Published on 11 Sep 2025

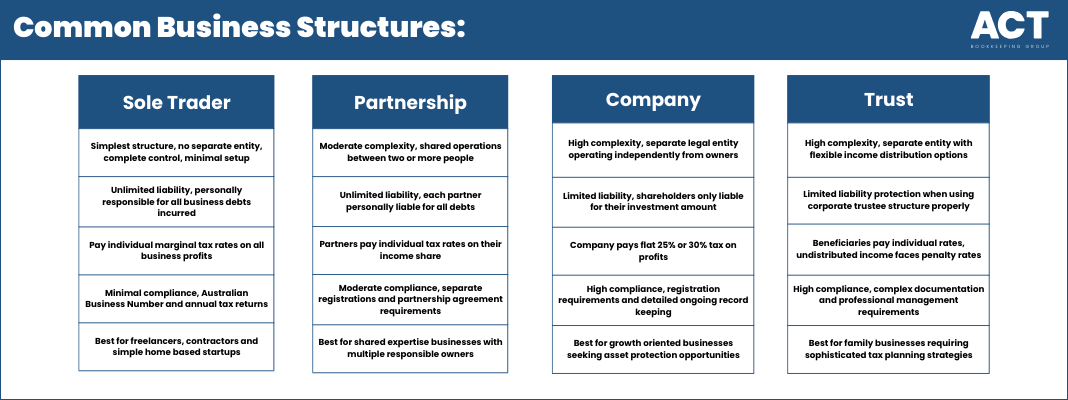

Choosing the right business structure in Australia is one of the most critical business decisions you’ll make as a business owner, directly impacting your tax implications, personal liability exposure, and legal obligations. With four main types of business structures available – sole trader, partnership, company, and trust – understanding how each affects your business profits, asset protection, and compliance requirements will help you select the best option for your circumstances.

The business structure you choose determines not only how much income tax you’ll pay but also whether your personal assets are protected from business debts and what administration costs you’ll face. Each of the different business structures offers distinct advantages and disadvantages, making it essential to evaluate your business operations, growth plans, and risk tolerance before making your choice.

Understanding Australia’s Four Common Business Structures

Australia offers four primary business structures, each designed to meet different operational needs and provide varying levels of complexity, tax treatment, and liability protection.

Do you know if your business structure minimises tax legally?

Schedule a complimentary consultation with us today to compare options and improve after-tax profits.

Sole Trader: The Simplest Business Structure

A sole trader remains the most popular choice for new businesses in Australia, representing the simplest business structure available. This option offers complete control over your own business and minimal setup requirements, making it ideal for freelancers, contractors, and home-based startups. When you operate as a sole trader, you personally pay tax on all business income at individual marginal rates, with your business profits treated as personal income and reported through your individual tax returns.

However, sole traders have unlimited liability, meaning you are personally liable for all business debts. If your business fails or incur debt, your personal assets including your home and savings are at risk. You are legally responsible for all business operations and legal obligations under your own name.

The compliance requirements for sole traders are minimal, requiring an Australian Business Number and annual tax return lodgement. You’ll also need a tax file number and potentially a business name registration if trading under a different name than your own.

Partnership: Shared Business Operations

Partnership business structures involve two or more people sharing business activities, income distribution, and business losses. While partnerships offer shared expertise and resources, they also involve shared unlimited liability, where each partner can be personally liable for all business debts. In a partnership, the business itself doesn’t pay income tax – instead, each partner pays tax on their share of the net partnership income at their individual tax rates.

A partnership agreement is essential to outline each partner’s responsibilities, profit sharing, and what happens if the business grows or one partner wants to leave. Without proper documentation, disputes can arise about income distribution and personal responsibility. Each partner remains personally liable for partnership debts, meaning personal assets are at risk if the business encounters financial difficulties.

Partnership structures require a separate tax file number and Australian Business Number, with the partnership lodging tax returns to show business income distribution while individual partners pay tax through their personal returns.

Company: A Separate Legal Entity

Company business structures provide significant asset protection by creating a separate legal entity that operates independently from its owners. Private companies pay a flat corporate tax rate of 25% if they are ‘base rate entities’—generally those with aggregated turnover under $50 million and carrying on a business. Other companies pay the standard corporate tax rate of 30%. This can provide tax advantages compared to individual marginal rates, especially for substantial business profits.

The company structure offers limited liability protection, meaning shareholders are generally only responsible for their investment amount while personal assets are protected from company debts. However, company directors may face personal responsibility for certain legal obligations, and when company profits are distributed to shareholders as dividends, additional personal tax obligations may apply.

Company structures involve higher administration costs and complexity, requiring registration with Australian Securities and Investments Commission, director appointments, maintaining a registered office, and lodging annual financial reports. Companies must also hold annual meetings and maintain detailed corporate records.

Trust: Flexible Income Distribution

Trust business structures offer exceptional flexibility for tax planning, particularly for family members involved in the business. Trusts don’t pay tax on income distributed to beneficiaries; they are taxed at the beneficiary’s marginal tax rate. Any undistributed trust income is generally taxed at the highest individual marginal tax rate (currently 47% including Medicare levy), allowing trustees to distribute different types of income to appropriate beneficiaries in lower tax brackets.

However, any undistributed income faces penalty tax rates at the highest marginal rate, making annual distribution decisions critical. Trust structures can provide asset protection benefits, especially when combined with a corporate trustee, but require sophisticated legal documentation and ongoing professional management.

Trust structures demand compliance with Australian Taxation Office requirements and involve complex administration, making them suitable primarily for businesses with substantial income or specific family wealth planning objectives.

Tax Implications Across Different Business Structures

Understanding how each business structure affects your tax obligations is crucial for making an informed decision that improves your financial position while meeting compliance requirements.

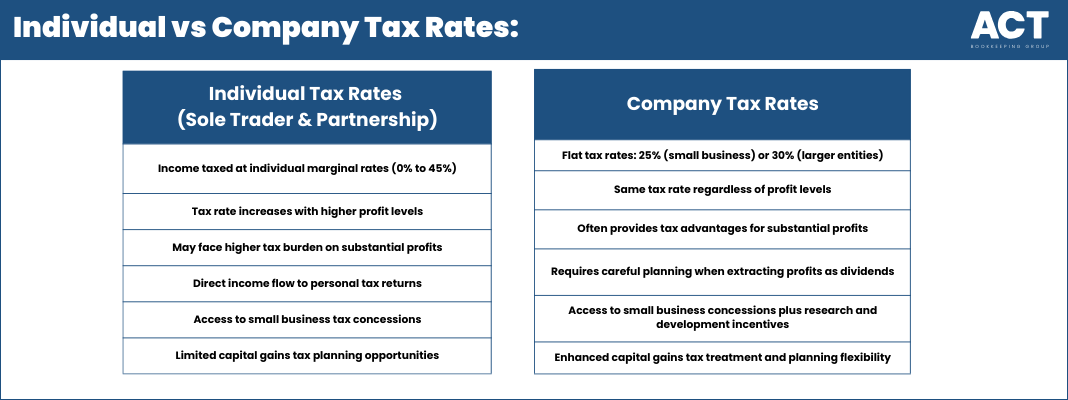

Individual vs Company Tax Rates

The tax treatment varies significantly between business structures, with sole traders and partnerships flowing income to individuals taxed at marginal rates while companies pay at the same rate regardless of profit levels. For businesses with substantial profits, company structures often provide tax advantages, though extracting profits requires careful planning to avoid additional tax obligations when income is distributed to shareholders.

Small businesses across all structures can access various tax concessions, though companies are the only structure eligible for certain research and development incentives. When your business grows and generates capital gains, different structures offer varying tax treatment and planning opportunities.

If you need to raise capital for expansion, company structures provide the most flexibility through share issuance, while other structures face significant limitations in attracting external investment.

Capital Gains and Business Growth

When your business grows and generates capital gains, different structures offer varying tax treatment. Companies and trusts can access different tax planning opportunities, while sole traders and partnerships face limitations in managing capital gains tax.

If you need to raise capital for expansion, company structures provide the most flexibility through share issuance, while other structures face significant limitations in attracting external investment.

Liability Protection and Personal Assets

The level of personal liability protection varies dramatically between business structures, making this a critical consideration for business owners concerned about protecting their personal wealth.

Personal Liability Exposure

Sole traders and partnerships offer no separation between personal and business liabilities, with business debts, legal judgments, and operational risks directly threatening personal assets including family homes, vehicles, and savings. Companies and trusts provide varying degrees of protection through legal separation, with company shareholders generally facing limited liability while properly structured trusts can shield assets from business-related claims.

Beyond structure selection, all businesses should implement comprehensive risk management including adequate insurance coverage and separate business banking. Professional liability and public liability insurance provide additional protection layers regardless of your chosen legal structure.

Managing Business Risks

Beyond structure selection, all businesses should implement comprehensive risk management including adequate insurance coverage and separate business banking. Professional liability and public liability insurance provide additional protection layers regardless of your chosen legal structure.

Compliance Requirements and Ongoing Obligations

Each business structure comes with distinct compliance obligations that affect both your time commitment and ongoing administration costs.

Registration and Reporting Differences

Compliance complexity increases significantly with more sophisticated structures, with sole traders needing minimal registrations beyond Australian Business Number requirements and basic record-keeping for tax purposes. Companies require Australian Securities and Investments Commission registration, director appointments, and annual compliance reporting, while all businesses with an annual turnover of $75,000 or more must register for Goods and Services Tax (GST), while non-profit organisations register if their turnover exceeds $150,000.

Australian businesses must maintain financial records for minimum five years, with companies facing additional documentation requirements and trust structures requiring valid trust deeds and annual distribution documentation. Professional advice from a registered tax agent becomes increasingly important with complex structures, ensuring compliance with Australian Taxation Office requirements and improving tax outcomes.

Record-Keeping and Professional Support

Australian businesses must maintain financial records for a minimum of five years in a format accessible to the ATO, with companies and trusts having additional reporting obligations for directors and beneficiaries. Trust structures require valid trust deeds and annual distribution documentation.

Professional advice from a registered tax agent becomes increasingly important with complex structures, ensuring compliance with Australian Taxation Office requirements and improving tax outcomes.

Making the Right Choice for Your Business

Selecting the most appropriate business structure requires careful consideration of multiple factors that will impact your business both immediately and in the long term.

We’re more than bookkeeping experts

As part of ACT Tax Group, we offer complete accounting and business advisory services tailored to your needs.

Key Decision Factors

When selecting your business structure, consider your industry risk profile, growth plans, current tax position, and administrative capacity. High-risk industries benefit from liability protection offered by companies or trusts, while simple service businesses might prefer sole trader simplicity. Financial projections should include both tax implications and administration costs, as while companies offer tax advantages for substantial profits, the additional compliance costs may outweigh benefits for smaller operations.

Consider your long-term business vision when choosing between different business structures, as companies facilitate investment attraction and expansion opportunities while sole trader partnerships face limitations in raising capital. Business structure changes are possible but involve significant administrative requirements and potential tax implications.

Professional advice can help model different scenarios and recommend structures supporting your business objectives while ensuring compliance with Australian regulations and improving your long-term financial position.

Future Flexibility and Growth Planning

Consider your long-term business vision when choosing between different business structures. Companies facilitate investment attraction and expansion opportunities, while sole trader partnerships face limitations in raising capital.

Business structure changes are possible but involve significant administrative requirements and potential tax implications. Professional advice can help model different scenarios and recommend structures supporting your business objectives.

Conclusion

The optimal business structure balances tax efficiency, asset protection, administration costs, and operational flexibility based on your specific circumstances. While sole traders offer simplicity, companies provide growth potential and limited liability. Partnerships suit collaborative ventures, and trusts excel for sophisticated tax planning.

Given the complexity and long-term implications of structure selection, professional advice from qualified accountants is essential. They can assess your situation, model tax scenarios, and recommend structures that support your business goals while ensuring ongoing compliance with Australian regulations.