all times—either as electronic records in accounting software or stored physically in a safe location with enough storage space to cover the entire period.

Security and Privacy of Records

Store all business and financial records securely and follow privacy guidelines. Destroy records after the period ends, unless they pertain to ongoing claims, reviews, or disputes with the Australian Taxation Office.

Conclusion

Small businesses must keep records for five years from the date a transaction is completed or after their tax return claim is lodged. Some records—such as those for capital gains tax, employment contracts, or investment property—require longer-term retention. Good records allow you to make reliable claims, provide written evidence during an audit, and free up time to focus on growing your business.

If you need help developing an organised, compliant tax record keeping system, ACT Bookkeeping is ready to save you time, offer peace of mind, and support you through every financial year. Is your business record keeping system ready for 2025? Let’s make your next tax time easier, together.