Published on 15 Oct 2025

Understanding Fortnightly Tax Tables: How to Calculate PAYG Withholding Correctly is the first step toward accurate and compliant payroll. Getting the tax calculations right ensures employees receive the correct amount in their pay, and employers stay on track with the Australian Taxation Office (ATO). At ACT Bookkeeping, we know managing employee payments can feel overwhelming, so we’re here to break it down in plain language.

Why Accurate PAYG Withholding Matters

Calculating the correct amount of tax to withhold is a key responsibility for employers. It affects not only your compliance with tax law but also the trust your employees place in you.

Are you unsure which ATO tax table to use?

Schedule a complimentary consultation with us today to avoid pay errors and ATO penalties.

Keeping Payroll on Track

Payroll isn’t just about paying wages. It’s about making sure each employee’s pay reflects their correct tax, including allowances, superannuation, and any adjustments. The ATO provides tax tables to help determine the right withholding amounts, but confusion can arise when using the wrong table—like applying weekly instead of fortnightly. This can lead to under-withholding or over-withholding, both of which create issues at the end of the financial year.

By using the correct fortnightly tax table, you ensure that each employee’s pay is accurate and reflects their total fortnightly earnings. This helps avoid surprises when tax returns are lodged and reduces the risk of penalties.

Common Issues to Watch For

One of the most frequent errors is failing to update withholding declarations. If an employee has submitted a new withholding declaration, such as a Medicare levy variation declaration, it must be actioned. Ignoring this can mean withholding too much or too little tax.

Another common issue is handling irregular payments. Accidental overtime, bonuses, or lump sum payments need to be treated differently from regular payments. For example, if someone receives a one-off payment, it may push them into a higher tax bracket temporarily. The ATO provides guidance on how to handle these situations, often using special tables for termination or non-standard payments.

Employers should also be aware of employees who are foreign residents, performing artists, or working in the horticultural industry. These groups may have different withholding rules. For instance, foreign residents don’t qualify for the tax-free threshold, so more tax is withheld from their pay.

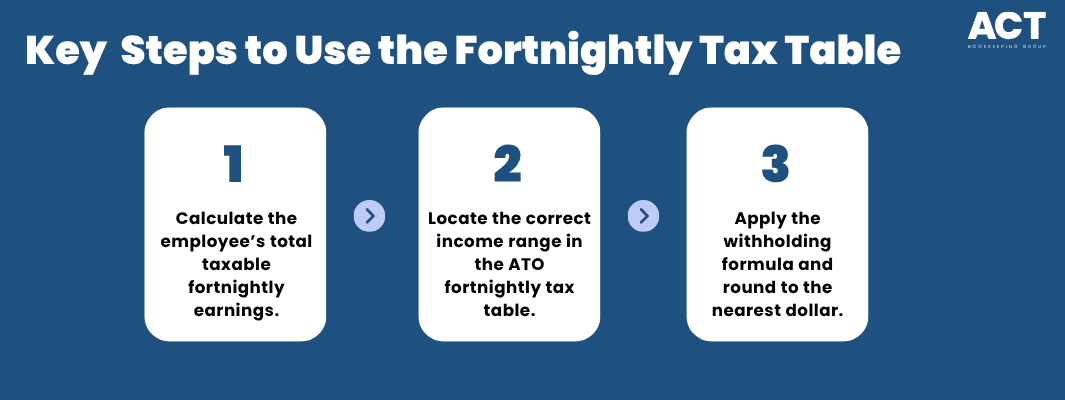

How to Use the Fortnightly Tax Table

Now that we’ve covered the importance of accuracy, let’s walk through the actual steps to use the fortnightly tax table. This guide applies to normal fortnightly earnings and helps you determine the correct amount of tax to withhold.

Step 1: Calculate Total Fortnightly Earnings

Start by adding up the employee’s salary or wages for the fortnight. Include regular hours, overtime, allowances, and any other taxable benefits. This gives you the employee’s total fortnightly earnings.

Next, subtract any pre-tax deductions. This includes salary sacrificed amounts for superannuation or other approved purposes. What remains is the taxable income used to calculate PAYG withholding.

Step 2: Find the Right Tax Table

The ATO publishes several tax tables, including weekly, fortnightly, and monthly tax tables. Be sure to use the fortnightly version. These tables are updated regularly—for example, changes made in July 2024 should be reflected in your current payroll.

Within the table, locate the income range that matches the employee’s taxable earnings. The table will show the correct amount of tax to withhold, broken down into a base amount and a percentage on the excess.

Step 3: Apply the Withholding Amount

Once you’ve found the correct range, apply the formula. For instance, if the table states “$452 plus 32.5 cents for each dollar over $2,500,” and the employee’s taxable income is $3,000, you would:

Calculate the excess: $3,000 – $2,500 = $500

Multiply the excess by 32.5 cents: $500 × 0.325 = $162.50

Add the base amount: $452 + $162.50 = $614.50

Round to the nearest dollar and record $615 as the tax to withhold.

This process should be repeated for each pay run. If you use Single Touch Payroll (STP), make sure your software reflects the latest ATO tax tables to simplify reporting.

Handling Special Cases

Not all employees fit the standard pattern. Some may have obligations like Training Support Loans or eligibility for a Medicare levy adjustment. This section helps you manage these situations with confidence.

Employees with HELP or Student Debts

If an employee has a Study and Training Support debt, they must repay it once their income exceeds the threshold. This is calculated based on their annual income, but employers can use ATO guidelines to estimate the additional withholding on a fortnightly basis.

The amount is not taken from the standard tax table. Instead, it’s added on top of the normal PAYG withholding. Your payroll system should support this, or you can manually calculate it using the ATO’s repayment rate table.

Medicare Levy and Exemptions

Most employees are required to pay the Medicare levy, but some may claim an exemption. This could be due to low income or a medical condition. If an employee submits a Medicare levy variation declaration, use the adjusted table to calculate the withholding.

If no declaration is on file, assume the standard rate applies. Always keep these forms on record and update them if circumstances change.

Other Payees and Labour Hire Workers

The rules also apply to other payees, such as contractors under labour hire arrangements. If you’re making regular payments to workers who aren’t standard employees, you may still need to withhold tax. This depends on the contract and whether the worker has an ABN.

For businesses in the horticultural industry, special rules apply. Some workers may be entitled to lower withholding if they meet specific conditions. Always refer to the ATO’s guidance on payments made to these workers.

We’re more than bookkeeping experts

As part of ACT Tax Group, we offer complete accounting and business advisory services tailored to your needs.

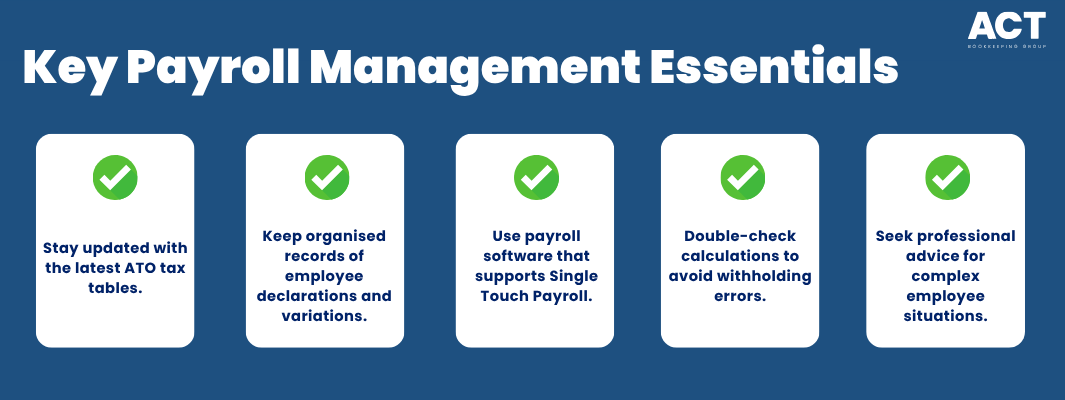

Tips for Smoother Payroll Management

Managing payroll doesn’t have to be stressful. With the right approach, you can reduce errors and save time.

Stay Updated and Organised

Check the ATO website regularly for updates to the following tax tables. Even small changes can affect your calculations. Set a reminder each month to verify you’re using the correct version. Keep a file of each employee’s withholding declaration. This includes their current form, any variation requests, and evidence of claims like tax offset entitlements.

Use Technology to Help

Most modern payroll systems automatically update tax tables and calculate withholding amounts. They can also handle superannuation, allowances, and irregular payments. If you’re still using spreadsheets, consider upgrading to software that supports Single Touch Payroll and simplifies employee wages.

When to Seek Professional Advice

If you’re unsure about a calculation, or if an employee has a complex situation—like multiple jobs, cross-border work, or fringe benefits—it’s wise to seek professional advice. An experienced bookkeeper or tax agent can help you apply the rules correctly and keep your business compliant.

Final Thoughts

Managing PAYG withholding doesn’t have to be complicated. By understanding the fortnightly tax table and using it correctly, you can ensure your employees receive the right pay and you meet your obligations as an employer. Whether you’re handling a small team or managing multiple payees, the key is consistency, accuracy, and staying informed.

At ACT Bookkeeping, we’re here to support local businesses with clear, practical solutions. If you’d like help reviewing your payroll process or setting up automated systems, we’d love to hear from you. What could you achieve with more time and confidence in your payroll?