Published on 29 Oct 2025

The Medicare Levy explained: How it’s calculated and what it means for your business guides Australian business owners through the essentials of Australia’s public health system contributions. Many people find themselves puzzled each year when they spot the Medicare Levy on their income tax return, wondering how much tax applies, why it’s needed, and what steps make it simpler to manage. This article delivers clear answers and practical steps so you can pay the Medicare Levy without stress, avoid unwanted surprises, and keep your business finances on track.

Understanding the Medicare Levy and Its Role

Almost all Australian taxpayers contribute to Medicare through a levy, which makes a big difference to Australia’s public health system. If you run a business—whether as a sole trader, part of a partnership, or a company director—knowing your Medicare Levy obligations early helps you manage cash flow, meet targets, and stay compliant.

When most Australians lodge their tax return, the Australian Taxation Office adds the Medicare Levy to their total tax. The levy is not an extra process; it’s an addition to the tax you pay based on your annual income. The Medicare Levy ensures everyone supports the healthcare system, whether they work for an employer, operate as a sole trader, or have income from other sources.

Confused about how much Medicare Levy your business owes?

Schedule a complimentary consultation with us today to get a clear breakdown based on your income.

Why Businesses and Individuals Pay the Medicare Levy

The Medicare Levy is worked out as a percentage of your taxable income and aims to encourage individuals to contribute fairly to the costs of healthcare for all. By including the levy with income tax, most Australian taxpayers help make Medicare benefits available across the country.

The Connection Between Income and the Levy

The levy doesn’t just impact salaries. Your annual income—whether from wages, your business, investments, or super—counts towards the amount you pay. If you have a business structure, such as a trust or partnership, your share of profits is added to your personal income for Medicare Levy purposes.

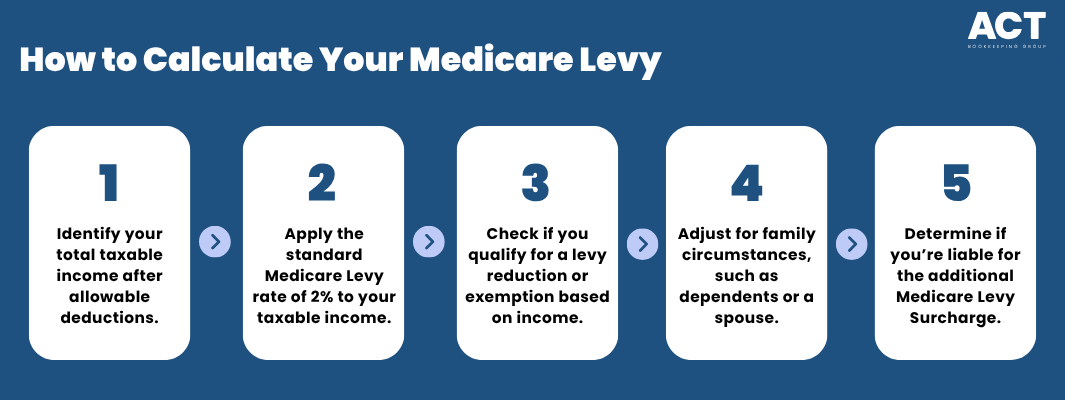

How Is the Medicare Levy Calculated?

Understanding how the Medicare Levy is calculated takes away confusion. Here’s a step-by-step look at what’s involved, what affects your total, and how to estimate what you’ll pay.

Step 1: Identifying Your Taxable Income

Start with your taxable income—the total income you receive (your wages includes business profits and other assessable amounts) after deducting allowable expenses. Business owners need to combine profit from business activities with other income, such as salary or dividends.

Step 2: Applying the Standard Rate

For most Australian taxpayers who exceed the income threshold, the Medicare Levy is 2 per cent of taxable income. For instance, if your taxable income is $80,000, you will pay $1,600 as the levy.

Step 3: Determining If You’re Eligible for a Reduction or Exemption

You may have to pay the Medicare Levy in full, part, or not at all, depending on personal circumstances and annual income:

If your income is below a certain income threshold, you may qualify for a Medicare Levy reduction or exemption.

The exemption means you don’t pay the levy if your yearly income, as a single person, is below $27,222. Families and single parents have higher thresholds, starting at $45,907 and increasing with each dependent child.

If your income falls in the “phase-in” band (between the lower threshold and the point where the full levy applies), you only pay a certain amount calculated at 10 cents for each dollar over the lower threshold until you reach the full rate.

Step 4: Considering Your Personal and Family Circumstances

Family situations, such as being married, having a spouse or de facto partner, or having children, alter your family income threshold. The threshold increases for each dependent child, making it easier for some families to get a partial exemption or pay a reduced levy.

Step 5: Medicare Levy Surcharge

Business owners and families with higher incomes may have to pay an extra amount called the Medicare Levy Surcharge (MLS) if they do not hold hospital cover at the appropriate level. The MLS is separate from the standard levy and is based on your family income. If your income for MLS purposes is above the MLS income threshold and you do not have eligible private hospital insurance, you pay the MLS on top of the standard levy.

Taxable Income, the MLS and Why Private Health Cover Matters

Your income tax return requires you to enter all sources of annual income. The total you declare—the income for MLS purposes—determines if you are liable for the MLS.

Private Hospital Cover and Avoiding the Surcharge

To avoid paying the MLS, many business owners and high-income earners take out private hospital insurance (private hospital cover). The MLS is there to encourage individuals and families to take out cover, reducing pressure on the public system and supporting choice when it comes to health services.

Not all private health insurance policies are equal. Only private patient hospital cover that meets the required standard in Australia counts in avoiding the MLS.

Surcharge Rates and Tiered Thresholds

There are family tiers and single tiers. For example, the MLS starts at an income threshold of $101,000 for singles and $202,000 for families. Rates increase with income and dependants. Family income threshold increases for every dependent child after the first.

How Business Structure Affects Your Levy

Whether you’re a sole trader, part of a partnership, or receive distributions from a trust or company, your share of taxable income must be included in your individual tax return:

Sole traders pay the levy on their business profit, which is added to their personal income.

Partnership profits are split, and each partner pays their share through their own return.

Directors and shareholders of companies include salary and dividends for Medicare purposes.

Trust beneficiaries declare their share and pay the levy based on their total assessable income.

Exemptions, Reductions, and Special Circumstances

Certain groups or conditions lead to a Medicare Levy exemption, reduction, or partial exemption:

Pensioners with a pensioners tax offset, some government card holders, and visitors with specific visa conditions might qualify for a full or partial exemption.

De facto couples or families on low incomes or with special medical needs may benefit from different treatment under the exemption or reduction rules.

If you qualify, you must claim the exemption or reduction on your tax return.

We’re more than bookkeeping experts

As part of ACT Tax Group, we offer complete accounting and business advisory services tailored to your needs.

Practical Strategies to Stay Ahead

Running a business means planning for more than just the basics. Here’s how to handle the Medicare Levy and surcharge so you don’t get caught out:

Estimate Your Levy and Surcharge Early

Use calculators offered by the Australian Taxation Office to estimate how much levy, surcharge, and income tax you will pay on your taxable income. If you expect to pay the MLS, get private hospital cover before the financial year starts to avoid paying the MLS.

Regularly Set Aside Funds

Each time you draw income, consider setting money aside for your tax and Medicare obligations. Some business owners allocate funds monthly or quarterly to a separate account.

Make the Most of Rebates and Offsets

Check if you are eligible for the private health insurance rebate or any tax offsets. This can reduce your costs, help you hold hospital cover all year, and keep your overall obligations manageable.

Talk to a Tax Agent

A tax agent can help you factor in personal circumstances, accurately estimate your obligations, and identify exemptions or rebates relevant to you.

What Happens If You Don’t Pay

If you do not pay the Medicare Levy, surcharge, or income tax, the Australian Taxation Office may charge penalties and interest, increasing your final tax bill. Most Australians avoid trouble by regularly reviewing their obligations, using online tools and calculators, and consulting a tax agent.

Conclusion

By understanding how the Medicare Levy is calculated, planning in advance, and making the most of available exemptions, reductions, and private health insurance options, business owners and families can confidently meet their obligations—and avoid unwelcome surprises at tax time.

If you want to make your next tax return smooth and stress-free, check your income, review hospital cover, and consult a friendly expert. ACT Bookkeeping is here to help you understand the levy, choose the right strategies, and keep your finances healthy.

Will you take simple steps today to prepare, or will an unexpected levy take you by surprise? Trust professionals who speak your language, keep it clear, and always put your business and family first.