Understanding how to calculate your business tax liability and plan for payments is essential for any small business owner aiming to maintain steady cash flow and avoid surprises at tax time. When you know how much tax you’re likely to pay and set aside funds throughout the financial year, you’ll reduce stress and keep your business on track.

Examining Your Business Tax Obligations

Calculating business tax liability starts with knowing your total assessable income for the income year and understanding how it’s taxed under different structures. Whether you’re a sole trader, partnership or company, the Australian Taxation Office (ATO) sets thresholds and rules that determine your obligations.

Unsure how to calculate your actual tax liability?

Schedule a complimentary consultation with us today to ensure your income and deductions are applied correctly.

Sole Trader and Partnership Structures

As a sole trader, your business income is treated as personal income and taxed at individual income tax rates, from the tax-free threshold up to the highest marginal rate. A partnership agreement divides assessable income among partners, each paying tax on their share. Income inclusion rules ensure all trading income, rental income and interest income are declared. Individual tax rates include the 2% Medicare Levy unless exempt.

Company Structures and Tax Rates

Companies are separate legal entities with obligations distinct from their owners. The full company tax rate is 30 per cent, but base rate entities—companies with aggregated turnover under $50 million and limited passive income—qualify for a lower company tax rate of 25 per cent. These eligibility requirements mean small business entities can benefit from reduced tax rates when filing their company tax returns.

Small Business Entity Concessions

Small business entities with aggregated turnover below the annual turnover threshold of $10 million can access concessions such as the instant asset write-off and simplified depreciation rules. These tax benefits reduce taxable income and help lower cash outflows for expenses like new equipment and vehicles.

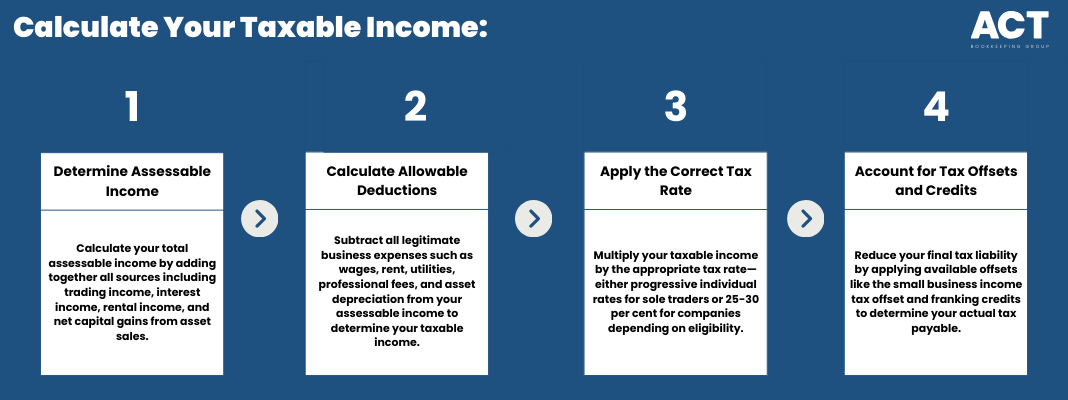

Step-by-Step Calculation of Taxable Income

Accurate tax calculations hinge on a clear understanding of assessable income and deductible expenses. Follow these steps to work out your company’s or your own taxable income.

Step 1: Determine Assessable Income

Your assessable income is the sum of trading income, interest income, rental income, and net capital gains from asset sales. For a listed investment company, franking credits may reduce the net tax payable on dividends.

Practical example:

Trading income: $200,000

Rental income: $20,000

Interest income: $5,000

Net capital gains: $10,000

Total assessable income: $235,000

Step 2: Calculate Allowable Deductions

Deductions include all business expenses incurred in earning assessable income. Common deductions cover wages for employees, rent, utilities, insurance, professional fees, advertising, and the decline in value of assets.

Practical example continued:

Wages and super: $80,000

Rent and utilities: $24,000

Professional fees: $10,000

Vehicle expenses: $5,000

Depreciation on equipment: $15,000

Total deductions: $134,000

Taxable income: $235,000 – $134,000 = $101,000

Step 3: Apply the Correct Tax Rate

Once taxable income is determined, apply the company tax rate or individual income tax rates:

Sole trader income tax: progressive rates from the tax-free threshold of $18,200 up to 45 per cent

Company tax: 25 per cent for base rate entities or 30 per cent for other companies

Using the practical example’s taxable income of $101,000 for a base rate entity:

Company tax liability: $101,000 × 25 per cent = $25,250

Step 4: Account for Tax Offsets and Credits

Offsets reduce the tax payable dollar for dollar. The small business income tax offset provides up to 16% of income tax on net small business income (sole traders, partnerships), subject to annual thresholds. The offset phases in with income. Franking credits on dividends can also offset liability. If you qualify, Capital Gains Tax (CGT) discounts for assets held over 12 months reduce net capital gains by 50 per cent.

Planning and Scheduling Payments

Knowing how to calculate your liability is one part of the puzzle; budgeted payments keep your cash flow healthy. The ATO requires businesses to pay tax through:

PAYG Instalments

PAYG instalments spread income tax payments over the income year. Instalment notices outline quarterly amounts or instalment rates.

If your company’s aggregated turnover exceeds $20 million, monthly PAYG applies. Primary producers may opt for annual payments.

Goods and Services Tax

Once your GST turnover exceeds $75,000, you must register for GST. You collect services tax on taxable supplies at 10 per cent and lodge Business Activity Statements (BAS) monthly or quarterly. Under the cash accounting method, you pay GST only when you receive payment, aiding cash flow.

Payroll Tax and Other Levies

Payroll tax applies at state level once your total wages exceed thresholds. Check your state’s legislation for rates and thresholds. Other obligations may include super guarantee contributions and PAYG withholding for employees.

Strategic Planning for Tax Time

Effective planning and a structured approach can turn tax from a burden into an opportunity to improve your financial position.

We’re more than bookkeeping experts

As part of ACT Tax Group, we offer complete accounting and business advisory services tailored to your needs.

Cash Flow Forecasting

Build a forecast that includes PAYG instalment dates, GST BAS lodgements, payroll tax payments and expected tax return dates. Allocate funds into a separate tax savings account to cover upcoming liabilities.

Income and Expense Timing

Timing strategies may involve deferring invoicing or bringing forward deductible expenses, like prepaying insurance or subscriptions before end of the financial year (30 June). These decisions must balance cash flow and genuine business needs.

Asset Purchase Decisions

Under the instant asset write-off, eligible assets costing up to $20,000 for small businesses (aggregated turnover < $10 million) are immediately deductible. For assets over the threshold, choose between pooling or standard depreciation to align deductions with profitability.

Professional Guidance

Engaging a registered tax agent ensures compliance with income inclusion rules, the undertaxed profits rule and other complex provisions. Agents help you understand obligations like the aggregated turnover threshold, separate legal entity rules and the specifics of CGT discounts.

Conclusion

Calculating your business tax liability and planning for payments involves clear steps: determining assessable income, claiming deductions, applying the right tax rate, and scheduling instalments. With practical examples and strategic planning—such as cash flow forecasting, timing expenses and using small business concessions—you’ll make tax time easier and support your business growth.

Take control by reviewing your current position, setting up a tax savings plan, and seeking advice from a registered tax agent. By treating tax planning as an ongoing process rather than a once-a-year event, you’ll secure better financial outcomes and focus on what matters most—growing your business.